Ethic Inc. increased its stake in Corning Incorporated (NYSE:GLW - Free Report) by 10.0% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 162,369 shares of the electronics maker's stock after buying an additional 14,707 shares during the period. Ethic Inc.'s holdings in Corning were worth $7,394,000 at the end of the most recent reporting period.

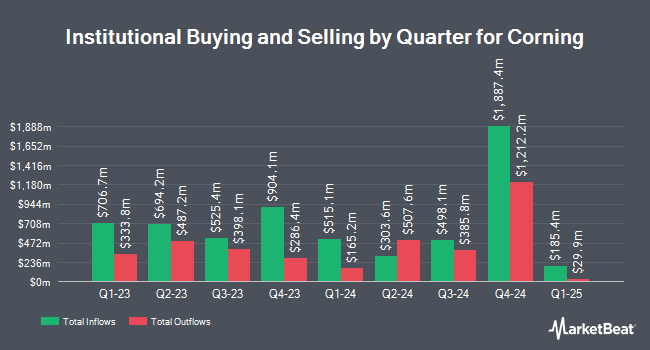

A number of other hedge funds and other institutional investors have also made changes to their positions in GLW. Vermillion Wealth Management Inc. bought a new stake in shares of Corning in the fourth quarter worth $29,000. Putney Financial Group LLC bought a new stake in shares of Corning in the fourth quarter worth $30,000. Investment Management Corp VA ADV increased its stake in Corning by 165.9% during the first quarter. Investment Management Corp VA ADV now owns 742 shares of the electronics maker's stock valued at $34,000 after purchasing an additional 463 shares during the last quarter. Annis Gardner Whiting Capital Advisors LLC increased its stake in Corning by 90.1% during the first quarter. Annis Gardner Whiting Capital Advisors LLC now owns 745 shares of the electronics maker's stock valued at $34,000 after purchasing an additional 353 shares during the last quarter. Finally, Headlands Technologies LLC bought a new stake in Corning during the first quarter valued at $38,000. Institutional investors own 69.80% of the company's stock.

Analysts Set New Price Targets

Several analysts have weighed in on the stock. UBS Group boosted their target price on shares of Corning from $57.00 to $65.00 and gave the company a "neutral" rating in a research note on Wednesday, August 6th. Susquehanna reiterated a "positive" rating and set a $75.00 target price (up previously from $60.00) on shares of Corning in a research note on Wednesday, July 30th. Barclays boosted their target price on shares of Corning from $52.00 to $65.00 and gave the company an "equal weight" rating in a research note on Wednesday, July 30th. Wall Street Zen upgraded shares of Corning from a "buy" rating to a "strong-buy" rating in a research note on Saturday, August 2nd. Finally, Oppenheimer reiterated an "outperform" rating and set a $72.00 target price (up previously from $55.00) on shares of Corning in a research note on Wednesday, July 30th. One analyst has rated the stock with a Strong Buy rating, ten have given a Buy rating and three have assigned a Hold rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $65.17.

View Our Latest Stock Report on Corning

Corning Price Performance

GLW stock traded up $0.3120 during trading on Thursday, hitting $64.9120. The company had a trading volume of 926,719 shares, compared to its average volume of 5,608,363. The firm has a market capitalization of $55.60 billion, a price-to-earnings ratio of 68.98, a P/E/G ratio of 1.45 and a beta of 1.08. The business has a 50 day moving average of $56.55 and a 200 day moving average of $50.42. Corning Incorporated has a fifty-two week low of $37.31 and a fifty-two week high of $66.50. The company has a current ratio of 1.50, a quick ratio of 0.93 and a debt-to-equity ratio of 0.58.

Corning (NYSE:GLW - Get Free Report) last issued its quarterly earnings results on Tuesday, July 29th. The electronics maker reported $0.60 earnings per share for the quarter, beating analysts' consensus estimates of $0.57 by $0.03. Corning had a net margin of 5.77% and a return on equity of 17.27%. The company had revenue of $3.86 billion during the quarter, compared to the consensus estimate of $3.84 billion. During the same period in the prior year, the company earned $0.47 EPS. Corning has set its Q3 2025 guidance at 0.630-0.670 EPS. As a group, research analysts predict that Corning Incorporated will post 2.33 earnings per share for the current year.

Corning Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, September 29th. Shareholders of record on Friday, August 29th will be issued a dividend of $0.28 per share. This represents a $1.12 annualized dividend and a yield of 1.7%. The ex-dividend date is Friday, August 29th. Corning's payout ratio is presently 119.15%.

Insider Activity

In related news, CFO Edward A. Schlesinger sold 14,082 shares of the stock in a transaction that occurred on Wednesday, July 30th. The stock was sold at an average price of $62.28, for a total value of $877,026.96. Following the transaction, the chief financial officer owned 78,316 shares in the company, valued at approximately $4,877,520.48. This represents a 15.24% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, EVP Lewis A. Steverson sold 16,646 shares of the stock in a transaction that occurred on Wednesday, July 30th. The stock was sold at an average price of $62.22, for a total value of $1,035,714.12. Following the completion of the transaction, the executive vice president owned 39,759 shares in the company, valued at $2,473,804.98. This represents a 29.51% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 211,484 shares of company stock worth $12,813,804. 0.40% of the stock is owned by company insiders.

Corning Profile

(

Free Report)

Corning Incorporated engages in the display technologies, optical communications, environmental technologies, specialty materials, and life sciences businesses in the United States and internationally. The company's Display Technologies segment offers glass substrates for flat panel displays, including liquid crystal displays and organic light-emitting diodes that are used in televisions, notebook computers, desktop monitors, tablets, and handheld devices.

Further Reading

Before you consider Corning, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corning wasn't on the list.

While Corning currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.