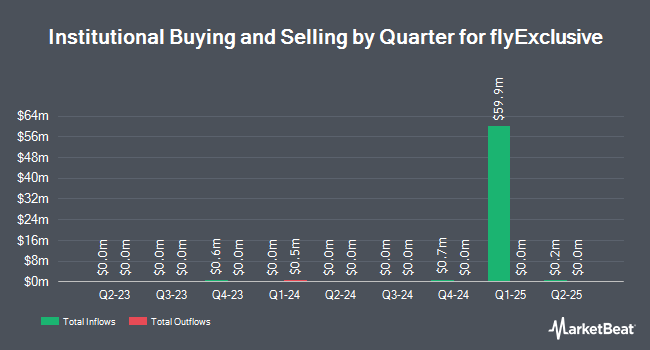

Entrust Global Partners L L C purchased a new stake in shares of flyExclusive, Inc. (NYSE:FLYX - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund purchased 13,951,712 shares of the company's stock, valued at approximately $43,390,000. flyExclusive makes up about 8.8% of Entrust Global Partners L L C's investment portfolio, making the stock its 3rd biggest position. Entrust Global Partners L L C owned 17.41% of flyExclusive as of its most recent SEC filing.

Several other large investors have also added to or reduced their stakes in FLYX. Citadel Advisors LLC purchased a new position in flyExclusive during the fourth quarter valued at approximately $70,000. Raymond James Financial Inc. purchased a new position in flyExclusive during the fourth quarter valued at approximately $64,000. Finally, Axxcess Wealth Management LLC purchased a new position in flyExclusive during the first quarter valued at approximately $47,000. Hedge funds and other institutional investors own 12.99% of the company's stock.

flyExclusive Stock Up 1.2%

NYSE:FLYX traded up $0.05 during trading hours on Friday, hitting $4.37. 22,864 shares of the stock traded hands, compared to its average volume of 19,614. flyExclusive, Inc. has a 1 year low of $1.79 and a 1 year high of $4.95. The company has a market cap of $350.17 million, a price-to-earnings ratio of -3.97 and a beta of 0.20. The stock has a 50 day moving average price of $3.13 and a 200 day moving average price of $3.00.

flyExclusive Profile

(

Free Report)

flyExclusive, Inc, through its subsidiary, LGM Enterprises, LLC., owns and operates private jets in North America. It also offers jet charter services; and aircraft maintenance, repair, overhaul (MRO) operations, and interior and exterior refurbishment services, as well as wholesale and retail ad hoc flights, a jet club program, partnership program, fractional program, and other services.

Read More

Before you consider flyExclusive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and flyExclusive wasn't on the list.

While flyExclusive currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.