Eisler Capital Management Ltd. purchased a new position in shares of Keurig Dr Pepper, Inc (NASDAQ:KDP - Free Report) in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund purchased 35,868 shares of the company's stock, valued at approximately $1,227,000.

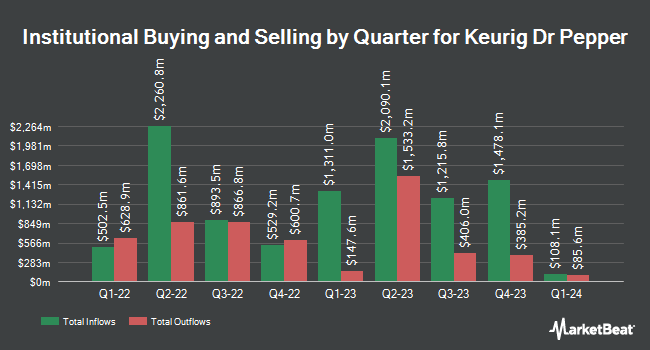

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the company. B. Metzler seel. Sohn & Co. AG grew its holdings in Keurig Dr Pepper by 13.7% during the 1st quarter. B. Metzler seel. Sohn & Co. AG now owns 77,865 shares of the company's stock worth $2,665,000 after acquiring an additional 9,374 shares in the last quarter. Ieq Capital LLC grew its holdings in Keurig Dr Pepper by 33.1% during the 1st quarter. Ieq Capital LLC now owns 88,214 shares of the company's stock worth $3,019,000 after acquiring an additional 21,955 shares in the last quarter. Caisse DE Depot ET Placement DU Quebec grew its holdings in Keurig Dr Pepper by 9,106.9% during the 1st quarter. Caisse DE Depot ET Placement DU Quebec now owns 1,026,381 shares of the company's stock worth $35,123,000 after acquiring an additional 1,015,233 shares in the last quarter. Kayne Anderson Rudnick Investment Management LLC grew its holdings in Keurig Dr Pepper by 25.9% during the 1st quarter. Kayne Anderson Rudnick Investment Management LLC now owns 126,099 shares of the company's stock worth $4,315,000 after acquiring an additional 25,971 shares in the last quarter. Finally, MetLife Investment Management LLC boosted its holdings in shares of Keurig Dr Pepper by 4.1% in the 1st quarter. MetLife Investment Management LLC now owns 310,093 shares of the company's stock valued at $10,611,000 after buying an additional 12,201 shares in the last quarter. Institutional investors and hedge funds own 93.99% of the company's stock.

Insider Activity at Keurig Dr Pepper

In related news, Director Robert James Gamgort sold 7,601 shares of the stock in a transaction dated Wednesday, August 20th. The shares were sold at an average price of $35.91, for a total value of $272,951.91. Following the sale, the director directly owned 2,284,568 shares of the company's stock, valued at approximately $82,038,836.88. This represents a 0.33% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director De Ven Michael G. Van acquired 15,000 shares of the stock in a transaction that occurred on Wednesday, June 4th. The stock was acquired at an average cost of $33.20 per share, for a total transaction of $498,000.00. Following the completion of the purchase, the director owned 15,000 shares in the company, valued at $498,000. The trade was a ∞ increase in their position. The disclosure for this purchase can be found here. In the last three months, insiders have sold 471,601 shares of company stock valued at $15,623,912. Insiders own 0.40% of the company's stock.

Wall Street Analysts Forecast Growth

KDP has been the subject of several research analyst reports. HSBC restated a "hold" rating and issued a $30.00 target price (down previously from $42.00) on shares of Keurig Dr Pepper in a report on Tuesday, August 26th. JPMorgan Chase & Co. lowered their target price on shares of Keurig Dr Pepper from $39.00 to $38.00 and set an "overweight" rating for the company in a report on Thursday, July 17th. UBS Group reduced their price target on shares of Keurig Dr Pepper from $40.00 to $35.00 and set a "buy" rating for the company in a research report on Wednesday, August 27th. Deutsche Bank Aktiengesellschaft reduced their price target on shares of Keurig Dr Pepper from $40.00 to $38.00 and set a "buy" rating for the company in a research report on Tuesday, August 26th. Finally, Hsbc Global Res downgraded shares of Keurig Dr Pepper from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, August 26th. Eleven equities research analysts have rated the stock with a Buy rating and four have assigned a Hold rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $38.38.

Check Out Our Latest Analysis on KDP

Keurig Dr Pepper Price Performance

Shares of KDP traded down $0.20 during trading hours on Monday, reaching $29.09. The company had a trading volume of 22,200,454 shares, compared to its average volume of 15,077,602. The firm has a 50 day simple moving average of $33.36 and a 200-day simple moving average of $33.61. The company has a current ratio of 0.64, a quick ratio of 0.40 and a debt-to-equity ratio of 0.56. The company has a market capitalization of $39.52 billion, a price-to-earnings ratio of 25.97, a PEG ratio of 1.59 and a beta of 0.47. Keurig Dr Pepper, Inc has a 12-month low of $28.70 and a 12-month high of $38.28.

Keurig Dr Pepper (NASDAQ:KDP - Get Free Report) last announced its quarterly earnings results on Thursday, July 24th. The company reported $0.49 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.49. The business had revenue of $4.16 billion during the quarter, compared to the consensus estimate of $4.14 billion. Keurig Dr Pepper had a net margin of 9.75% and a return on equity of 11.05%. The business's revenue was up 6.1% compared to the same quarter last year. During the same quarter last year, the firm posted $0.45 EPS. Research analysts expect that Keurig Dr Pepper, Inc will post 1.92 earnings per share for the current year.

Keurig Dr Pepper Profile

(

Free Report)

Keurig Dr Pepper Inc owns, manufactures, and distributors beverages and single serve brewing systems in the United States and internationally. It operates through three segments: U.S. Refreshment Beverages, U.S. Coffee, and International. The U.S. Refreshment Beverages segment manufactures and distributes branded concentrates, syrup, and finished beverages.

See Also

Before you consider Keurig Dr Pepper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keurig Dr Pepper wasn't on the list.

While Keurig Dr Pepper currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report