DLD Asset Management LP lifted its stake in Equity Commonwealth (NYSE:EQC - Free Report) by 56.3% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 645,191 shares of the real estate investment trust's stock after acquiring an additional 232,412 shares during the period. DLD Asset Management LP owned approximately 0.60% of Equity Commonwealth worth $1,039,000 at the end of the most recent reporting period.

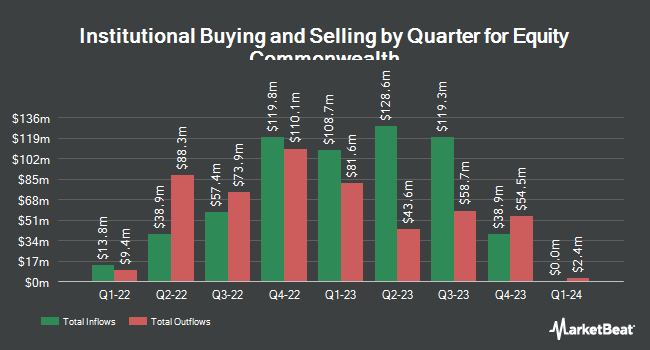

A number of other institutional investors and hedge funds also recently made changes to their positions in the business. Acadian Asset Management LLC purchased a new stake in shares of Equity Commonwealth in the first quarter worth $1,257,000. Jane Street Group LLC increased its holdings in shares of Equity Commonwealth by 846.6% in the first quarter. Jane Street Group LLC now owns 328,925 shares of the real estate investment trust's stock worth $530,000 after buying an additional 294,177 shares during the period. Jones Financial Companies Lllp increased its holdings in shares of Equity Commonwealth by 63,967.4% in the first quarter. Jones Financial Companies Lllp now owns 141,589 shares of the real estate investment trust's stock worth $228,000 after buying an additional 141,368 shares during the period. Ursa Fund Management LLC increased its holdings in Equity Commonwealth by 13.1% during the 1st quarter. Ursa Fund Management LLC now owns 7,025,000 shares of the real estate investment trust's stock valued at $11,310,000 after purchasing an additional 811,822 shares during the period. Finally, AQR Capital Management LLC increased its holdings in Equity Commonwealth by 68.0% during the 1st quarter. AQR Capital Management LLC now owns 1,400,141 shares of the real estate investment trust's stock valued at $2,254,000 after purchasing an additional 566,667 shares during the period. Hedge funds and other institutional investors own 96.00% of the company's stock.

Equity Commonwealth Price Performance

NYSE:EQC remained flat at $1.58 during mid-day trading on Wednesday. Equity Commonwealth has a 1 year low of $1.40 and a 1 year high of $20.60. The stock has a market capitalization of $169.73 million, a P/E ratio of 4.05 and a beta of 0.57. The company's 50 day moving average price is $1.58 and its two-hundred day moving average price is $1.59.

About Equity Commonwealth

(

Free Report)

Equity Commonwealth NYSE: EQC is a Chicago based, internally managed and self-advised real estate investment trust (REIT) with commercial office properties in the United States. EQC's portfolio is comprised of four properties totaling 1.5 million square feet.

Featured Articles

Before you consider Equity Commonwealth, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equity Commonwealth wasn't on the list.

While Equity Commonwealth currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.