Envestnet Asset Management Inc. increased its position in shares of Ryanair Holdings PLC (NASDAQ:RYAAY - Free Report) by 19.9% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 526,540 shares of the transportation company's stock after purchasing an additional 87,532 shares during the period. Envestnet Asset Management Inc. owned 0.10% of Ryanair worth $22,310,000 at the end of the most recent quarter.

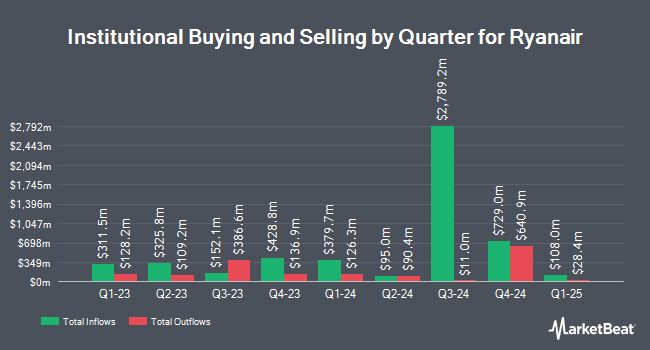

Several other hedge funds and other institutional investors have also recently bought and sold shares of the company. Bank of New York Mellon Corp boosted its stake in shares of Ryanair by 19.9% in the first quarter. Bank of New York Mellon Corp now owns 97,405 shares of the transportation company's stock valued at $4,127,000 after purchasing an additional 16,177 shares during the period. DAVENPORT & Co LLC purchased a new position in shares of Ryanair in the first quarter valued at approximately $257,000. Golden State Wealth Management LLC boosted its stake in shares of Ryanair by 100.0% in the first quarter. Golden State Wealth Management LLC now owns 962 shares of the transportation company's stock valued at $41,000 after purchasing an additional 481 shares during the period. Bessemer Group Inc. boosted its stake in shares of Ryanair by 351.1% in the first quarter. Bessemer Group Inc. now owns 19,247 shares of the transportation company's stock valued at $816,000 after purchasing an additional 14,980 shares during the period. Finally, Oppenheimer Asset Management Inc. boosted its stake in shares of Ryanair by 46.6% in the first quarter. Oppenheimer Asset Management Inc. now owns 104,730 shares of the transportation company's stock valued at $4,437,000 after purchasing an additional 33,281 shares during the period. 43.66% of the stock is currently owned by institutional investors and hedge funds.

Ryanair Trading Down 3.3%

RYAAY stock traded down $1.89 on Friday, hitting $56.15. 2,762,803 shares of the company were exchanged, compared to its average volume of 1,647,489. Ryanair Holdings PLC has a twelve month low of $36.96 and a twelve month high of $59.36. The company has a debt-to-equity ratio of 0.24, a current ratio of 0.74 and a quick ratio of 0.74. The business's fifty day moving average is $55.96 and its two-hundred day moving average is $49.11. The stock has a market capitalization of $29.80 billion, a price-to-earnings ratio of 17.57, a price-to-earnings-growth ratio of 1.00 and a beta of 1.38.

Analyst Ratings Changes

A number of research analysts recently issued reports on the stock. Wall Street Zen upgraded shares of Ryanair from a "hold" rating to a "buy" rating in a research note on Saturday, July 5th. Citigroup restated a "buy" rating on shares of Ryanair in a research report on Wednesday, May 21st. Raymond James Financial restated a "strong-buy" rating on shares of Ryanair in a research report on Wednesday, July 2nd. Deutsche Bank Aktiengesellschaft upgraded shares of Ryanair from a "hold" rating to a "buy" rating in a research report on Thursday, March 27th. Finally, Royal Bank Of Canada restated an "outperform" rating on shares of Ryanair in a research report on Wednesday, May 21st. Seven research analysts have rated the stock with a buy rating and three have issued a strong buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Buy" and an average target price of $108.50.

Check Out Our Latest Report on Ryanair

Ryanair Profile

(

Free Report)

Ryanair Holdings plc, together with its subsidiaries, provides scheduled-passenger airline services in Ireland, the United Kingdom, Italy, Spain, and internationally. It is also involved in the provision of various ancillary services, such as non-flight scheduled and Internet-related services, as well as in-flight sale of beverages, food, duty-free, and merchandise; and markets car hire, travel insurance, and accommodation services through its website and mobile app.

Featured Articles

Before you consider Ryanair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ryanair wasn't on the list.

While Ryanair currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.