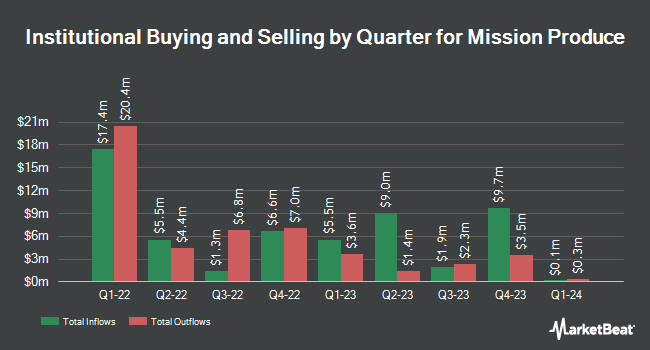

EntryPoint Capital LLC lifted its holdings in shares of Mission Produce, Inc. (NASDAQ:AVO - Free Report) by 115.4% during the 1st quarter, according to the company in its most recent filing with the SEC. The fund owned 41,516 shares of the company's stock after purchasing an additional 22,242 shares during the period. EntryPoint Capital LLC owned about 0.06% of Mission Produce worth $435,000 as of its most recent filing with the SEC.

Other institutional investors and hedge funds also recently made changes to their positions in the company. PNC Financial Services Group Inc. grew its holdings in shares of Mission Produce by 123.1% during the 1st quarter. PNC Financial Services Group Inc. now owns 2,950 shares of the company's stock valued at $31,000 after purchasing an additional 1,628 shares during the last quarter. GAMMA Investing LLC grew its holdings in shares of Mission Produce by 1,255.4% during the 1st quarter. GAMMA Investing LLC now owns 3,375 shares of the company's stock valued at $322,000 after purchasing an additional 3,126 shares during the last quarter. Ameriflex Group Inc. bought a new position in shares of Mission Produce during the 4th quarter valued at $57,000. State of Wyoming bought a new position in shares of Mission Produce in the fourth quarter worth approximately $63,000. Finally, ProShare Advisors LLC purchased a new position in shares of Mission Produce in the fourth quarter worth $176,000. Institutional investors own 63.57% of the company's stock.

Mission Produce Trading Down 1.1%

Shares of NASDAQ AVO traded down $0.14 during mid-day trading on Tuesday, hitting $12.42. The stock had a trading volume of 55,912 shares, compared to its average volume of 320,852. The company has a debt-to-equity ratio of 0.29, a quick ratio of 1.23 and a current ratio of 1.98. Mission Produce, Inc. has a 1 year low of $9.56 and a 1 year high of $15.25. The business has a 50 day moving average price of $12.24 and a two-hundred day moving average price of $11.31. The firm has a market cap of $877.08 million, a P/E ratio of 24.86 and a beta of 0.57.

Mission Produce (NASDAQ:AVO - Get Free Report) last issued its earnings results on Thursday, June 5th. The company reported $0.12 EPS for the quarter, topping the consensus estimate of $0.03 by $0.09. Mission Produce had a net margin of 2.63% and a return on equity of 7.82%. The company had revenue of $380.30 million for the quarter, compared to the consensus estimate of $296.15 million. During the same period in the previous year, the firm earned $0.14 earnings per share. The firm's revenue for the quarter was up 27.8% on a year-over-year basis. On average, equities analysts anticipate that Mission Produce, Inc. will post 0.34 EPS for the current fiscal year.

Insider Activity at Mission Produce

In related news, CFO Bryan E. Giles sold 3,500 shares of Mission Produce stock in a transaction on Tuesday, June 10th. The shares were sold at an average price of $11.43, for a total value of $40,005.00. Following the transaction, the chief financial officer directly owned 131,062 shares of the company's stock, valued at $1,498,038.66. The trade was a 2.60% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 35.41% of the stock is currently owned by insiders.

Mission Produce Profile

(

Free Report)

Mission Produce, Inc engages in the sourcing, farming, packaging, marketing, and distribution of avocados, mangoes, and blueberries to food retailers, distributors, and foodservice customers in the United States and internationally. The company operates through three segments, Marketing and Distribution; International Farming; and Blueberries.

Featured Stories

Before you consider Mission Produce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mission Produce wasn't on the list.

While Mission Produce currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.