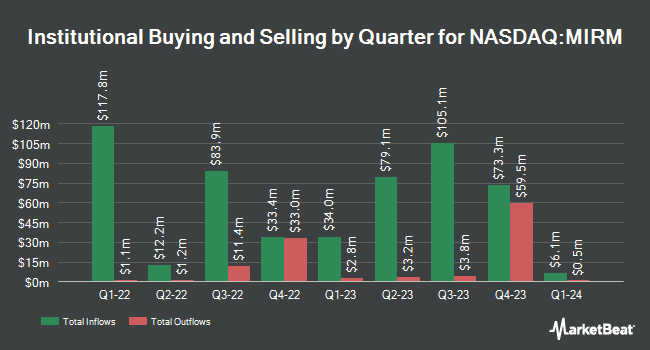

E Fund Management Co. Ltd. acquired a new stake in Mirum Pharmaceuticals, Inc. (NASDAQ:MIRM - Free Report) during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund acquired 4,847 shares of the company's stock, valued at approximately $218,000.

Other institutional investors and hedge funds have also recently modified their holdings of the company. GAMMA Investing LLC grew its stake in Mirum Pharmaceuticals by 4,555.0% during the 1st quarter. GAMMA Investing LLC now owns 5,586 shares of the company's stock worth $252,000 after purchasing an additional 5,466 shares in the last quarter. SG Americas Securities LLC grew its stake in Mirum Pharmaceuticals by 174.9% during the 1st quarter. SG Americas Securities LLC now owns 19,182 shares of the company's stock worth $864,000 after purchasing an additional 12,204 shares in the last quarter. Wealth Enhancement Advisory Services LLC grew its stake in Mirum Pharmaceuticals by 2.1% during the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 16,685 shares of the company's stock worth $752,000 after purchasing an additional 339 shares in the last quarter. MPM Bioimpact LLC grew its stake in Mirum Pharmaceuticals by 19.7% during the 4th quarter. MPM Bioimpact LLC now owns 589,579 shares of the company's stock worth $24,379,000 after purchasing an additional 96,856 shares in the last quarter. Finally, KBC Group NV acquired a new position in Mirum Pharmaceuticals during the 1st quarter worth $89,000.

Mirum Pharmaceuticals Stock Performance

Shares of NASDAQ MIRM traded up $1.55 during trading hours on Wednesday, reaching $66.71. The stock had a trading volume of 342,828 shares, compared to its average volume of 727,638. The firm has a market cap of $3.35 billion, a price-to-earnings ratio of -55.13 and a beta of 0.94. The company has a current ratio of 3.13, a quick ratio of 2.97 and a debt-to-equity ratio of 1.21. Mirum Pharmaceuticals, Inc. has a fifty-two week low of $36.86 and a fifty-two week high of $69.27. The firm has a 50-day moving average of $53.97 and a 200-day moving average of $48.15.

Mirum Pharmaceuticals (NASDAQ:MIRM - Get Free Report) last announced its earnings results on Wednesday, August 6th. The company reported ($0.12) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.31) by $0.19. The firm had revenue of $127.79 million during the quarter, compared to analysts' expectations of $107.91 million. Mirum Pharmaceuticals had a negative return on equity of 24.76% and a negative net margin of 13.65%.The business's revenue was up 64.1% on a year-over-year basis. During the same period in the prior year, the firm earned ($0.52) EPS. Equities research analysts predict that Mirum Pharmaceuticals, Inc. will post -1.43 earnings per share for the current year.

Analyst Ratings Changes

MIRM has been the subject of several analyst reports. Wall Street Zen raised Mirum Pharmaceuticals from a "buy" rating to a "strong-buy" rating in a research note on Sunday. Raymond James Financial reissued a "strong-buy" rating on shares of Mirum Pharmaceuticals in a research note on Thursday, August 7th. HC Wainwright boosted their target price on Mirum Pharmaceuticals from $73.00 to $80.00 and gave the stock a "buy" rating in a research note on Thursday, August 7th. JMP Securities set a $81.00 price objective on Mirum Pharmaceuticals and gave the stock a "market outperform" rating in a research report on Thursday, August 7th. Finally, Stifel Nicolaus set a $89.00 price objective on Mirum Pharmaceuticals and gave the stock a "buy" rating in a research report on Monday, August 11th. One research analyst has rated the stock with a Strong Buy rating and seven have given a Buy rating to the company's stock. According to MarketBeat.com, the company has a consensus rating of "Buy" and an average price target of $74.13.

Read Our Latest Analysis on MIRM

Insider Activity at Mirum Pharmaceuticals

In other Mirum Pharmaceuticals news, CEO Christopher Peetz sold 40,000 shares of the company's stock in a transaction that occurred on Monday, August 11th. The stock was sold at an average price of $62.00, for a total transaction of $2,480,000.00. Following the completion of the sale, the chief executive officer directly owned 138,641 shares of the company's stock, valued at $8,595,742. This represents a 22.39% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, SVP Jolanda Howe sold 10,000 shares of the company's stock in a transaction that occurred on Thursday, August 7th. The shares were sold at an average price of $58.00, for a total value of $580,000.00. Following the sale, the senior vice president directly owned 2,426 shares of the company's stock, valued at approximately $140,708. This represents a 80.48% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 91,041 shares of company stock valued at $5,320,624. 14.36% of the stock is owned by company insiders.

Mirum Pharmaceuticals Company Profile

(

Free Report)

Mirum Pharmaceuticals, Inc, a biopharmaceutical company, focuses on the development and commercialization of novel therapies for debilitating rare and orphan diseases. Its lead product candidate is LIVMARLI (maralixibat), an orally administered and minimally absorbed ileal bile acid transporter (IBAT) inhibitor that is approved for the treatment of cholestatic pruritus in patients with Alagille syndrome in the United States and internationally.

Featured Articles

Before you consider Mirum Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mirum Pharmaceuticals wasn't on the list.

While Mirum Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.