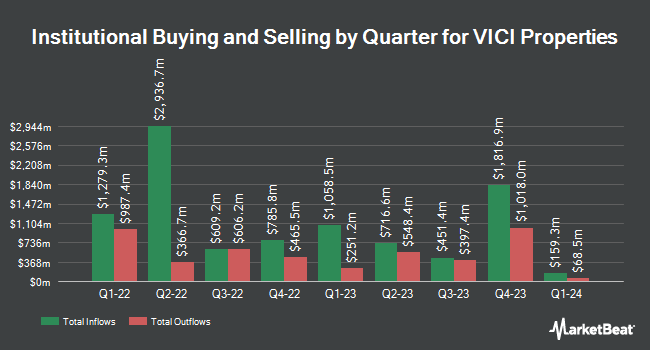

Exchange Traded Concepts LLC increased its stake in shares of VICI Properties Inc. (NYSE:VICI - Free Report) by 10.9% in the second quarter, according to its most recent 13F filing with the SEC. The firm owned 135,701 shares of the company's stock after purchasing an additional 13,365 shares during the period. Exchange Traded Concepts LLC's holdings in VICI Properties were worth $4,424,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Wayfinding Financial LLC acquired a new position in VICI Properties during the first quarter worth $29,000. AdvisorNet Financial Inc lifted its stake in VICI Properties by 362.2% during the 1st quarter. AdvisorNet Financial Inc now owns 1,003 shares of the company's stock worth $33,000 after acquiring an additional 786 shares in the last quarter. Avalon Trust Co acquired a new position in VICI Properties in the 1st quarter valued at about $35,000. Investment Management Corp VA ADV grew its position in VICI Properties by 171.3% in the 1st quarter. Investment Management Corp VA ADV now owns 1,123 shares of the company's stock valued at $37,000 after acquiring an additional 709 shares in the last quarter. Finally, Kestra Investment Management LLC increased its stake in VICI Properties by 55.5% during the first quarter. Kestra Investment Management LLC now owns 1,776 shares of the company's stock worth $58,000 after purchasing an additional 634 shares during the period. Hedge funds and other institutional investors own 97.71% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms have recently commented on VICI. Morgan Stanley raised their price objective on shares of VICI Properties from $33.00 to $35.00 and gave the company an "equal weight" rating in a research note on Tuesday, July 8th. Wells Fargo & Company raised their price target on shares of VICI Properties from $35.00 to $36.00 and gave the company an "overweight" rating in a research report on Wednesday, August 27th. Citigroup restated a "market outperform" rating on shares of VICI Properties in a research note on Tuesday, July 22nd. JPMorgan Chase & Co. lifted their target price on VICI Properties from $37.00 to $38.00 and gave the company an "overweight" rating in a report on Wednesday, September 10th. Finally, Mizuho lifted their target price on VICI Properties from $34.00 to $35.00 and gave the company an "outperform" rating in a report on Thursday, September 11th. Eleven equities research analysts have rated the stock with a Buy rating and three have issued a Hold rating to the company. According to data from MarketBeat.com, VICI Properties currently has a consensus rating of "Moderate Buy" and a consensus price target of $35.92.

Read Our Latest Stock Report on VICI Properties

VICI Properties Stock Up 0.9%

NYSE VICI traded up $0.28 during trading on Tuesday, reaching $31.71. 1,733,401 shares of the company's stock were exchanged, compared to its average volume of 7,022,165. The company has a 50 day moving average price of $33.03 and a two-hundred day moving average price of $32.36. The stock has a market cap of $33.82 billion, a P/E ratio of 12.14, a price-to-earnings-growth ratio of 3.18 and a beta of 0.70. VICI Properties Inc. has a 1 year low of $27.98 and a 1 year high of $34.03. The company has a debt-to-equity ratio of 0.62, a quick ratio of 1.74 and a current ratio of 1.74.

VICI Properties (NYSE:VICI - Get Free Report) last issued its quarterly earnings data on Wednesday, July 30th. The company reported $0.60 earnings per share for the quarter, hitting the consensus estimate of $0.60. The business had revenue of $1 billion during the quarter, compared to the consensus estimate of $991.59 million. VICI Properties had a net margin of 70.20% and a return on equity of 10.21%. The company's revenue was up 4.6% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $0.57 EPS. VICI Properties has set its FY 2025 guidance at 2.350-2.370 EPS. On average, equities research analysts anticipate that VICI Properties Inc. will post 2.31 EPS for the current fiscal year.

VICI Properties Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, October 9th. Stockholders of record on Thursday, September 18th will be issued a $0.45 dividend. This represents a $1.80 annualized dividend and a dividend yield of 5.7%. The ex-dividend date of this dividend is Thursday, September 18th. This is an increase from VICI Properties's previous quarterly dividend of $0.43. VICI Properties's dividend payout ratio (DPR) is presently 68.97%.

About VICI Properties

(

Free Report)

VICI Properties Inc is an S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

See Also

Before you consider VICI Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VICI Properties wasn't on the list.

While VICI Properties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.