Cbre Investment Management Listed Real Assets LLC trimmed its position in shares of Equinix, Inc. (NASDAQ:EQIX - Free Report) by 7.6% in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 427,908 shares of the financial services provider's stock after selling 35,008 shares during the quarter. Equinix accounts for approximately 5.3% of Cbre Investment Management Listed Real Assets LLC's investment portfolio, making the stock its 2nd largest position. Cbre Investment Management Listed Real Assets LLC owned 0.44% of Equinix worth $348,895,000 at the end of the most recent reporting period.

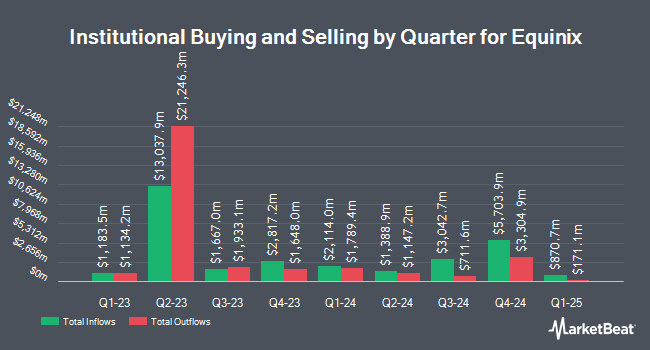

Several other institutional investors and hedge funds also recently bought and sold shares of EQIX. GAMMA Investing LLC boosted its stake in Equinix by 82,340.9% during the first quarter. GAMMA Investing LLC now owns 890,362 shares of the financial services provider's stock worth $725,957,000 after buying an additional 889,282 shares during the period. Nuveen LLC purchased a new position in Equinix during the first quarter worth $662,663,000. Northern Trust Corp boosted its stake in Equinix by 65.3% during the fourth quarter. Northern Trust Corp now owns 1,483,781 shares of the financial services provider's stock worth $1,399,042,000 after buying an additional 586,034 shares during the period. JPMorgan Chase & Co. boosted its stake in Equinix by 22.5% during the first quarter. JPMorgan Chase & Co. now owns 1,590,568 shares of the financial services provider's stock worth $1,296,871,000 after buying an additional 291,753 shares during the period. Finally, National Bank of Canada FI boosted its stake in Equinix by 169.7% during the first quarter. National Bank of Canada FI now owns 394,223 shares of the financial services provider's stock worth $321,427,000 after buying an additional 248,075 shares during the period. 94.94% of the stock is owned by hedge funds and other institutional investors.

Insider Activity

In other Equinix news, Director Christopher B. Paisley sold 75 shares of Equinix stock in a transaction dated Monday, August 18th. The stock was sold at an average price of $781.50, for a total value of $58,612.50. Following the transaction, the director owned 17,832 shares in the company, valued at $13,935,708. The trade was a 0.42% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Adaire Fox-Martin sold 2,949 shares of Equinix stock in a transaction dated Tuesday, June 3rd. The shares were sold at an average price of $884.91, for a total value of $2,609,599.59. Following the completion of the transaction, the chief executive officer owned 9,615 shares in the company, valued at $8,508,409.65. This trade represents a 23.47% decrease in their position. The disclosure for this sale can be found here. 0.27% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

Several analysts have recently weighed in on EQIX shares. Wall Street Zen downgraded Equinix from a "hold" rating to a "sell" rating in a research report on Saturday, August 16th. Wells Fargo & Company decreased their target price on Equinix from $1,065.00 to $925.00 and set an "overweight" rating for the company in a research report on Thursday, June 26th. Cowen reiterated a "buy" rating on shares of Equinix in a research report on Thursday, July 3rd. Guggenheim began coverage on Equinix in a research report on Thursday, July 10th. They set a "buy" rating and a $933.00 target price for the company. Finally, Dbs Bank upgraded Equinix to a "moderate buy" rating in a report on Wednesday, August 6th. Five analysts have rated the stock with a Strong Buy rating, nineteen have issued a Buy rating and five have issued a Hold rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Buy" and an average target price of $962.52.

Read Our Latest Report on EQIX

Equinix Stock Performance

EQIX stock opened at $786.47 on Friday. The business has a 50-day moving average price of $796.24 and a 200 day moving average price of $839.14. Equinix, Inc. has a 1-year low of $701.41 and a 1-year high of $994.03. The company has a debt-to-equity ratio of 1.29, a current ratio of 1.54 and a quick ratio of 1.54. The company has a market capitalization of $76.96 billion, a P/E ratio of 77.03, a PEG ratio of 1.39 and a beta of 0.90.

Equinix (NASDAQ:EQIX - Get Free Report) last posted its earnings results on Wednesday, July 30th. The financial services provider reported $9.91 earnings per share (EPS) for the quarter, beating the consensus estimate of $3.49 by $6.42. Equinix had a return on equity of 7.22% and a net margin of 11.11%.The company had revenue of $2.26 billion for the quarter, compared to analyst estimates of $2.26 billion. During the same quarter in the previous year, the firm earned $9.22 earnings per share. The firm's quarterly revenue was up 4.5% compared to the same quarter last year. Equinix has set its Q3 2025 guidance at EPS. FY 2025 guidance at 37.670-38.480 EPS. As a group, equities research analysts forecast that Equinix, Inc. will post 33.1 EPS for the current fiscal year.

Equinix Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, September 17th. Shareholders of record on Wednesday, August 20th will be paid a $4.69 dividend. This represents a $18.76 annualized dividend and a yield of 2.4%. The ex-dividend date is Wednesday, August 20th. Equinix's payout ratio is 183.74%.

About Equinix

(

Free Report)

Equinix Nasdaq: EQIX is the world's digital infrastructure company . Digital leaders harness Equinix's trusted platform to bring together and interconnect foundational infrastructure at software speed. Equinix enables organizations to access all the right places, partners and possibilities to scale with agility, speed the launch of digital services, deliver world-class experiences and multiply their value, while supporting their sustainability goals.

Read More

Want to see what other hedge funds are holding EQIX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Equinix, Inc. (NASDAQ:EQIX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Equinix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equinix wasn't on the list.

While Equinix currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report