Eastern Bank lessened its holdings in Bank of America Corporation (NYSE:BAC - Free Report) by 1.2% during the second quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 1,346,473 shares of the financial services provider's stock after selling 16,835 shares during the quarter. Bank of America accounts for approximately 1.2% of Eastern Bank's investment portfolio, making the stock its 24th biggest position. Eastern Bank's holdings in Bank of America were worth $63,715,000 at the end of the most recent quarter.

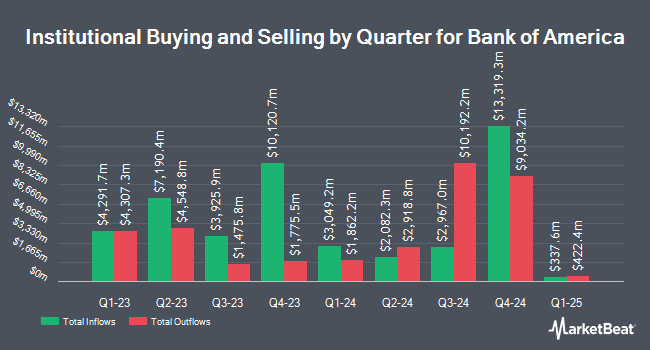

A number of other institutional investors also recently modified their holdings of the business. Wealth Advisory Solutions LLC raised its holdings in shares of Bank of America by 4.4% during the 2nd quarter. Wealth Advisory Solutions LLC now owns 5,126 shares of the financial services provider's stock worth $243,000 after buying an additional 214 shares in the last quarter. Cyndeo Wealth Partners LLC raised its holdings in shares of Bank of America by 0.8% during the 2nd quarter. Cyndeo Wealth Partners LLC now owns 28,394 shares of the financial services provider's stock worth $1,344,000 after buying an additional 221 shares in the last quarter. Centurion Wealth Management LLC raised its holdings in shares of Bank of America by 2.3% during the 2nd quarter. Centurion Wealth Management LLC now owns 9,862 shares of the financial services provider's stock worth $467,000 after buying an additional 225 shares in the last quarter. Nova Wealth Management Inc. raised its holdings in shares of Bank of America by 75.2% during the 2nd quarter. Nova Wealth Management Inc. now owns 529 shares of the financial services provider's stock worth $25,000 after buying an additional 227 shares in the last quarter. Finally, Cape Investment Advisory Inc. raised its holdings in shares of Bank of America by 1.9% during the 1st quarter. Cape Investment Advisory Inc. now owns 12,567 shares of the financial services provider's stock worth $524,000 after buying an additional 238 shares in the last quarter. Institutional investors and hedge funds own 70.71% of the company's stock.

Insider Buying and Selling at Bank of America

In other news, insider James P. Demare sold 148,391 shares of Bank of America stock in a transaction dated Friday, August 1st. The stock was sold at an average price of $45.57, for a total value of $6,762,177.87. Following the completion of the transaction, the insider directly owned 223,407 shares of the company's stock, valued at approximately $10,180,656.99. This trade represents a 39.91% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Company insiders own 0.30% of the company's stock.

Bank of America Trading Down 2.4%

NYSE BAC opened at $48.62 on Friday. The business's 50-day moving average price is $49.61 and its two-hundred day moving average price is $45.50. Bank of America Corporation has a 12 month low of $33.06 and a 12 month high of $52.88. The firm has a market capitalization of $360.12 billion, a PE ratio of 14.22, a price-to-earnings-growth ratio of 1.93 and a beta of 1.33. The company has a current ratio of 0.80, a quick ratio of 0.79 and a debt-to-equity ratio of 1.14.

Bank of America (NYSE:BAC - Get Free Report) last posted its quarterly earnings data on Wednesday, July 16th. The financial services provider reported $0.89 earnings per share for the quarter, topping the consensus estimate of $0.86 by $0.03. Bank of America had a return on equity of 10.25% and a net margin of 14.81%.The firm had revenue of ($22,273.00) million during the quarter, compared to analyst estimates of $26.79 billion. During the same period last year, the company posted $0.83 EPS. The business's quarterly revenue was up 4.3% on a year-over-year basis. On average, analysts expect that Bank of America Corporation will post 3.7 EPS for the current year.

Bank of America declared that its board has authorized a stock buyback program on Wednesday, July 23rd that allows the company to repurchase $40.00 billion in shares. This repurchase authorization allows the financial services provider to purchase up to 11.1% of its shares through open market purchases. Shares repurchase programs are often an indication that the company's management believes its stock is undervalued.

Bank of America Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, September 26th. Stockholders of record on Friday, September 5th were given a $0.28 dividend. This is a boost from Bank of America's previous quarterly dividend of $0.26. The ex-dividend date of this dividend was Friday, September 5th. This represents a $1.12 annualized dividend and a dividend yield of 2.3%. Bank of America's dividend payout ratio is 32.75%.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently commented on the company. Seaport Global Securities boosted their price target on Bank of America from $59.00 to $66.00 and gave the stock a "buy" rating in a report on Monday, October 6th. Morgan Stanley upped their target price on Bank of America from $50.00 to $66.00 and gave the stock an "overweight" rating in a report on Monday, September 29th. Phillip Securities downgraded Bank of America from a "strong-buy" rating to a "moderate buy" rating in a research report on Friday, July 25th. Hsbc Global Res downgraded Bank of America from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, July 8th. Finally, Evercore ISI increased their target price on Bank of America from $49.00 to $55.00 and gave the company an "outperform" rating in a research report on Tuesday, September 30th. Twenty-one research analysts have rated the stock with a Buy rating and five have given a Hold rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $54.64.

View Our Latest Stock Report on BAC

Bank of America Profile

(

Free Report)

Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. It operates in four segments: Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking, and Global Markets.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bank of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of America wasn't on the list.

While Bank of America currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.