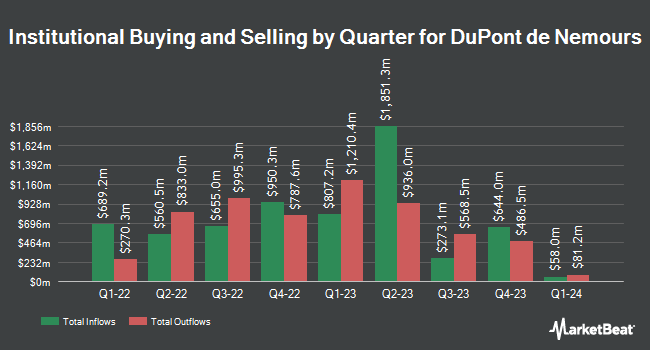

Erste Asset Management GmbH decreased its position in shares of DuPont de Nemours, Inc. (NYSE:DD - Free Report) by 89.1% during the first quarter, according to its most recent filing with the SEC. The firm owned 1,340 shares of the basic materials company's stock after selling 10,960 shares during the period. Erste Asset Management GmbH's holdings in DuPont de Nemours were worth $100,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also recently made changes to their positions in the company. Hancock Whitney Corp grew its holdings in shares of DuPont de Nemours by 2.6% during the 4th quarter. Hancock Whitney Corp now owns 5,625 shares of the basic materials company's stock worth $429,000 after acquiring an additional 143 shares during the period. Ballast Inc. grew its holdings in shares of DuPont de Nemours by 0.9% during the 1st quarter. Ballast Inc. now owns 17,754 shares of the basic materials company's stock worth $1,326,000 after acquiring an additional 159 shares during the period. GHP Investment Advisors Inc. grew its holdings in shares of DuPont de Nemours by 16.9% during the 1st quarter. GHP Investment Advisors Inc. now owns 1,173 shares of the basic materials company's stock worth $88,000 after acquiring an additional 170 shares during the period. Moody National Bank Trust Division grew its holdings in shares of DuPont de Nemours by 0.9% during the 1st quarter. Moody National Bank Trust Division now owns 19,286 shares of the basic materials company's stock worth $1,440,000 after acquiring an additional 171 shares during the period. Finally, HBK Sorce Advisory LLC grew its holdings in shares of DuPont de Nemours by 3.6% during the 1st quarter. HBK Sorce Advisory LLC now owns 5,096 shares of the basic materials company's stock worth $381,000 after acquiring an additional 176 shares during the period. Hedge funds and other institutional investors own 73.96% of the company's stock.

Wall Street Analysts Forecast Growth

DD has been the topic of a number of analyst reports. Morgan Stanley dropped their price target on DuPont de Nemours from $94.00 to $80.00 and set an "equal weight" rating on the stock in a research report on Monday, May 5th. Wells Fargo & Company boosted their price target on DuPont de Nemours from $81.00 to $90.00 and gave the stock an "overweight" rating in a research report on Monday, July 14th. JPMorgan Chase & Co. boosted their price target on DuPont de Nemours from $78.00 to $93.00 and gave the stock an "overweight" rating in a research report on Friday, May 16th. Royal Bank Of Canada boosted their price target on DuPont de Nemours from $93.00 to $94.00 and gave the stock an "outperform" rating in a research report on Friday, August 8th. Finally, Barclays dropped their price target on DuPont de Nemours from $89.00 to $73.00 and set an "equal weight" rating on the stock in a research report on Tuesday, April 29th. Nine equities research analysts have rated the stock with a Buy rating and three have given a Hold rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $88.25.

Check Out Our Latest Research Report on DuPont de Nemours

DuPont de Nemours Stock Performance

DD stock opened at $77.2410 on Friday. The stock has a market capitalization of $32.34 billion, a PE ratio of -164.34, a price-to-earnings-growth ratio of 1.86 and a beta of 1.06. DuPont de Nemours, Inc. has a 12-month low of $53.77 and a 12-month high of $90.06. The company has a current ratio of 1.41, a quick ratio of 0.94 and a debt-to-equity ratio of 0.23. The stock's 50 day simple moving average is $72.41 and its 200 day simple moving average is $71.48.

DuPont de Nemours (NYSE:DD - Get Free Report) last released its quarterly earnings data on Tuesday, August 5th. The basic materials company reported $1.12 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.06 by $0.06. The business had revenue of $3.26 billion for the quarter, compared to analysts' expectations of $3.23 billion. DuPont de Nemours had a positive return on equity of 7.85% and a negative net margin of 1.54%.The firm's quarterly revenue was up 2.7% on a year-over-year basis. During the same period in the prior year, the firm posted $0.97 EPS. DuPont de Nemours has set its FY 2025 guidance at 4.400-4.400 EPS. Q3 2025 guidance at 1.150-1.150 EPS. As a group, research analysts forecast that DuPont de Nemours, Inc. will post 4.38 earnings per share for the current fiscal year.

DuPont de Nemours Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, September 15th. Investors of record on Friday, August 29th will be given a $0.41 dividend. The ex-dividend date of this dividend is Friday, August 29th. This represents a $1.64 annualized dividend and a yield of 2.1%. DuPont de Nemours's dividend payout ratio is -348.94%.

DuPont de Nemours Company Profile

(

Free Report)

DuPont de Nemours, Inc provides technology-based materials and solutions in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa. It operates through Electronics & Industrial, Water & Protection, and Corporate & Other segments. The Electronics & Industrial segment supplies materials and solutions for the fabrication of semiconductors and integrated circuits.

See Also

Want to see what other hedge funds are holding DD? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for DuPont de Nemours, Inc. (NYSE:DD - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider DuPont de Nemours, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DuPont de Nemours wasn't on the list.

While DuPont de Nemours currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.