NBC Securities Inc. reduced its stake in shares of DT Midstream, Inc. (NYSE:DTM - Free Report) by 4.9% in the 2nd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 53,028 shares of the company's stock after selling 2,730 shares during the period. DT Midstream accounts for about 0.5% of NBC Securities Inc.'s holdings, making the stock its 26th biggest position. NBC Securities Inc. owned about 0.05% of DT Midstream worth $5,828,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

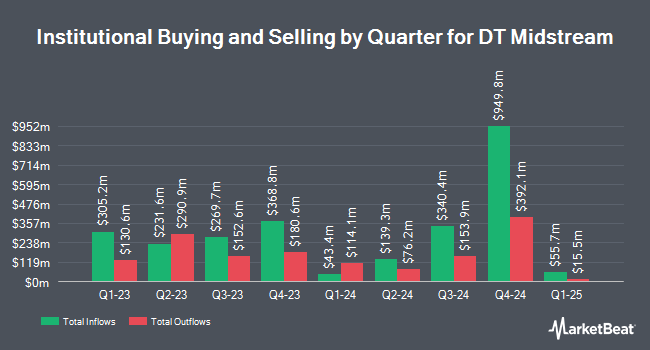

Several other institutional investors have also recently modified their holdings of the stock. CWM LLC raised its holdings in DT Midstream by 18.9% in the 1st quarter. CWM LLC now owns 4,201 shares of the company's stock valued at $405,000 after acquiring an additional 669 shares during the last quarter. OneDigital Investment Advisors LLC acquired a new position in DT Midstream in the 1st quarter valued at $274,000. Bessemer Group Inc. raised its holdings in DT Midstream by 44.0% in the 1st quarter. Bessemer Group Inc. now owns 442 shares of the company's stock valued at $43,000 after acquiring an additional 135 shares during the last quarter. True Link Financial Advisors LLC acquired a new position in DT Midstream in the 1st quarter valued at $238,000. Finally, Catalyst Capital Advisors LLC raised its holdings in DT Midstream by 10.1% in the 1st quarter. Catalyst Capital Advisors LLC now owns 144,025 shares of the company's stock valued at $13,896,000 after acquiring an additional 13,243 shares during the last quarter. 81.53% of the stock is currently owned by institutional investors and hedge funds.

DT Midstream Stock Performance

DTM traded down $1.27 on Friday, hitting $106.44. 294,799 shares of the company's stock were exchanged, compared to its average volume of 963,593. The firm has a market cap of $10.81 billion, a PE ratio of 28.53, a P/E/G ratio of 2.35 and a beta of 0.77. DT Midstream, Inc. has a twelve month low of $76.13 and a twelve month high of $114.50. The stock has a fifty day moving average of $103.53 and a two-hundred day moving average of $101.25. The company has a current ratio of 0.88, a quick ratio of 0.88 and a debt-to-equity ratio of 0.69.

DT Midstream (NYSE:DTM - Get Free Report) last released its quarterly earnings data on Thursday, July 31st. The company reported $1.04 earnings per share for the quarter, topping the consensus estimate of $0.98 by $0.06. The firm had revenue of $299.00 million for the quarter, compared to analyst estimates of $295.70 million. DT Midstream had a net margin of 33.90% and a return on equity of 8.48%. During the same quarter in the prior year, the business earned $0.98 earnings per share. DT Midstream has set its FY 2025 guidance at 4.050-4.450 EPS. On average, research analysts anticipate that DT Midstream, Inc. will post 3.8 earnings per share for the current fiscal year.

DT Midstream Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Wednesday, October 15th. Shareholders of record on Monday, September 15th will be paid a $0.82 dividend. The ex-dividend date is Monday, September 15th. This represents a $3.28 annualized dividend and a dividend yield of 3.1%. DT Midstream's dividend payout ratio (DPR) is presently 87.94%.

Wall Street Analysts Forecast Growth

DTM has been the subject of several analyst reports. Stifel Nicolaus boosted their price target on DT Midstream from $102.00 to $108.00 and gave the company a "buy" rating in a report on Friday, August 1st. Mizuho boosted their price target on DT Midstream from $105.00 to $108.00 and gave the company a "neutral" rating in a report on Friday, August 29th. Morgan Stanley upped their price objective on DT Midstream from $113.00 to $118.00 and gave the stock an "underweight" rating in a report on Wednesday, August 6th. Finally, Wells Fargo & Company upped their price objective on DT Midstream from $108.00 to $117.00 and gave the stock an "overweight" rating in a report on Friday, August 1st. Six analysts have rated the stock with a Buy rating, four have given a Hold rating and two have given a Sell rating to the company's stock. According to data from MarketBeat, the company has an average rating of "Hold" and a consensus target price of $110.67.

View Our Latest Report on DT Midstream

Insider Activity

In other news, VP Melissa Cox sold 4,755 shares of the stock in a transaction that occurred on Monday, August 11th. The shares were sold at an average price of $104.47, for a total value of $496,754.85. Following the completion of the transaction, the vice president directly owned 5,171 shares in the company, valued at $540,214.37. This trade represents a 47.90% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. 0.34% of the stock is owned by company insiders.

DT Midstream Profile

(

Free Report)

DT Midstream, Inc, together with its subsidiaries, provides integrated natural gas services in the United States. The company operates through two segments, Pipeline and Gathering. The Pipeline segment owns and operates interstate and intrastate natural gas pipelines, storage systems, and natural gas gathering lateral pipelines.

Featured Articles

Before you consider DT Midstream, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DT Midstream wasn't on the list.

While DT Midstream currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.