Ethic Inc. decreased its position in shares of Host Hotels & Resorts, Inc. (NASDAQ:HST - Free Report) by 18.7% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 161,893 shares of the company's stock after selling 37,333 shares during the period. Ethic Inc.'s holdings in Host Hotels & Resorts were worth $2,338,000 as of its most recent filing with the Securities & Exchange Commission.

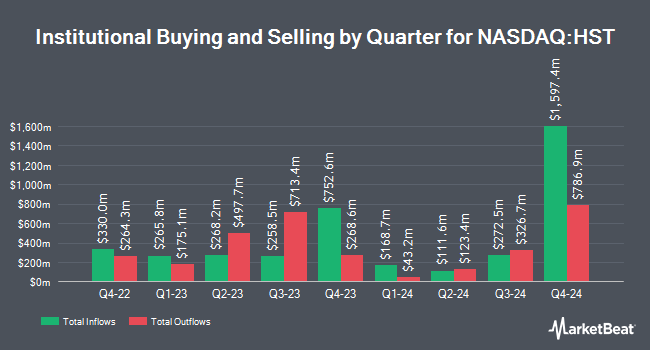

A number of other hedge funds and other institutional investors also recently bought and sold shares of the company. Brandywine Global Investment Management LLC purchased a new stake in Host Hotels & Resorts during the first quarter valued at approximately $38,611,000. Aberdeen Group plc lifted its position in Host Hotels & Resorts by 24.9% during the first quarter. Aberdeen Group plc now owns 1,824,642 shares of the company's stock valued at $25,718,000 after acquiring an additional 363,533 shares during the last quarter. Tokio Marine Asset Management Co. Ltd. lifted its position in Host Hotels & Resorts by 2.6% during the first quarter. Tokio Marine Asset Management Co. Ltd. now owns 24,842 shares of the company's stock valued at $353,000 after acquiring an additional 638 shares during the last quarter. Caitong International Asset Management Co. Ltd lifted its position in Host Hotels & Resorts by 136.5% during the first quarter. Caitong International Asset Management Co. Ltd now owns 7,305 shares of the company's stock valued at $104,000 after acquiring an additional 4,216 shares during the last quarter. Finally, National Pension Service lifted its position in Host Hotels & Resorts by 74.8% during the first quarter. National Pension Service now owns 2,596 shares of the company's stock valued at $37,000 after acquiring an additional 1,111 shares during the last quarter. Hedge funds and other institutional investors own 98.52% of the company's stock.

Wall Street Analysts Forecast Growth

HST has been the subject of a number of analyst reports. Morgan Stanley reissued an "outperform" rating on shares of Host Hotels & Resorts in a research report on Tuesday, July 15th. Stifel Nicolaus increased their target price on shares of Host Hotels & Resorts from $17.00 to $18.50 and gave the company a "buy" rating in a research report on Thursday, July 31st. Wells Fargo & Company increased their target price on shares of Host Hotels & Resorts from $16.00 to $18.00 and gave the company an "overweight" rating in a research report on Tuesday, July 1st. JPMorgan Chase & Co. assumed coverage on shares of Host Hotels & Resorts in a report on Monday, June 23rd. They issued a "neutral" rating and a $16.00 price target for the company. Finally, Evercore ISI raised their price target on shares of Host Hotels & Resorts from $19.00 to $20.00 and gave the stock an "outperform" rating in a report on Monday, July 28th. Six investment analysts have rated the stock with a Buy rating and five have given a Hold rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $17.50.

Get Our Latest Research Report on HST

Host Hotels & Resorts Stock Performance

Shares of NASDAQ HST traded up $0.76 during midday trading on Friday, reaching $16.91. The company had a trading volume of 9,060,799 shares, compared to its average volume of 11,222,170. The business's 50-day simple moving average is $15.97 and its 200 day simple moving average is $15.38. The stock has a market cap of $11.63 billion, a P/E ratio of 17.99 and a beta of 1.34. Host Hotels & Resorts, Inc. has a 1 year low of $12.22 and a 1 year high of $19.36. The company has a current ratio of 2.20, a quick ratio of 2.20 and a debt-to-equity ratio of 0.76.

Host Hotels & Resorts (NASDAQ:HST - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The company reported $0.58 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.51 by $0.07. The business had revenue of $1.59 billion during the quarter, compared to analysts' expectations of $1.51 billion. Host Hotels & Resorts had a net margin of 11.12% and a return on equity of 9.90%. The business's quarterly revenue was up 8.2% on a year-over-year basis. During the same quarter last year, the company posted $0.57 earnings per share. Host Hotels & Resorts has set its FY 2025 guidance at 1.980-2.020 EPS. On average, analysts forecast that Host Hotels & Resorts, Inc. will post 1.88 earnings per share for the current fiscal year.

Host Hotels & Resorts Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, July 15th. Stockholders of record on Monday, June 30th were paid a $0.20 dividend. The ex-dividend date was Monday, June 30th. This represents a $0.80 dividend on an annualized basis and a dividend yield of 4.7%. Host Hotels & Resorts's dividend payout ratio is presently 85.11%.

About Host Hotels & Resorts

(

Free Report)

Host Hotels & Resorts, Inc is a real estate investment trust, which engages in the management of luxury and upper-upscale hotels. It operates through the following geographical segments: United States, Brazil, and Canada. The company was founded in 1927 and is headquartered in Bethesda, MD.

Featured Stories

Before you consider Host Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Host Hotels & Resorts wasn't on the list.

While Host Hotels & Resorts currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.