Atalanta Sosnoff Capital LLC grew its stake in DuPont de Nemours, Inc. (NYSE:DD - Free Report) by 142.8% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 410,288 shares of the basic materials company's stock after purchasing an additional 241,309 shares during the period. Atalanta Sosnoff Capital LLC owned approximately 0.10% of DuPont de Nemours worth $30,640,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

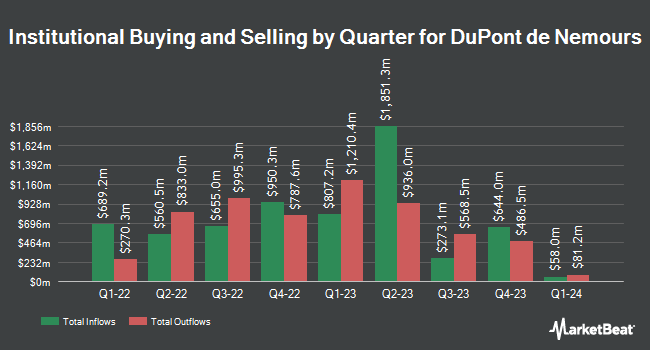

A number of other large investors have also made changes to their positions in the stock. Vanguard Group Inc. grew its position in shares of DuPont de Nemours by 0.6% in the first quarter. Vanguard Group Inc. now owns 46,894,623 shares of the basic materials company's stock valued at $3,502,090,000 after purchasing an additional 298,408 shares in the last quarter. Nuveen LLC purchased a new stake in shares of DuPont de Nemours in the first quarter valued at approximately $531,037,000. Price T Rowe Associates Inc. MD grew its position in shares of DuPont de Nemours by 21.9% in the first quarter. Price T Rowe Associates Inc. MD now owns 4,159,807 shares of the basic materials company's stock valued at $310,656,000 after purchasing an additional 746,364 shares in the last quarter. Bank of New York Mellon Corp grew its position in shares of DuPont de Nemours by 1.1% in the first quarter. Bank of New York Mellon Corp now owns 3,347,098 shares of the basic materials company's stock valued at $249,961,000 after purchasing an additional 37,327 shares in the last quarter. Finally, Dimensional Fund Advisors LP grew its position in shares of DuPont de Nemours by 2.7% in the first quarter. Dimensional Fund Advisors LP now owns 3,190,172 shares of the basic materials company's stock valued at $238,200,000 after purchasing an additional 83,147 shares in the last quarter. 73.96% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

DD has been the subject of a number of analyst reports. Citigroup upped their price target on DuPont de Nemours from $75.00 to $85.00 and gave the company a "buy" rating in a research report on Thursday, July 3rd. KeyCorp upped their price objective on DuPont de Nemours from $87.00 to $92.00 and gave the company an "overweight" rating in a report on Wednesday, August 6th. Wells Fargo & Company upped their price objective on DuPont de Nemours from $81.00 to $90.00 and gave the company an "overweight" rating in a report on Monday, July 14th. Royal Bank Of Canada upped their price objective on DuPont de Nemours from $93.00 to $94.00 and gave the company an "outperform" rating in a report on Friday, August 8th. Finally, JPMorgan Chase & Co. upped their price objective on DuPont de Nemours from $78.00 to $93.00 and gave the company an "overweight" rating in a report on Friday, May 16th. Nine investment analysts have rated the stock with a Buy rating and three have assigned a Hold rating to the stock. According to data from MarketBeat, DuPont de Nemours presently has an average rating of "Moderate Buy" and an average price target of $88.25.

Get Our Latest Analysis on DuPont de Nemours

DuPont de Nemours Trading Up 0.8%

NYSE:DD traded up $0.62 during trading hours on Friday, reaching $77.77. 3,374,635 shares of the stock were exchanged, compared to its average volume of 2,365,223. The company has a quick ratio of 0.94, a current ratio of 1.41 and a debt-to-equity ratio of 0.23. The business has a 50-day moving average of $74.28 and a two-hundred day moving average of $71.16. DuPont de Nemours, Inc. has a twelve month low of $53.77 and a twelve month high of $90.06. The company has a market capitalization of $32.56 billion, a price-to-earnings ratio of -165.46, a PEG ratio of 1.94 and a beta of 1.07.

DuPont de Nemours (NYSE:DD - Get Free Report) last released its quarterly earnings results on Tuesday, August 5th. The basic materials company reported $1.12 EPS for the quarter, topping analysts' consensus estimates of $1.06 by $0.06. The company had revenue of $3.26 billion for the quarter, compared to analysts' expectations of $3.23 billion. DuPont de Nemours had a positive return on equity of 7.85% and a negative net margin of 1.54%.The firm's revenue was up 2.7% compared to the same quarter last year. During the same period in the prior year, the firm earned $0.97 earnings per share. DuPont de Nemours has set its FY 2025 guidance at 4.400-4.400 EPS. Q3 2025 guidance at 1.150-1.150 EPS. On average, equities analysts predict that DuPont de Nemours, Inc. will post 4.38 EPS for the current year.

DuPont de Nemours Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, September 15th. Stockholders of record on Friday, August 29th will be paid a $0.41 dividend. This represents a $1.64 annualized dividend and a dividend yield of 2.1%. The ex-dividend date is Friday, August 29th. DuPont de Nemours's dividend payout ratio (DPR) is presently -348.94%.

DuPont de Nemours Profile

(

Free Report)

DuPont de Nemours, Inc provides technology-based materials and solutions in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa. It operates through Electronics & Industrial, Water & Protection, and Corporate & Other segments. The Electronics & Industrial segment supplies materials and solutions for the fabrication of semiconductors and integrated circuits.

See Also

Before you consider DuPont de Nemours, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DuPont de Nemours wasn't on the list.

While DuPont de Nemours currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.