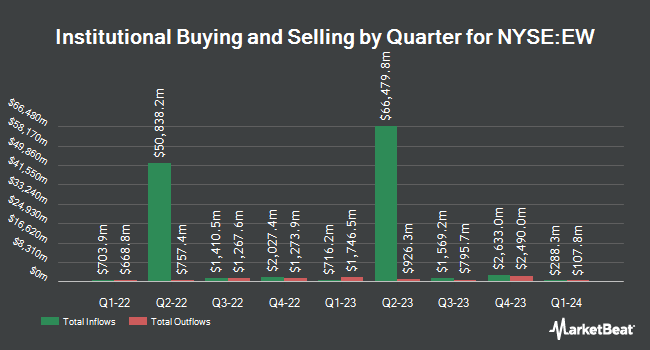

Ethic Inc. increased its holdings in shares of Edwards Lifesciences Corporation (NYSE:EW - Free Report) by 39.1% in the first quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 56,168 shares of the medical research company's stock after purchasing an additional 15,775 shares during the quarter. Ethic Inc.'s holdings in Edwards Lifesciences were worth $4,037,000 as of its most recent filing with the SEC.

Several other hedge funds also recently made changes to their positions in EW. Brighton Jones LLC bought a new position in shares of Edwards Lifesciences during the 4th quarter worth approximately $266,000. Bank Pictet & Cie Europe AG grew its stake in shares of Edwards Lifesciences by 16.7% during the 4th quarter. Bank Pictet & Cie Europe AG now owns 10,231 shares of the medical research company's stock worth $757,000 after acquiring an additional 1,463 shares in the last quarter. Townsquare Capital LLC grew its stake in shares of Edwards Lifesciences by 24.8% during the 4th quarter. Townsquare Capital LLC now owns 6,501 shares of the medical research company's stock worth $481,000 after acquiring an additional 1,293 shares in the last quarter. CreativeOne Wealth LLC bought a new position in shares of Edwards Lifesciences during the 4th quarter worth approximately $201,000. Finally, United Capital Financial Advisors LLC grew its stake in shares of Edwards Lifesciences by 64.8% during the 4th quarter. United Capital Financial Advisors LLC now owns 24,859 shares of the medical research company's stock worth $1,840,000 after acquiring an additional 9,779 shares in the last quarter. 79.46% of the stock is owned by institutional investors.

Edwards Lifesciences Stock Performance

Edwards Lifesciences stock traded up $2.3440 during mid-day trading on Wednesday, hitting $81.2740. 5,058,602 shares of the company's stock traded hands, compared to its average volume of 4,509,291. The firm has a 50 day simple moving average of $77.23 and a two-hundred day simple moving average of $74.49. Edwards Lifesciences Corporation has a fifty-two week low of $64.00 and a fifty-two week high of $83.00. The stock has a market cap of $47.72 billion, a price-to-earnings ratio of 11.69, a P/E/G ratio of 3.78 and a beta of 1.08. The company has a debt-to-equity ratio of 0.06, a current ratio of 4.68 and a quick ratio of 3.87.

Edwards Lifesciences (NYSE:EW - Get Free Report) last announced its quarterly earnings results on Thursday, July 24th. The medical research company reported $0.67 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.62 by $0.05. Edwards Lifesciences had a return on equity of 15.01% and a net margin of 72.96%.The business had revenue of $1.53 billion during the quarter, compared to the consensus estimate of $1.49 billion. During the same quarter last year, the firm posted $0.70 EPS. The company's quarterly revenue was up 11.9% on a year-over-year basis. Edwards Lifesciences has set its Q3 2025 guidance at 0.540-0.60 EPS. FY 2025 guidance at 2.400-2.500 EPS. On average, research analysts expect that Edwards Lifesciences Corporation will post 2.45 EPS for the current fiscal year.

Insiders Place Their Bets

In other Edwards Lifesciences news, VP Daveen Chopra sold 1,500 shares of the firm's stock in a transaction on Thursday, May 22nd. The stock was sold at an average price of $75.08, for a total transaction of $112,620.00. Following the completion of the sale, the vice president owned 33,496 shares of the company's stock, valued at $2,514,879.68. This trade represents a 4.29% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, VP Donald E. Bobo, Jr. sold 2,570 shares of the stock in a transaction on Monday, June 2nd. The stock was sold at an average price of $77.40, for a total value of $198,918.00. Following the transaction, the vice president owned 50,356 shares in the company, valued at $3,897,554.40. The trade was a 4.86% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 26,084 shares of company stock worth $2,010,382. Company insiders own 0.34% of the company's stock.

Analyst Upgrades and Downgrades

EW has been the subject of several research reports. Robert W. Baird raised their price target on shares of Edwards Lifesciences from $78.00 to $79.00 and gave the stock a "neutral" rating in a research note on Friday, July 25th. Stifel Nicolaus increased their price objective on Edwards Lifesciences from $90.00 to $95.00 and gave the company a "buy" rating in a report on Friday, July 25th. Dbs Bank raised Edwards Lifesciences to a "hold" rating in a report on Monday, June 2nd. JPMorgan Chase & Co. increased their price objective on Edwards Lifesciences from $80.00 to $85.00 and gave the company a "neutral" rating in a report on Friday, July 25th. Finally, Citigroup reissued a "buy" rating and issued a $95.00 price objective (up previously from $84.00) on shares of Edwards Lifesciences in a report on Thursday, May 22nd. Three analysts have rated the stock with a Strong Buy rating, twelve have issued a Buy rating, ten have issued a Hold rating and one has given a Sell rating to the company. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $85.90.

View Our Latest Stock Analysis on Edwards Lifesciences

Edwards Lifesciences Company Profile

(

Free Report)

Edwards Lifesciences Corporation provides products and technologies for structural heart disease and critical care monitoring in the United States, Europe, Japan, and internationally. It offers transcatheter heart valve replacement products for the minimally invasive replacement of aortic heart valves under the Edwards SAPIEN family of valves system; and transcatheter heart valve repair and replacement products to treat mitral and tricuspid valve diseases under the PASCAL PRECISION and Cardioband names.

Featured Stories

Before you consider Edwards Lifesciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Edwards Lifesciences wasn't on the list.

While Edwards Lifesciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.