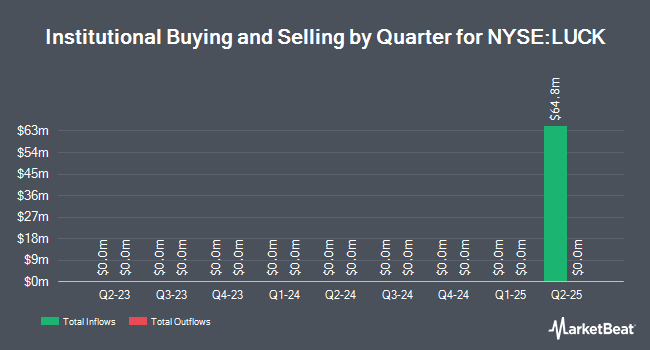

Diversified Trust Co purchased a new stake in shares of Lucky Strike Entertainment (NYSE:LUCK - Free Report) during the 2nd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm purchased 29,193 shares of the company's stock, valued at approximately $267,000.

Analyst Ratings Changes

Several equities analysts recently issued reports on LUCK shares. Roth Capital reissued a "neutral" rating and set a $11.00 price objective on shares of Lucky Strike Entertainment in a report on Friday, August 29th. Canaccord Genuity Group reiterated a "buy" rating and issued a $16.00 price target on shares of Lucky Strike Entertainment in a report on Friday, August 29th. Zacks Research upgraded Lucky Strike Entertainment from a "strong sell" rating to a "hold" rating in a report on Wednesday, September 10th. Finally, Stifel Nicolaus lifted their target price on Lucky Strike Entertainment from $12.00 to $13.00 and gave the company a "buy" rating in a research note on Friday, August 29th. Three equities research analysts have rated the stock with a Buy rating and three have issued a Hold rating to the company. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $12.20.

Get Our Latest Report on Lucky Strike Entertainment

Lucky Strike Entertainment Price Performance

Shares of LUCK stock opened at $9.98 on Thursday. Lucky Strike Entertainment has a 1-year low of $7.66 and a 1-year high of $13.25. The stock's fifty day moving average price is $10.11 and its 200 day moving average price is $9.57. The company has a market cap of $1.40 billion, a price-to-earnings ratio of -76.76 and a beta of 0.76.

Lucky Strike Entertainment (NYSE:LUCK - Get Free Report) last announced its earnings results on Thursday, August 28th. The company reported ($0.49) earnings per share for the quarter, missing the consensus estimate of ($0.07) by ($0.42). Lucky Strike Entertainment had a negative return on equity of 23.31% and a negative net margin of 0.83%.The business had revenue of $301.18 million for the quarter, compared to analysts' expectations of $295.07 million. Lucky Strike Entertainment has set its FY 2025 guidance at EPS. As a group, equities research analysts anticipate that Lucky Strike Entertainment will post 0.43 earnings per share for the current year.

Lucky Strike Entertainment Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, September 12th. Shareholders of record on Friday, August 29th were given a dividend of $0.055 per share. This represents a $0.22 annualized dividend and a yield of 2.2%. The ex-dividend date of this dividend was Friday, August 29th. Lucky Strike Entertainment's payout ratio is currently -169.23%.

Insiders Place Their Bets

In related news, President Lev Ekster bought 2,505 shares of the company's stock in a transaction on Friday, September 5th. The shares were bought at an average price of $9.99 per share, with a total value of $25,024.95. Following the transaction, the president owned 71,800 shares in the company, valued at approximately $717,282. This trade represents a 3.61% increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Over the last quarter, insiders have purchased 5,179 shares of company stock worth $51,627. 79.90% of the stock is currently owned by insiders.

Lucky Strike Entertainment Profile

(

Free Report)

Lucky Strike Entertainment Corp. engages in operating bowling centers. It offers entertainment concepts with lounge seating, arcades, food and beverage offerings, and hosting and overseeing professional and non-professional bowling tournaments and related broadcasting. The company was founded by Thomas F.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lucky Strike Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lucky Strike Entertainment wasn't on the list.

While Lucky Strike Entertainment currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.