Dynamic Technology Lab Private Ltd bought a new stake in shares of OGE Energy Corporation (NYSE:OGE - Free Report) during the 1st quarter, according to its most recent filing with the SEC. The firm bought 8,381 shares of the utilities provider's stock, valued at approximately $385,000.

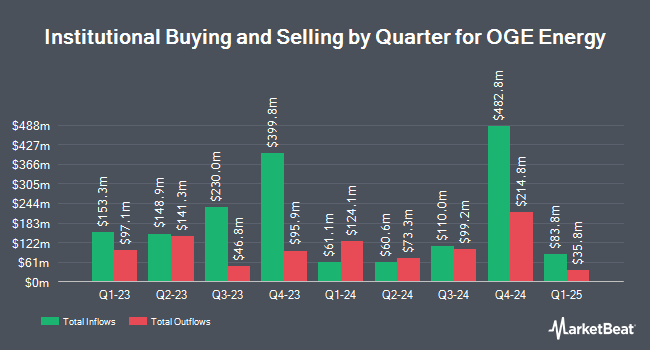

Several other hedge funds have also modified their holdings of OGE. Jane Street Group LLC raised its holdings in shares of OGE Energy by 3.4% during the 4th quarter. Jane Street Group LLC now owns 42,546 shares of the utilities provider's stock valued at $1,755,000 after buying an additional 1,401 shares during the period. BNP Paribas Financial Markets increased its holdings in OGE Energy by 3.3% during the 4th quarter. BNP Paribas Financial Markets now owns 35,907 shares of the utilities provider's stock worth $1,481,000 after purchasing an additional 1,155 shares during the last quarter. Captrust Financial Advisors increased its holdings in OGE Energy by 9.1% during the 4th quarter. Captrust Financial Advisors now owns 29,552 shares of the utilities provider's stock worth $1,219,000 after purchasing an additional 2,472 shares during the last quarter. Cetera Investment Advisers increased its holdings in OGE Energy by 10.8% during the 4th quarter. Cetera Investment Advisers now owns 62,831 shares of the utilities provider's stock worth $2,592,000 after purchasing an additional 6,135 shares during the last quarter. Finally, Deutsche Bank AG increased its holdings in OGE Energy by 417.3% during the 4th quarter. Deutsche Bank AG now owns 77,990 shares of the utilities provider's stock worth $3,217,000 after purchasing an additional 62,913 shares during the last quarter. 71.84% of the stock is currently owned by hedge funds and other institutional investors.

OGE Energy Stock Performance

OGE stock traded up $0.57 during trading on Wednesday, reaching $44.21. 101,526 shares of the company's stock were exchanged, compared to its average volume of 1,128,731. The company has a quick ratio of 0.48, a current ratio of 0.78 and a debt-to-equity ratio of 1.16. OGE Energy Corporation has a 1-year low of $39.10 and a 1-year high of $46.91. The company's fifty day moving average price is $44.79 and its 200-day moving average price is $44.56. The firm has a market cap of $8.90 billion, a PE ratio of 18.12, a P/E/G ratio of 3.08 and a beta of 0.60.

OGE Energy (NYSE:OGE - Get Free Report) last announced its quarterly earnings results on Tuesday, July 29th. The utilities provider reported $0.53 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.58 by ($0.05). OGE Energy had a return on equity of 10.60% and a net margin of 15.27%.The business had revenue of $741.60 million for the quarter, compared to analyst estimates of $719.97 million. During the same quarter last year, the firm posted $0.51 EPS. The company's revenue was up 11.9% compared to the same quarter last year. On average, research analysts expect that OGE Energy Corporation will post 2.27 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Several equities research analysts have issued reports on the company. Barclays upgraded OGE Energy from an "equal weight" rating to an "overweight" rating and lifted their price objective for the stock from $45.00 to $47.00 in a report on Thursday, June 5th. Wall Street Zen upgraded OGE Energy from a "sell" rating to a "hold" rating in a report on Sunday, September 7th. Four analysts have rated the stock with a Buy rating and two have given a Hold rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $46.80.

Get Our Latest Stock Report on OGE Energy

OGE Energy Profile

(

Free Report)

OGE Energy Corp., together with its subsidiaries, operates as an energy services provider in the United States. The company generates, transmits, distributes, and sells electric energy. In addition, it provides retail electric service to approximately 896,000 customers, which covers a service area of approximately 30,000 square miles in Oklahoma and western Arkansas; and owns and operates coal-fired, natural gas-fired, wind-powered, and solar-powered generating assets.

Featured Articles

Before you consider OGE Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OGE Energy wasn't on the list.

While OGE Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.