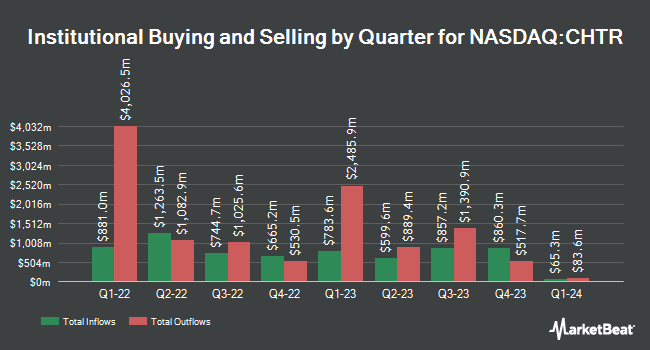

Elser Financial Planning Inc acquired a new stake in Charter Communications, Inc. (NASDAQ:CHTR - Free Report) in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 1,032 shares of the company's stock, valued at approximately $392,000.

Several other hedge funds and other institutional investors have also recently bought and sold shares of the stock. SouthState Corp acquired a new position in shares of Charter Communications in the 1st quarter valued at $25,000. Salem Investment Counselors Inc. boosted its position in Charter Communications by 2,033.3% during the second quarter. Salem Investment Counselors Inc. now owns 64 shares of the company's stock worth $26,000 after purchasing an additional 61 shares in the last quarter. ST Germain D J Co. Inc. grew its holdings in Charter Communications by 1,283.3% in the first quarter. ST Germain D J Co. Inc. now owns 83 shares of the company's stock valued at $31,000 after purchasing an additional 77 shares during the period. SBI Securities Co. Ltd. increased its position in shares of Charter Communications by 93.2% in the first quarter. SBI Securities Co. Ltd. now owns 85 shares of the company's stock valued at $31,000 after buying an additional 41 shares in the last quarter. Finally, Strengthening Families & Communities LLC acquired a new position in shares of Charter Communications during the 1st quarter worth approximately $33,000. 81.76% of the stock is owned by institutional investors and hedge funds.

Insiders Place Their Bets

In other news, Director Balan Nair purchased 360 shares of the stock in a transaction dated Thursday, July 31st. The shares were purchased at an average price of $274.21 per share, with a total value of $98,715.60. Following the transaction, the director owned 9,622 shares in the company, valued at $2,638,448.62. The trade was a 3.89% increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CEO Christopher L. Winfrey acquired 3,670 shares of the company's stock in a transaction that occurred on Thursday, July 31st. The stock was purchased at an average cost of $273.10 per share, with a total value of $1,002,277.00. Following the acquisition, the chief executive officer directly owned 70,243 shares of the company's stock, valued at $19,183,363.30. This trade represents a 5.51% increase in their position. The disclosure for this purchase can be found here. 0.83% of the stock is owned by company insiders.

Analysts Set New Price Targets

A number of equities research analysts recently issued reports on the stock. UBS Group dropped their price target on shares of Charter Communications from $425.00 to $355.00 and set a "neutral" rating on the stock in a research note on Monday, July 28th. Bank of America decreased their price objective on shares of Charter Communications from $440.00 to $355.00 and set a "buy" rating on the stock in a report on Wednesday, September 24th. The Goldman Sachs Group began coverage on shares of Charter Communications in a research report on Tuesday, September 2nd. They issued a "sell" rating and a $223.00 target price on the stock. Wolfe Research upgraded shares of Charter Communications from an "underperform" rating to a "peer perform" rating in a research report on Friday, June 20th. Finally, Royal Bank Of Canada lowered their price objective on Charter Communications from $430.00 to $370.00 and set a "sector perform" rating on the stock in a report on Monday, July 28th. Eight research analysts have rated the stock with a Buy rating, eight have assigned a Hold rating and four have given a Sell rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $384.89.

Check Out Our Latest Research Report on CHTR

Charter Communications Stock Performance

NASDAQ:CHTR opened at $273.40 on Monday. The company has a market cap of $37.34 billion, a P/E ratio of 7.49, a P/E/G ratio of 0.61 and a beta of 1.02. Charter Communications, Inc. has a twelve month low of $251.80 and a twelve month high of $437.06. The company's 50-day moving average price is $277.24 and its 200-day moving average price is $345.29. The company has a current ratio of 0.33, a quick ratio of 0.33 and a debt-to-equity ratio of 4.57.

Charter Communications (NASDAQ:CHTR - Get Free Report) last released its quarterly earnings data on Friday, July 25th. The company reported $9.18 EPS for the quarter, missing analysts' consensus estimates of $10.06 by ($0.88). The business had revenue of $13.77 billion during the quarter, compared to analyst estimates of $13.76 billion. Charter Communications had a net margin of 9.53% and a return on equity of 26.77%. The firm's revenue was up .6% on a year-over-year basis. During the same quarter in the previous year, the company posted $8.49 EPS. On average, sell-side analysts forecast that Charter Communications, Inc. will post 38.16 earnings per share for the current fiscal year.

About Charter Communications

(

Free Report)

Charter Communications, Inc operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States. The company offers subscription-based internet, video, and mobile and voice services; a suite of broadband connectivity services, including fixed internet, WiFi, and mobile; Advanced WiFi services; Spectrum Security Shield; in-home WiFi, which provides customers with high performance wireless routers and managed WiFi services to enhance their fixed wireless internet experience; out-of-home WiFi; and Spectrum WiFi services.

Further Reading

Want to see what other hedge funds are holding CHTR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Charter Communications, Inc. (NASDAQ:CHTR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Charter Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charter Communications wasn't on the list.

While Charter Communications currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.