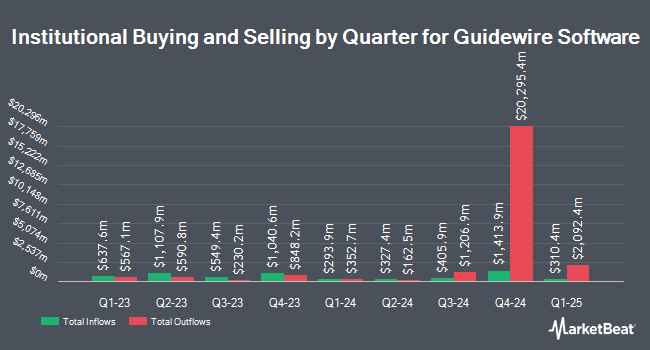

DMC Group LLC bought a new stake in Guidewire Software, Inc. (NYSE:GWRE - Free Report) in the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 1,210 shares of the technology company's stock, valued at approximately $227,000.

A number of other institutional investors have also recently added to or reduced their stakes in the business. MassMutual Private Wealth & Trust FSB raised its position in shares of Guidewire Software by 70.0% in the first quarter. MassMutual Private Wealth & Trust FSB now owns 170 shares of the technology company's stock valued at $32,000 after purchasing an additional 70 shares during the period. Fifth Third Bancorp increased its position in Guidewire Software by 16.4% during the first quarter. Fifth Third Bancorp now owns 569 shares of the technology company's stock worth $107,000 after acquiring an additional 80 shares during the period. True Wealth Design LLC increased its position in Guidewire Software by 14.4% during the fourth quarter. True Wealth Design LLC now owns 677 shares of the technology company's stock worth $114,000 after acquiring an additional 85 shares during the period. Mitsubishi UFJ Asset Management Co. Ltd. increased its position in Guidewire Software by 101.0% during the fourth quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 197 shares of the technology company's stock worth $34,000 after acquiring an additional 99 shares during the period. Finally, Nebula Research & Development LLC increased its position in Guidewire Software by 8.5% during the fourth quarter. Nebula Research & Development LLC now owns 1,274 shares of the technology company's stock worth $215,000 after acquiring an additional 100 shares during the period.

Insider Activity

In other news, CEO Michael George Rosenbaum sold 1,400 shares of the business's stock in a transaction on Monday, July 7th. The shares were sold at an average price of $230.70, for a total value of $322,980.00. Following the sale, the chief executive officer owned 234,468 shares in the company, valued at approximately $54,091,767.60. The trade was a 0.59% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, President John P. Mullen sold 3,000 shares of the stock in a transaction dated Tuesday, July 1st. The stock was sold at an average price of $235.05, for a total transaction of $705,150.00. Following the sale, the president directly owned 146,489 shares in the company, valued at approximately $34,432,239.45. This represents a 2.01% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 18,860 shares of company stock worth $4,214,136. Corporate insiders own 0.48% of the company's stock.

Guidewire Software Price Performance

Shares of NYSE:GWRE traded down $4.22 on Friday, hitting $220.91. The stock had a trading volume of 275,429 shares, compared to its average volume of 1,042,818. Guidewire Software, Inc. has a twelve month low of $132.01 and a twelve month high of $263.20. The company has a debt-to-equity ratio of 0.49, a quick ratio of 3.23 and a current ratio of 3.23. The firm's 50 day moving average price is $228.17 and its 200-day moving average price is $204.09. The company has a market capitalization of $18.60 billion, a price-to-earnings ratio of 552.28, a price-to-earnings-growth ratio of 20.51 and a beta of 1.16.

Guidewire Software (NYSE:GWRE - Get Free Report) last issued its earnings results on Tuesday, June 3rd. The technology company reported $0.88 EPS for the quarter, beating the consensus estimate of $0.47 by $0.41. Guidewire Software had a net margin of 3.04% and a return on equity of 6.96%. The company had revenue of $293.51 million for the quarter, compared to the consensus estimate of $286.40 million. During the same quarter in the previous year, the company earned $0.26 EPS. The firm's revenue for the quarter was up 22.0% compared to the same quarter last year. On average, equities research analysts predict that Guidewire Software, Inc. will post 0.52 earnings per share for the current year.

Analyst Ratings Changes

A number of equities analysts recently issued reports on GWRE shares. Wall Street Zen raised shares of Guidewire Software from a "hold" rating to a "buy" rating in a research report on Friday, June 6th. JMP Securities boosted their target price on shares of Guidewire Software from $250.00 to $281.00 and gave the stock a "market outperform" rating in a research report on Wednesday, June 4th. Stifel Nicolaus boosted their price target on shares of Guidewire Software from $230.00 to $270.00 and gave the company a "buy" rating in a report on Wednesday, June 4th. Bank of America boosted their price target on shares of Guidewire Software from $135.00 to $160.00 and gave the company an "underperform" rating in a report on Wednesday, June 4th. Finally, DA Davidson reissued a "neutral" rating and issued a $226.00 price target on shares of Guidewire Software in a report on Wednesday, June 4th. One analyst has rated the stock with a sell rating, three have assigned a hold rating and eleven have assigned a buy rating to the stock. Based on data from MarketBeat, Guidewire Software presently has a consensus rating of "Moderate Buy" and a consensus target price of $248.31.

View Our Latest Report on GWRE

Guidewire Software Company Profile

(

Free Report)

Guidewire Software, Inc provides a platform for property and casualty (P&C) insurers worldwide. The company offers Guidewire InsuranceSuite Cloud, such as PolicyCenter Cloud, BillingCenter Cloud, and ClaimCenter Cloud applications. It also provides Guidewire InsuranceNow, a cloud-based platform that offers policy, billing, and claims management functionality to insurers; and Guidewire InsuranceSuite for Self-Managed.

Featured Articles

Before you consider Guidewire Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Guidewire Software wasn't on the list.

While Guidewire Software currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.