E Fund Management Co. Ltd. lessened its stake in KE Holdings Inc. Sponsored ADR (NYSE:BEKE - Free Report) by 18.4% during the 1st quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 3,503,210 shares of the company's stock after selling 788,541 shares during the quarter. KE accounts for about 3.4% of E Fund Management Co. Ltd.'s holdings, making the stock its 5th biggest position. E Fund Management Co. Ltd. owned approximately 0.29% of KE worth $70,379,000 as of its most recent filing with the SEC.

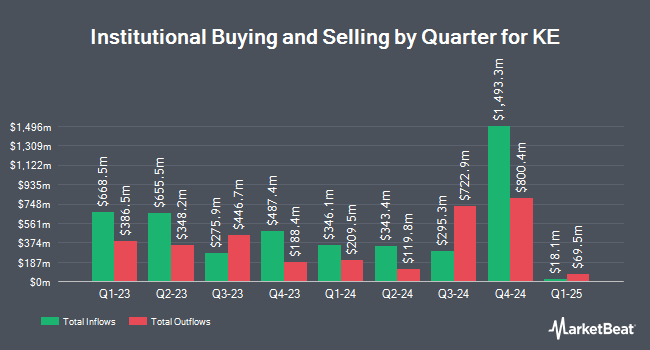

Several other large investors have also recently added to or reduced their stakes in the stock. Canada Pension Plan Investment Board increased its stake in shares of KE by 111,822,650.0% during the 4th quarter. Canada Pension Plan Investment Board now owns 11,182,275 shares of the company's stock worth $205,978,000 after purchasing an additional 11,182,265 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. increased its stake in shares of KE by 3,203.0% during the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 8,002,448 shares of the company's stock worth $160,769,000 after purchasing an additional 7,760,169 shares during the last quarter. Aspex Management HK Ltd acquired a new position in shares of KE during the 4th quarter worth $119,996,000. Nuveen Asset Management LLC increased its stake in shares of KE by 504.2% during the 4th quarter. Nuveen Asset Management LLC now owns 5,643,271 shares of the company's stock worth $103,949,000 after purchasing an additional 4,709,266 shares during the last quarter. Finally, Nuveen LLC acquired a new position in shares of KE during the 1st quarter worth $81,473,000. Institutional investors and hedge funds own 39.34% of the company's stock.

KE Stock Down 0.3%

KE stock traded down $0.06 during mid-day trading on Friday, reaching $18.33. The company had a trading volume of 2,808,766 shares, compared to its average volume of 5,094,183. KE Holdings Inc. Sponsored ADR has a 52 week low of $13.28 and a 52 week high of $26.05. The company has a 50 day moving average of $18.48 and a 200-day moving average of $19.55. The firm has a market cap of $21.83 billion, a price-to-earnings ratio of 34.59, a PEG ratio of 1.37 and a beta of -0.76.

Analyst Ratings Changes

Several brokerages have recently commented on BEKE. JPMorgan Chase & Co. dropped their price target on shares of KE from $24.00 to $22.00 and set an "overweight" rating on the stock in a research note on Tuesday, August 12th. UBS Group raised shares of KE from a "neutral" rating to a "buy" rating and upped their price objective for the stock from $22.10 to $23.00 in a report on Friday, May 16th. Wall Street Zen downgraded shares of KE from a "buy" rating to a "hold" rating in a report on Sunday, June 22nd. Citigroup decreased their price objective on shares of KE from $25.80 to $24.80 and set a "buy" rating for the company in a report on Friday, May 16th. Finally, Barclays decreased their price objective on shares of KE from $33.00 to $25.00 and set an "overweight" rating for the company in a report on Friday. One research analyst has rated the stock with a hold rating and seven have issued a buy rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $24.97.

Read Our Latest Stock Analysis on KE

About KE

(

Free Report)

KE Holdings Inc, through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China. It operates through four segments: Existing Home Transaction Services, New Home Transaction Services, Home Renovation and Furnishing, and Emerging and Other Services.

Read More

Before you consider KE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KE wasn't on the list.

While KE currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.