Landscape Capital Management L.L.C. lifted its position in shares of Dutch Bros Inc. (NYSE:BROS - Free Report) by 80.5% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 63,402 shares of the company's stock after buying an additional 28,273 shares during the quarter. Landscape Capital Management L.L.C.'s holdings in Dutch Bros were worth $3,914,000 at the end of the most recent quarter.

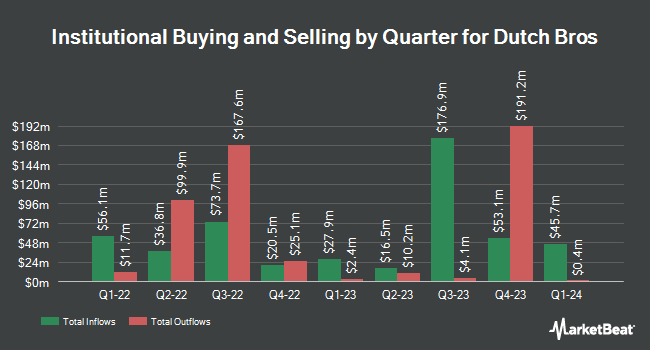

A number of other hedge funds and other institutional investors have also modified their holdings of the company. D. E. Shaw & Co. Inc. grew its holdings in shares of Dutch Bros by 14.0% during the fourth quarter. D. E. Shaw & Co. Inc. now owns 5,118,265 shares of the company's stock worth $268,095,000 after buying an additional 627,875 shares in the last quarter. 1832 Asset Management L.P. grew its holdings in shares of Dutch Bros by 29.9% during the first quarter. 1832 Asset Management L.P. now owns 3,420,200 shares of the company's stock worth $211,163,000 after buying an additional 788,100 shares in the last quarter. Invesco Ltd. grew its holdings in shares of Dutch Bros by 16.4% during the first quarter. Invesco Ltd. now owns 1,365,281 shares of the company's stock worth $84,292,000 after buying an additional 192,458 shares in the last quarter. Fuller & Thaler Asset Management Inc. grew its holdings in shares of Dutch Bros by 25.9% during the first quarter. Fuller & Thaler Asset Management Inc. now owns 1,324,676 shares of the company's stock worth $81,786,000 after buying an additional 272,473 shares in the last quarter. Finally, Millennium Management LLC grew its holdings in shares of Dutch Bros by 7.5% during the fourth quarter. Millennium Management LLC now owns 1,295,545 shares of the company's stock worth $67,861,000 after buying an additional 90,166 shares in the last quarter. 85.54% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

BROS has been the subject of a number of recent research reports. Robert W. Baird lifted their price target on shares of Dutch Bros from $66.00 to $72.00 and gave the stock an "outperform" rating in a report on Thursday, May 8th. The Goldman Sachs Group started coverage on shares of Dutch Bros in a report on Thursday, June 26th. They set a "neutral" rating and a $75.00 price target for the company. Bank of America raised their target price on shares of Dutch Bros from $80.00 to $84.00 and gave the stock an "overweight" rating in a research report on Thursday, August 7th. UBS Group raised their target price on shares of Dutch Bros from $80.00 to $85.00 and gave the stock a "buy" rating in a research report on Thursday. Finally, Stifel Nicolaus decreased their target price on shares of Dutch Bros from $85.00 to $82.00 and set a "buy" rating on the stock in a research report on Thursday, May 8th. Two investment analysts have rated the stock with a Strong Buy rating, sixteen have issued a Buy rating and two have issued a Hold rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Buy" and an average price target of $80.06.

Get Our Latest Research Report on Dutch Bros

Dutch Bros Trading Down 3.1%

BROS stock traded down $2.27 during midday trading on Friday, reaching $71.97. 3,341,555 shares of the company's stock traded hands, compared to its average volume of 4,318,958. The company has a market capitalization of $11.84 billion, a P/E ratio of 153.13, a PEG ratio of 4.03 and a beta of 2.63. The company has a debt-to-equity ratio of 0.69, a current ratio of 1.64 and a quick ratio of 1.42. Dutch Bros Inc. has a fifty-two week low of $30.30 and a fifty-two week high of $86.88. The business has a 50-day moving average price of $64.95 and a two-hundred day moving average price of $66.05.

Dutch Bros (NYSE:BROS - Get Free Report) last announced its quarterly earnings results on Wednesday, August 6th. The company reported $0.26 earnings per share for the quarter, beating analysts' consensus estimates of $0.18 by $0.08. The firm had revenue of $415.81 million for the quarter, compared to analysts' expectations of $403.24 million. Dutch Bros had a net margin of 3.94% and a return on equity of 8.86%. Dutch Bros's revenue was up 28.0% compared to the same quarter last year. During the same period in the previous year, the company posted $0.19 earnings per share. Equities research analysts forecast that Dutch Bros Inc. will post 0.57 EPS for the current fiscal year.

Insider Buying and Selling

In other Dutch Bros news, major shareholder Dm Individual Aggregator, Llc sold 482,750 shares of Dutch Bros stock in a transaction that occurred on Friday, August 22nd. The shares were sold at an average price of $65.17, for a total transaction of $31,460,817.50. Following the transaction, the insider directly owned 1,279,144 shares of the company's stock, valued at $83,361,814.48. The trade was a 27.40% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, Chairman Travis Boersma sold 1,250,371 shares of Dutch Bros stock in a transaction that occurred on Friday, August 22nd. The shares were sold at an average price of $65.17, for a total transaction of $81,486,678.07. Following the transaction, the chairman directly owned 1,279,144 shares in the company, valued at approximately $83,361,814.48. This trade represents a 49.43% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 3,161,101 shares of company stock worth $207,633,882. 42.40% of the stock is currently owned by corporate insiders.

Dutch Bros Company Profile

(

Free Report)

Dutch Bros Inc, together with its subsidiaries, operates and franchises drive-thru shops in the United States. The company operates through Company-Operated Shops and Franchising and Other segments. It serves through company-operated shops and online channels under Dutch Bros; Dutch Bros Coffee; Dutch Bros Rebel; Dutch Bros; and Blue Rebel brands.

Further Reading

Before you consider Dutch Bros, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dutch Bros wasn't on the list.

While Dutch Bros currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report