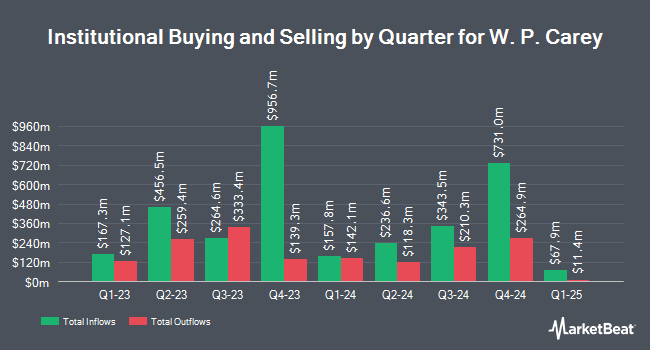

Entropy Technologies LP purchased a new stake in shares of W.P. Carey Inc. (NYSE:WPC - Free Report) during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 35,630 shares of the real estate investment trust's stock, valued at approximately $2,249,000.

Other institutional investors and hedge funds have also modified their holdings of the company. Russell Investments Group Ltd. grew its stake in W.P. Carey by 33.0% in the fourth quarter. Russell Investments Group Ltd. now owns 83,494 shares of the real estate investment trust's stock valued at $4,549,000 after purchasing an additional 20,695 shares in the last quarter. Federated Hermes Inc. boosted its stake in shares of W.P. Carey by 11.3% during the 4th quarter. Federated Hermes Inc. now owns 27,494 shares of the real estate investment trust's stock worth $1,498,000 after acquiring an additional 2,801 shares in the last quarter. Cerity Partners LLC boosted its stake in shares of W.P. Carey by 7.1% during the 4th quarter. Cerity Partners LLC now owns 26,674 shares of the real estate investment trust's stock worth $1,496,000 after acquiring an additional 1,763 shares in the last quarter. Bank of Montreal Can boosted its stake in shares of W.P. Carey by 8.4% during the 4th quarter. Bank of Montreal Can now owns 35,927 shares of the real estate investment trust's stock worth $1,957,000 after acquiring an additional 2,770 shares in the last quarter. Finally, Invesco Ltd. boosted its stake in shares of W.P. Carey by 10.8% during the 4th quarter. Invesco Ltd. now owns 750,151 shares of the real estate investment trust's stock worth $40,868,000 after acquiring an additional 72,833 shares in the last quarter. Hedge funds and other institutional investors own 73.73% of the company's stock.

W.P. Carey Stock Down 0.2%

Shares of WPC traded down $0.13 during midday trading on Tuesday, hitting $65.47. The stock had a trading volume of 905,749 shares, compared to its average volume of 1,387,383. The company has a 50 day simple moving average of $63.46 and a two-hundred day simple moving average of $61.67. W.P. Carey Inc. has a twelve month low of $52.91 and a twelve month high of $66.64. The firm has a market cap of $14.34 billion, a price-to-earnings ratio of 43.07, a price-to-earnings-growth ratio of 9.58 and a beta of 0.78. The company has a debt-to-equity ratio of 0.97, a current ratio of 0.19 and a quick ratio of 0.19.

W.P. Carey (NYSE:WPC - Get Free Report) last announced its quarterly earnings data on Tuesday, July 29th. The real estate investment trust reported $1.28 earnings per share for the quarter, beating the consensus estimate of $1.23 by $0.05. The company had revenue of $430.78 million during the quarter, compared to analysts' expectations of $420.99 million. W.P. Carey had a return on equity of 4.00% and a net margin of 20.42%. W.P. Carey's revenue for the quarter was up 10.5% compared to the same quarter last year. During the same quarter last year, the company earned $1.17 EPS. On average, analysts anticipate that W.P. Carey Inc. will post 4.87 EPS for the current year.

W.P. Carey Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, July 15th. Stockholders of record on Monday, June 30th were issued a $0.90 dividend. This represents a $3.60 annualized dividend and a dividend yield of 5.5%. The ex-dividend date was Monday, June 30th. This is a positive change from W.P. Carey's previous quarterly dividend of $0.89. W.P. Carey's dividend payout ratio is 236.84%.

Analyst Upgrades and Downgrades

Several equities analysts recently weighed in on WPC shares. Barclays set a $61.00 price objective on W.P. Carey and gave the stock an "underweight" rating in a research report on Wednesday, May 21st. UBS Group cut their price objective on W.P. Carey from $66.00 to $63.00 and set a "neutral" rating for the company in a research report on Tuesday, May 13th. BNP Paribas Exane raised W.P. Carey from an "underperform" rating to a "neutral" rating and set a $66.00 price objective for the company in a research report on Monday, June 9th. BNP Paribas set a $66.00 price objective on W.P. Carey and gave the stock a "neutral" rating in a research report on Monday, June 9th. Finally, Royal Bank Of Canada boosted their price objective on W.P. Carey from $66.00 to $67.00 and gave the stock an "outperform" rating in a research report on Thursday, July 31st. One research analyst has rated the stock with a sell rating, seven have assigned a hold rating and two have given a buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Hold" and an average target price of $65.00.

Read Our Latest Research Report on WPC

W.P. Carey Profile

(

Free Report)

W. P. Carey ranks among the largest net lease REITs with a well-diversified portfolio of high-quality, operationally critical commercial real estate, which includes 1,424 net lease properties covering approximately 173 million square feet and a portfolio of 89 self-storage operating properties as of December 31, 2023.

Featured Stories

Before you consider W.P. Carey, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and W.P. Carey wasn't on the list.

While W.P. Carey currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.