Dimensional Fund Advisors LP trimmed its position in Dorman Products, Inc. (NASDAQ:DORM - Free Report) by 5.2% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 952,550 shares of the auto parts company's stock after selling 51,830 shares during the period. Dimensional Fund Advisors LP owned 3.12% of Dorman Products worth $114,819,000 at the end of the most recent reporting period.

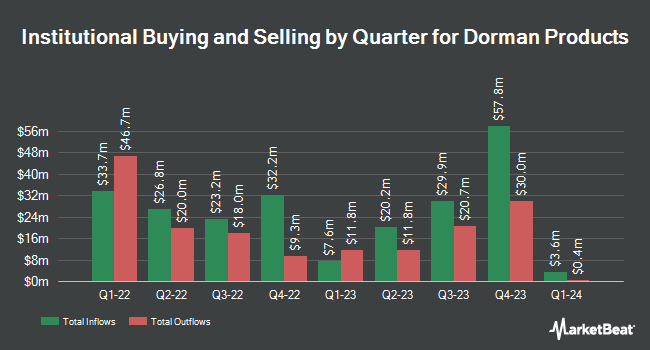

Other large investors have also recently bought and sold shares of the company. Principal Financial Group Inc. boosted its holdings in Dorman Products by 2.3% in the 1st quarter. Principal Financial Group Inc. now owns 141,288 shares of the auto parts company's stock valued at $17,031,000 after purchasing an additional 3,206 shares during the period. Flagship Harbor Advisors LLC boosted its holdings in Dorman Products by 12.5% in the 1st quarter. Flagship Harbor Advisors LLC now owns 2,493 shares of the auto parts company's stock valued at $301,000 after purchasing an additional 277 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its holdings in Dorman Products by 19.2% in the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 52,664 shares of the auto parts company's stock valued at $6,823,000 after purchasing an additional 8,494 shares during the period. GAMMA Investing LLC boosted its holdings in Dorman Products by 16,876.2% in the 1st quarter. GAMMA Investing LLC now owns 113,910 shares of the auto parts company's stock valued at $13,731,000 after purchasing an additional 113,239 shares during the period. Finally, Wellington Management Group LLP boosted its holdings in Dorman Products by 1,136.2% in the 4th quarter. Wellington Management Group LLP now owns 174,717 shares of the auto parts company's stock valued at $22,635,000 after purchasing an additional 160,584 shares during the period. 84.70% of the stock is owned by institutional investors.

Dorman Products Trading Down 0.3%

Dorman Products stock traded down $0.43 during mid-day trading on Wednesday, hitting $163.45. The company's stock had a trading volume of 122,164 shares, compared to its average volume of 219,649. The company has a debt-to-equity ratio of 0.31, a current ratio of 2.74 and a quick ratio of 1.21. The stock has a market cap of $4.99 billion, a price-to-earnings ratio of 22.24 and a beta of 0.79. The business has a 50 day moving average price of $131.94 and a 200-day moving average price of $126.16. Dorman Products, Inc. has a 12 month low of $106.21 and a 12 month high of $165.05.

Dorman Products (NASDAQ:DORM - Get Free Report) last posted its quarterly earnings results on Monday, August 4th. The auto parts company reported $2.06 earnings per share for the quarter, topping the consensus estimate of $1.76 by $0.30. The business had revenue of $540.96 million during the quarter, compared to the consensus estimate of $517.13 million. Dorman Products had a net margin of 10.83% and a return on equity of 19.23%. The firm's revenue for the quarter was up 7.6% on a year-over-year basis. During the same period in the previous year, the firm posted $1.67 earnings per share. Dorman Products has set its FY 2025 guidance at 8.600-8.900 EPS. As a group, analysts forecast that Dorman Products, Inc. will post 6.9 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of research firms have recently issued reports on DORM. Roth Capital lifted their price objective on shares of Dorman Products to $182.00 and gave the stock a "buy" rating in a report on Tuesday. Wall Street Zen downgraded shares of Dorman Products from a "strong-buy" rating to a "buy" rating in a report on Saturday, August 9th. Zacks Research raised shares of Dorman Products from a "hold" rating to a "strong-buy" rating in a report on Wednesday, August 13th. Finally, Wells Fargo & Company began coverage on shares of Dorman Products in a report on Friday, August 22nd. They set an "overweight" rating and a $175.00 price objective for the company. One investment analyst has rated the stock with a Strong Buy rating and four have assigned a Buy rating to the stock. According to MarketBeat, the stock has an average rating of "Buy" and a consensus price target of $161.00.

Read Our Latest Stock Analysis on Dorman Products

Insiders Place Their Bets

In other Dorman Products news, SVP Donna M. Long sold 820 shares of the business's stock in a transaction on Monday, July 28th. The shares were sold at an average price of $122.21, for a total value of $100,212.20. Following the completion of the sale, the senior vice president directly owned 19,074 shares of the company's stock, valued at $2,331,033.54. The trade was a 4.12% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. 8.90% of the stock is owned by corporate insiders.

About Dorman Products

(

Free Report)

Dorman Products, Inc supplies replacement and upgrade parts for passenger cars, light trucks, medium- and heavy-duty trucks, utility terrain vehicles, and all-terrain vehicles in the motor vehicle aftermarket industry in the United States and internationally. It offers engine products, including intake and exhaust manifolds, fans, thermostat housings, and throttle bodies; undercar products comprising fluid lines, fluid reservoirs, connectors, 4-wheel drive components and axles, drain plugs, other engine, and transmission and axle components; steering and suspension products consist of control arms, ball joints, tie-rod ends, brake hardware and hydraulics, wheel and axle hardware, suspension arms, knuckles, links, bushings, and leaf springs, as well as other suspension, steering, and brake components; body products, such as door handles and hinges, window lift motors, window regulators, switches and handles, wiper components, lighting, electrical, and other interior and exterior vehicle body components, including windshields for UTVs; electronics products comprise new and remanufactured modules, clusters and sensors; and hardware products, such as threaded bolts and auto body fasteners, automotive and home electrical wiring components, and other hardware assortments and merchandise.

See Also

Before you consider Dorman Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dorman Products wasn't on the list.

While Dorman Products currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report