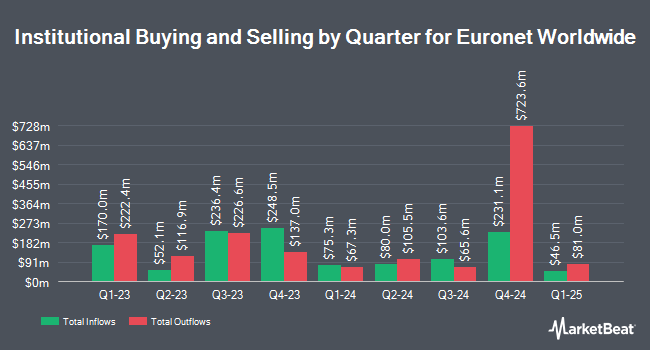

Van Berkom & Associates Inc. trimmed its stake in Euronet Worldwide, Inc. (NASDAQ:EEFT - Free Report) by 7.6% during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 1,009,391 shares of the business services provider's stock after selling 82,942 shares during the period. Euronet Worldwide makes up approximately 3.5% of Van Berkom & Associates Inc.'s portfolio, making the stock its biggest holding. Van Berkom & Associates Inc. owned approximately 2.33% of Euronet Worldwide worth $107,853,000 as of its most recent SEC filing.

Several other institutional investors also recently modified their holdings of the stock. Principal Financial Group Inc. boosted its holdings in Euronet Worldwide by 0.3% in the first quarter. Principal Financial Group Inc. now owns 95,039 shares of the business services provider's stock valued at $10,155,000 after acquiring an additional 280 shares in the last quarter. GAMMA Investing LLC increased its holdings in Euronet Worldwide by 99.9% in the 1st quarter. GAMMA Investing LLC now owns 1,907 shares of the business services provider's stock worth $204,000 after buying an additional 953 shares in the last quarter. Asset Management One Co. Ltd. grew its stake in shares of Euronet Worldwide by 211.6% during the 1st quarter. Asset Management One Co. Ltd. now owns 1,991 shares of the business services provider's stock valued at $213,000 after purchasing an additional 1,352 shares during the period. SG Americas Securities LLC grew its stake in shares of Euronet Worldwide by 46.4% during the 1st quarter. SG Americas Securities LLC now owns 4,721 shares of the business services provider's stock valued at $504,000 after acquiring an additional 1,496 shares during the period. Finally, Wealth Enhancement Advisory Services LLC bought a new position in shares of Euronet Worldwide during the 1st quarter valued at approximately $1,400,000. 91.60% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several analysts have recently issued reports on the company. Oppenheimer upped their price objective on Euronet Worldwide from $135.00 to $137.00 and gave the stock an "outperform" rating in a report on Wednesday, July 2nd. Keefe, Bruyette & Woods decreased their price objective on Euronet Worldwide from $112.00 to $110.00 and set a "market perform" rating for the company in a research note on Friday, April 25th. Needham & Company LLC decreased their price target on Euronet Worldwide from $130.00 to $120.00 and set a "buy" rating for the company in a research note on Friday, April 25th. Finally, William Blair restated an "outperform" rating on shares of Euronet Worldwide in a research note on Thursday, April 24th. Three equities research analysts have rated the stock with a hold rating, five have assigned a buy rating and one has given a strong buy rating to the company. According to MarketBeat, Euronet Worldwide currently has a consensus rating of "Moderate Buy" and an average target price of $123.83.

View Our Latest Stock Analysis on EEFT

Euronet Worldwide Trading Down 0.2%

Shares of EEFT stock traded down $0.20 during mid-day trading on Wednesday, hitting $100.99. 128,279 shares of the company's stock were exchanged, compared to its average volume of 422,924. Euronet Worldwide, Inc. has a fifty-two week low of $85.24 and a fifty-two week high of $114.25. The stock has a 50-day simple moving average of $105.37 and a two-hundred day simple moving average of $102.53. The company has a quick ratio of 1.60, a current ratio of 1.60 and a debt-to-equity ratio of 1.46. The stock has a market cap of $4.37 billion, a price-to-earnings ratio of 14.96, a PEG ratio of 0.77 and a beta of 1.23.

Euronet Worldwide Company Profile

(

Free Report)

Euronet Worldwide, Inc provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide. It operates through three segments: Electronic Fund Transfer Processing, epay, and Money Transfer. The Electronic Fund Transfer Processing segment provides electronic payment solutions, including automated teller machine (ATM) cash withdrawal and deposit services, ATM network participation, outsourced ATM and point-of-sale (POS) management solutions, credit and debit and prepaid card outsourcing, card issuing, and merchant acquiring services.

Further Reading

Before you consider Euronet Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Euronet Worldwide wasn't on the list.

While Euronet Worldwide currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.