DRW Securities LLC decreased its holdings in Pacific Gas & Electric Co. (NYSE:PCG - Free Report) by 70.2% in the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 175,849 shares of the utilities provider's stock after selling 413,415 shares during the period. DRW Securities LLC's holdings in Pacific Gas & Electric were worth $3,021,000 at the end of the most recent reporting period.

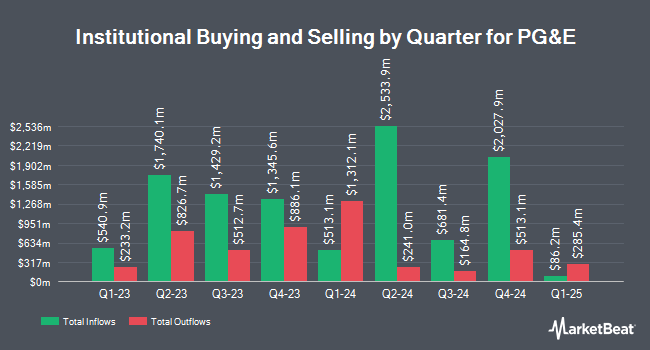

A number of other hedge funds have also recently made changes to their positions in PCG. Lido Advisors LLC boosted its stake in shares of Pacific Gas & Electric by 14.7% in the fourth quarter. Lido Advisors LLC now owns 37,051 shares of the utilities provider's stock worth $749,000 after acquiring an additional 4,752 shares during the period. Comerica Bank boosted its stake in shares of Pacific Gas & Electric by 24.1% in the fourth quarter. Comerica Bank now owns 333,797 shares of the utilities provider's stock worth $6,736,000 after acquiring an additional 64,919 shares during the period. Freestone Grove Partners LP bought a new position in shares of Pacific Gas & Electric in the fourth quarter worth about $657,000. Caisse DE Depot ET Placement DU Quebec purchased a new stake in shares of Pacific Gas & Electric in the fourth quarter worth about $2,767,000. Finally, AXA S.A. lifted its position in shares of Pacific Gas & Electric by 26.9% in the fourth quarter. AXA S.A. now owns 110,031 shares of the utilities provider's stock worth $2,220,000 after buying an additional 23,353 shares in the last quarter. Institutional investors own 78.56% of the company's stock.

Pacific Gas & Electric Trading Down 0.8%

Shares of NYSE:PCG traded down $0.12 during trading hours on Thursday, hitting $15.23. 13,533,258 shares of the company's stock traded hands, compared to its average volume of 23,421,758. Pacific Gas & Electric Co. has a 1 year low of $12.97 and a 1 year high of $21.72. The business has a fifty day moving average price of $14.39 and a 200-day moving average price of $15.70. The firm has a market capitalization of $40.74 billion, a P/E ratio of 13.97, a price-to-earnings-growth ratio of 1.14 and a beta of 0.57. The company has a debt-to-equity ratio of 1.81, a current ratio of 0.94 and a quick ratio of 0.89.

Pacific Gas & Electric (NYSE:PCG - Get Free Report) last announced its earnings results on Thursday, July 31st. The utilities provider reported $0.31 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.33 by ($0.02). Pacific Gas & Electric had a net margin of 9.95% and a return on equity of 10.13%. The business had revenue of $5.90 billion for the quarter, compared to analysts' expectations of $6.37 billion. During the same quarter last year, the firm earned $0.31 EPS. The firm's quarterly revenue was down 1.5% on a year-over-year basis. Pacific Gas & Electric has set its FY 2025 guidance at 1.480-1.520 EPS. Equities analysts expect that Pacific Gas & Electric Co. will post 1.49 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of research firms recently commented on PCG. Morgan Stanley reiterated an "underweight" rating on shares of Pacific Gas & Electric in a research report on Thursday, August 21st. Barclays decreased their target price on Pacific Gas & Electric from $22.00 to $20.00 and set an "overweight" rating on the stock in a research report on Tuesday, July 22nd. Argus upgraded Pacific Gas & Electric to a "hold" rating in a research report on Monday, June 16th. Zacks Research raised Pacific Gas & Electric from a "strong sell" rating to a "hold" rating in a research note on Monday, August 18th. Finally, UBS Group set a $19.00 price objective on Pacific Gas & Electric in a research note on Friday, August 29th. Seven equities research analysts have rated the stock with a Buy rating, five have assigned a Hold rating and one has issued a Sell rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $20.55.

Get Our Latest Analysis on PCG

About Pacific Gas & Electric

(

Free Report)

PG&E Corp. operates as a holding company, which engages in generation, transmission, and distribution of electricity and natural gas to customers. It specializes in energy, utility, power, gas, electricity, solar and sustainability. The company was founded in 1995 and is headquartered in Oakland, CA.

Further Reading

Before you consider Pacific Gas & Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pacific Gas & Electric wasn't on the list.

While Pacific Gas & Electric currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.