Emmett Investment Management LP lifted its holdings in shares of IDT Corporation (NYSE:IDT - Free Report) by 10.0% during the first quarter, according to its most recent disclosure with the SEC. The fund owned 121,691 shares of the utilities provider's stock after acquiring an additional 11,074 shares during the period. IDT makes up approximately 5.8% of Emmett Investment Management LP's investment portfolio, making the stock its 5th largest holding. Emmett Investment Management LP owned 0.48% of IDT worth $6,401,000 as of its most recent SEC filing.

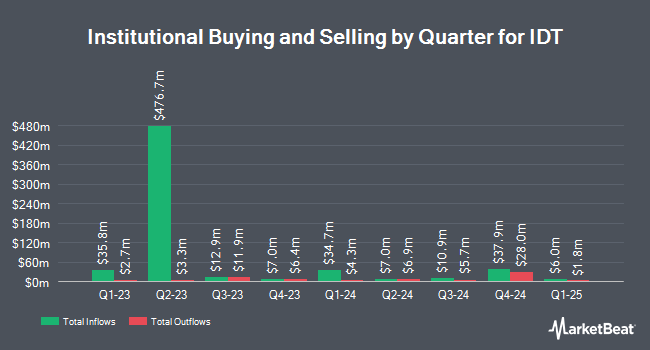

Several other hedge funds and other institutional investors have also recently modified their holdings of the stock. Vanguard Group Inc. increased its holdings in shares of IDT by 1.8% in the first quarter. Vanguard Group Inc. now owns 1,288,634 shares of the utilities provider's stock valued at $66,120,000 after purchasing an additional 22,819 shares during the period. Wealth Enhancement Advisory Services LLC increased its holdings in IDT by 0.5% in the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 514,043 shares of the utilities provider's stock worth $26,376,000 after buying an additional 2,768 shares during the period. D. E. Shaw & Co. Inc. raised its position in IDT by 6.8% during the 4th quarter. D. E. Shaw & Co. Inc. now owns 351,588 shares of the utilities provider's stock worth $16,707,000 after buying an additional 22,528 shares during the last quarter. Deutsche Bank AG lifted its stake in IDT by 32.4% during the 4th quarter. Deutsche Bank AG now owns 330,616 shares of the utilities provider's stock valued at $15,711,000 after acquiring an additional 80,817 shares during the period. Finally, Nuveen LLC acquired a new stake in IDT during the 1st quarter valued at approximately $10,409,000. 59.34% of the stock is owned by hedge funds and other institutional investors.

IDT Trading Down 0.1%

NYSE:IDT traded down $0.06 during trading hours on Monday, hitting $63.26. The company had a trading volume of 20,505 shares, compared to its average volume of 144,161. IDT Corporation has a 1 year low of $36.12 and a 1 year high of $71.12. The company has a market cap of $1.60 billion, a P/E ratio of 16.69 and a beta of 0.74. The company has a 50-day moving average of $62.35 and a 200 day moving average of $56.14.

IDT (NYSE:IDT - Get Free Report) last posted its earnings results on Thursday, June 5th. The utilities provider reported $0.87 earnings per share for the quarter. IDT had a net margin of 7.85% and a return on equity of 26.38%. The company had revenue of $301.98 million for the quarter.

IDT Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, June 18th. Investors of record on Monday, June 9th were issued a $0.06 dividend. This represents a $0.24 annualized dividend and a yield of 0.4%. IDT's dividend payout ratio (DPR) is currently 6.33%.

Wall Street Analyst Weigh In

Separately, Wall Street Zen lowered IDT from a "strong-buy" rating to a "buy" rating in a research note on Saturday, June 14th.

Read Our Latest Analysis on IDT

About IDT

(

Free Report)

IDT Corporation provides communications and payment services in the United States, the United Kingdom, and internationally. It operates through Fintech, National Retail Solutions, net2phone, and Traditional Communications segments. The company operates point of sale, a terminal-based platform which provides independent retailers store management software, electronic payment processing, and other ancillary merchant services; and provides marketers with digital out-of-home advertising and transaction data.

Recommended Stories

Before you consider IDT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDT wasn't on the list.

While IDT currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.