Empirical Financial Services LLC d.b.a. Empirical Wealth Management boosted its stake in Amneal Pharmaceuticals, Inc. (NASDAQ:AMRX - Free Report) by 93.8% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 89,598 shares of the company's stock after purchasing an additional 43,358 shares during the quarter. Empirical Financial Services LLC d.b.a. Empirical Wealth Management's holdings in Amneal Pharmaceuticals were worth $751,000 as of its most recent SEC filing.

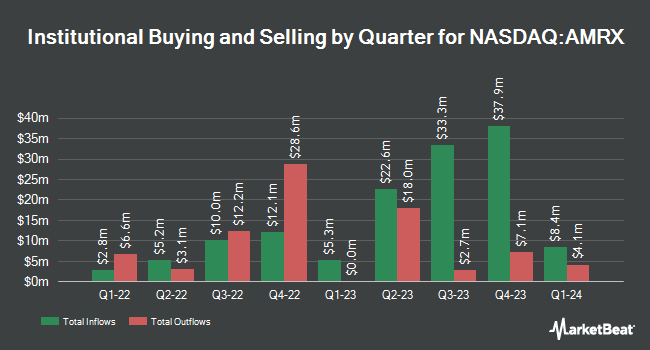

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. GAMMA Investing LLC grew its holdings in shares of Amneal Pharmaceuticals by 5,975.0% during the first quarter. GAMMA Investing LLC now owns 3,159 shares of the company's stock worth $26,000 after buying an additional 3,107 shares in the last quarter. Amalgamated Bank grew its position in Amneal Pharmaceuticals by 33.0% in the first quarter. Amalgamated Bank now owns 5,511 shares of the company's stock valued at $46,000 after purchasing an additional 1,367 shares in the last quarter. GF Fund Management CO. LTD. acquired a new stake in Amneal Pharmaceuticals in the 4th quarter valued at $52,000. Straightline Group LLC acquired a new position in shares of Amneal Pharmaceuticals during the 4th quarter worth about $92,000. Finally, Xponance Inc. increased its position in shares of Amneal Pharmaceuticals by 16.1% in the first quarter. Xponance Inc. now owns 13,183 shares of the company's stock valued at $110,000 after acquiring an additional 1,828 shares during the last quarter. Institutional investors own 31.82% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages recently weighed in on AMRX. The Goldman Sachs Group assumed coverage on shares of Amneal Pharmaceuticals in a report on Friday, June 6th. They set a "buy" rating and a $12.00 target price on the stock. Wall Street Zen downgraded Amneal Pharmaceuticals from a "strong-buy" rating to a "buy" rating in a research note on Tuesday, May 13th. Six research analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the stock has an average rating of "Buy" and an average target price of $11.60.

Get Our Latest Analysis on Amneal Pharmaceuticals

Amneal Pharmaceuticals Trading Down 1.0%

NASDAQ:AMRX traded down $0.08 during trading hours on Wednesday, hitting $8.05. 1,558,049 shares of the company were exchanged, compared to its average volume of 1,679,624. The company has a fifty day simple moving average of $7.97 and a 200 day simple moving average of $7.96. Amneal Pharmaceuticals, Inc. has a one year low of $6.68 and a one year high of $9.48. The stock has a market capitalization of $2.52 billion, a price-to-earnings ratio of -201.20 and a beta of 1.11.

Amneal Pharmaceuticals (NASDAQ:AMRX - Get Free Report) last issued its earnings results on Tuesday, August 5th. The company reported $0.23 earnings per share for the quarter, topping analysts' consensus estimates of $0.17 by $0.06. Amneal Pharmaceuticals had a negative return on equity of 188.26% and a negative net margin of 0.46%. Equities research analysts predict that Amneal Pharmaceuticals, Inc. will post 0.53 earnings per share for the current fiscal year.

About Amneal Pharmaceuticals

(

Free Report)

Amneal Pharmaceuticals, Inc, together with its subsidiaries, develops, manufactures, markets, and distributes generics, injectables, biosimilars, and specialty branded pharmaceutical products worldwide. The company operates through three segments: Generics, Specialty, and AvKARE. The Generics segment offers immediate and extended release oral solid, powder, liquid, sterile injectable, nasal spray, inhalation and respiratory, biosimilar, ophthalmic, film, transdermal patch, and topical products.

Featured Articles

Before you consider AMNEAL PHARMACEUTICALS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AMNEAL PHARMACEUTICALS wasn't on the list.

While AMNEAL PHARMACEUTICALS currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.