Entropy Technologies LP acquired a new position in Ubiquiti Inc. (NYSE:UI - Free Report) in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund acquired 1,055 shares of the company's stock, valued at approximately $327,000.

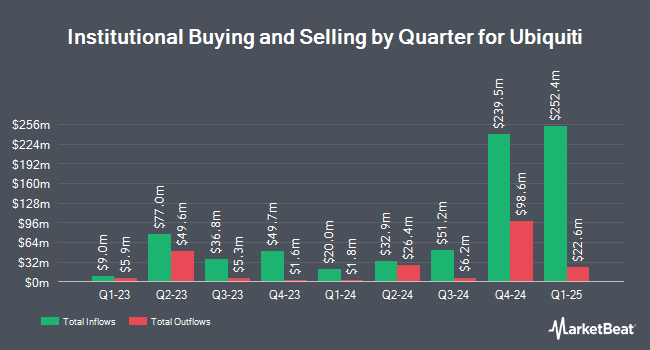

A number of other large investors have also recently bought and sold shares of the company. Golden State Wealth Management LLC bought a new position in Ubiquiti in the 1st quarter valued at about $25,000. Versant Capital Management Inc increased its holdings in Ubiquiti by 484.2% in the 1st quarter. Versant Capital Management Inc now owns 111 shares of the company's stock valued at $34,000 after buying an additional 92 shares during the period. Sterling Capital Management LLC increased its holdings in Ubiquiti by 30.2% in the 4th quarter. Sterling Capital Management LLC now owns 168 shares of the company's stock valued at $56,000 after buying an additional 39 shares during the period. Lazard Asset Management LLC bought a new position in Ubiquiti in the 4th quarter valued at about $74,000. Finally, New Age Alpha Advisors LLC bought a new position in Ubiquiti in the 1st quarter valued at about $92,000. 4.00% of the stock is currently owned by institutional investors and hedge funds.

Ubiquiti Trading Down 1.5%

NYSE:UI traded down $6.2380 during mid-day trading on Tuesday, hitting $399.1220. 22,651 shares of the company's stock were exchanged, compared to its average volume of 104,916. The company has a 50 day simple moving average of $421.27 and a 200-day simple moving average of $372.22. Ubiquiti Inc. has a fifty-two week low of $165.50 and a fifty-two week high of $488.79. The firm has a market capitalization of $24.14 billion, a P/E ratio of 43.81 and a beta of 1.35.

Wall Street Analysts Forecast Growth

UI has been the topic of several recent analyst reports. Barclays raised their target price on shares of Ubiquiti from $222.00 to $247.00 and gave the company an "underweight" rating in a report on Monday, May 12th. BWS Financial reissued a "buy" rating and set a $440.00 target price on shares of Ubiquiti in a research note on Friday, July 11th. One equities research analyst has rated the stock with a Buy rating and one has issued a Sell rating to the company's stock. According to data from MarketBeat, Ubiquiti currently has an average rating of "Hold" and an average target price of $343.50.

View Our Latest Stock Analysis on Ubiquiti

About Ubiquiti

(

Free Report)

Ubiquiti Inc develops networking technology for service providers, enterprises, and consumers. The company develops technology platforms for high-capacity distributed Internet access, unified information technology, and consumer electronics for professional, home, and personal use. Its service provider product platforms offer carrier-class network infrastructure for fixed wireless broadband, wireless backhaul systems, and routing and related software; and enterprise product platforms provide wireless LAN infrastructure, video surveillance products, switching and routing solutions, security gateways, door access systems, and other WLAN products.

Recommended Stories

Before you consider Ubiquiti, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ubiquiti wasn't on the list.

While Ubiquiti currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.