Discipline Wealth Solutions LLC trimmed its holdings in ProShares UltraPro QQQ (NASDAQ:TQQQ - Free Report) by 22.7% during the second quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 13,316 shares of the exchange traded fund's stock after selling 3,907 shares during the quarter. Discipline Wealth Solutions LLC's holdings in ProShares UltraPro QQQ were worth $1,105,000 at the end of the most recent quarter.

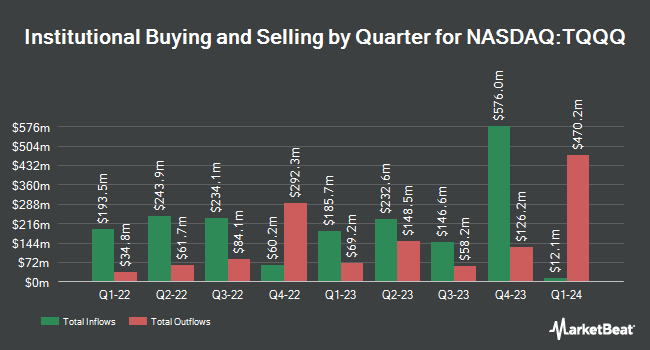

Several other institutional investors also recently made changes to their positions in TQQQ. Stuart Chaussee & Associates Inc. purchased a new stake in shares of ProShares UltraPro QQQ during the 4th quarter worth $1,473,000. Blue Sky Capital Consultants Group Inc. acquired a new position in shares of ProShares UltraPro QQQ during the 4th quarter valued at about $1,964,000. Menard Financial Group LLC purchased a new stake in shares of ProShares UltraPro QQQ during the 4th quarter worth about $146,000. Alpha Wealth Funds LLC purchased a new position in ProShares UltraPro QQQ in the 4th quarter worth approximately $1,878,000. Finally, Howard Financial Services LTD. purchased a new position in shares of ProShares UltraPro QQQ during the 1st quarter valued at approximately $470,000.

ProShares UltraPro QQQ Price Performance

Shares of TQQQ stock traded up $1.34 on Friday, hitting $102.32. 22,067,910 shares of the stock traded hands, compared to its average volume of 79,263,133. ProShares UltraPro QQQ has a 1-year low of $35.00 and a 1-year high of $102.47. The company's fifty day moving average is $90.49 and its 200 day moving average is $73.44. The company has a market capitalization of $31.54 billion, a PE ratio of 38.25 and a beta of 3.45.

ProShares UltraPro QQQ Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Tuesday, July 1st. Investors of record on Wednesday, June 25th were given a $0.2183 dividend. This is a positive change from ProShares UltraPro QQQ's previous quarterly dividend of $0.20. The ex-dividend date was Wednesday, June 25th. This represents a $0.87 dividend on an annualized basis and a dividend yield of 0.9%.

ProShares UltraPro QQQ Profile

(

Free Report)

Proshares UltraPro QQQ ETF (the Fund) seeks daily investment results, before fees and expenses that correspond to triple (300%) the daily performance of the NASDAQ-100 Index (the Index). The Fund invests in equity securities, derivatives, such as futures contracts, swap agreements, and money market instruments.

Featured Articles

Before you consider ProShares UltraPro QQQ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ProShares UltraPro QQQ wasn't on the list.

While ProShares UltraPro QQQ currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.