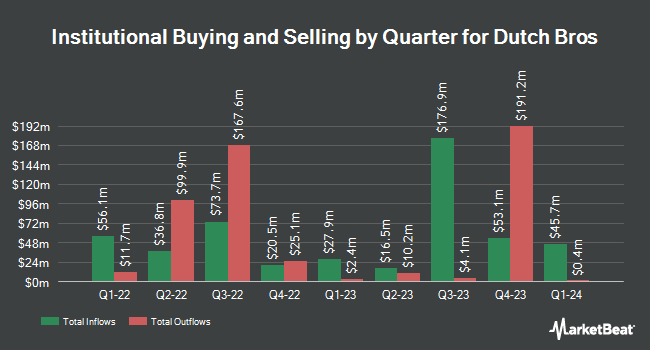

Quantbot Technologies LP boosted its holdings in shares of Dutch Bros Inc. (NYSE:BROS - Free Report) by 40.3% in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 126,855 shares of the company's stock after acquiring an additional 36,421 shares during the period. Quantbot Technologies LP owned about 0.08% of Dutch Bros worth $7,832,000 at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the business. D. E. Shaw & Co. Inc. raised its position in shares of Dutch Bros by 14.0% in the fourth quarter. D. E. Shaw & Co. Inc. now owns 5,118,265 shares of the company's stock valued at $268,095,000 after buying an additional 627,875 shares during the last quarter. Lord Abbett & CO. LLC raised its position in shares of Dutch Bros by 120.6% in the first quarter. Lord Abbett & CO. LLC now owns 1,082,414 shares of the company's stock valued at $66,828,000 after buying an additional 591,657 shares during the last quarter. Bank of Nova Scotia raised its position in shares of Dutch Bros by 751.0% in the first quarter. Bank of Nova Scotia now owns 625,036 shares of the company's stock valued at $38,589,000 after buying an additional 551,587 shares during the last quarter. Deutsche Bank AG raised its position in shares of Dutch Bros by 8,912.8% in the fourth quarter. Deutsche Bank AG now owns 546,268 shares of the company's stock valued at $28,614,000 after buying an additional 540,207 shares during the last quarter. Finally, Barclays PLC raised its position in shares of Dutch Bros by 699.4% in the fourth quarter. Barclays PLC now owns 429,693 shares of the company's stock valued at $22,507,000 after buying an additional 375,943 shares during the last quarter. Institutional investors and hedge funds own 85.54% of the company's stock.

Dutch Bros Trading Up 3.5%

BROS traded up $2.2050 during trading on Friday, hitting $65.3350. 4,738,619 shares of the company's stock were exchanged, compared to its average volume of 3,949,006. The company has a current ratio of 1.64, a quick ratio of 1.42 and a debt-to-equity ratio of 0.69. Dutch Bros Inc. has a 1 year low of $30.30 and a 1 year high of $86.88. The stock has a 50 day moving average price of $64.65 and a 200 day moving average price of $65.83. The firm has a market cap of $10.75 billion, a P/E ratio of 139.01, a price-to-earnings-growth ratio of 3.54 and a beta of 2.63.

Dutch Bros (NYSE:BROS - Get Free Report) last announced its earnings results on Wednesday, August 6th. The company reported $0.26 earnings per share for the quarter, beating the consensus estimate of $0.18 by $0.08. Dutch Bros had a net margin of 3.94% and a return on equity of 8.86%. The business had revenue of $415.81 million during the quarter, compared to the consensus estimate of $403.24 million. During the same period in the prior year, the firm earned $0.19 earnings per share. The business's quarterly revenue was up 28.0% compared to the same quarter last year. As a group, analysts expect that Dutch Bros Inc. will post 0.57 EPS for the current fiscal year.

Wall Street Analyst Weigh In

Several brokerages recently commented on BROS. Piper Sandler dropped their price target on shares of Dutch Bros from $70.00 to $63.00 and set a "neutral" rating for the company in a research report on Thursday, May 8th. Morgan Stanley reaffirmed an "overweight" rating and set a $84.00 price target (up previously from $80.00) on shares of Dutch Bros in a research report on Thursday, August 7th. Bank of America upped their price target on shares of Dutch Bros from $80.00 to $84.00 and gave the stock an "overweight" rating in a research report on Thursday, August 7th. The Goldman Sachs Group began coverage on shares of Dutch Bros in a research report on Thursday, June 26th. They set a "neutral" rating and a $75.00 price target for the company. Finally, Guggenheim upped their price target on shares of Dutch Bros from $72.00 to $76.00 and gave the stock a "buy" rating in a research report on Thursday, August 7th. Two research analysts have rated the stock with a Strong Buy rating, sixteen have issued a Buy rating and two have issued a Hold rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Buy" and an average price target of $79.76.

View Our Latest Stock Report on Dutch Bros

About Dutch Bros

(

Free Report)

Dutch Bros Inc, together with its subsidiaries, operates and franchises drive-thru shops in the United States. The company operates through Company-Operated Shops and Franchising and Other segments. It serves through company-operated shops and online channels under Dutch Bros; Dutch Bros Coffee; Dutch Bros Rebel; Dutch Bros; and Blue Rebel brands.

See Also

Before you consider Dutch Bros, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dutch Bros wasn't on the list.

While Dutch Bros currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.