EntryPoint Capital LLC trimmed its position in Cogent Biosciences, Inc. (NASDAQ:COGT - Free Report) by 46.5% during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 28,005 shares of the technology company's stock after selling 24,341 shares during the quarter. EntryPoint Capital LLC's holdings in Cogent Biosciences were worth $168,000 at the end of the most recent quarter.

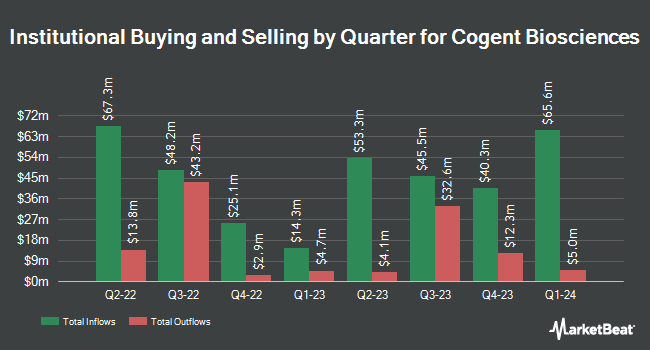

A number of other institutional investors and hedge funds have also recently modified their holdings of COGT. Octagon Capital Advisors LP raised its stake in Cogent Biosciences by 111.7% in the fourth quarter. Octagon Capital Advisors LP now owns 2,763,000 shares of the technology company's stock valued at $21,551,000 after purchasing an additional 1,458,000 shares in the last quarter. Paradigm Biocapital Advisors LP raised its stake in Cogent Biosciences by 6.7% in the fourth quarter. Paradigm Biocapital Advisors LP now owns 4,917,412 shares of the technology company's stock valued at $38,356,000 after purchasing an additional 307,650 shares in the last quarter. Renaissance Technologies LLC purchased a new stake in Cogent Biosciences in the fourth quarter valued at approximately $1,895,000. Nuveen LLC purchased a new stake in Cogent Biosciences in the first quarter valued at approximately $1,401,000. Finally, Knott David M Jr purchased a new stake in Cogent Biosciences in the first quarter valued at approximately $1,278,000.

Cogent Biosciences Price Performance

Shares of NASDAQ COGT opened at $12.12 on Monday. Cogent Biosciences, Inc. has a one year low of $3.72 and a one year high of $12.97. The firm's 50 day simple moving average is $10.28 and its two-hundred day simple moving average is $7.54. The stock has a market capitalization of $1.38 billion, a P/E ratio of -6.81 and a beta of 0.36.

Cogent Biosciences (NASDAQ:COGT - Get Free Report) last issued its quarterly earnings results on Tuesday, August 5th. The technology company reported ($0.53) EPS for the quarter, beating analysts' consensus estimates of ($0.55) by $0.02. As a group, equities analysts expect that Cogent Biosciences, Inc. will post -2.42 earnings per share for the current fiscal year.

Insider Activity

In other news, Director Fairmount Funds Management Llc bought 2,777,777 shares of the business's stock in a transaction dated Thursday, July 10th. The shares were purchased at an average price of $9.00 per share, for a total transaction of $24,999,993.00. Following the completion of the acquisition, the director owned 9,003,418 shares of the company's stock, valued at approximately $81,030,762. This trade represents a 44.62% increase in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Corporate insiders own 7.29% of the company's stock.

Analysts Set New Price Targets

COGT has been the topic of a number of recent analyst reports. Guggenheim reaffirmed a "buy" rating and issued a $17.00 target price on shares of Cogent Biosciences in a research note on Tuesday, July 8th. HC Wainwright lowered their target price on shares of Cogent Biosciences from $22.00 to $21.00 and set a "buy" rating on the stock in a research note on Wednesday, August 6th. Robert W. Baird raised their target price on shares of Cogent Biosciences from $7.00 to $9.00 and gave the company a "neutral" rating in a research note on Tuesday, July 8th. Citigroup raised their target price on shares of Cogent Biosciences from $15.00 to $22.00 and gave the company a "buy" rating in a research note on Friday, July 18th. Finally, Wedbush reaffirmed a "neutral" rating and issued a $10.00 target price on shares of Cogent Biosciences in a research note on Monday, June 30th. One research analyst has rated the stock with a Strong Buy rating, seven have issued a Buy rating and three have given a Hold rating to the stock. According to data from MarketBeat, Cogent Biosciences has a consensus rating of "Moderate Buy" and an average price target of $18.70.

Get Our Latest Report on Cogent Biosciences

About Cogent Biosciences

(

Free Report)

Cogent Biosciences, Inc, a biotechnology company, focuses on developing precision therapies for genetically defined diseases. Its lead product candidate includes bezuclastinib (CGT9486), a selective tyrosine kinase inhibitor designed to target mutations within the KIT receptor tyrosine kinase, including KIT D816V KIT D816V mutation that drives systemic mastocytosis, as well as other mutations in KIT exon 17, which are found in patients with advanced gastrointestinal stromal tumors.

Recommended Stories

Want to see what other hedge funds are holding COGT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Cogent Biosciences, Inc. (NASDAQ:COGT - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cogent Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cogent Biosciences wasn't on the list.

While Cogent Biosciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.