Exchange Traded Concepts LLC reduced its stake in shares of Energy Transfer LP (NYSE:ET - Free Report) by 1.8% during the second quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 1,522,647 shares of the pipeline company's stock after selling 28,432 shares during the quarter. Exchange Traded Concepts LLC's holdings in Energy Transfer were worth $27,606,000 at the end of the most recent reporting period.

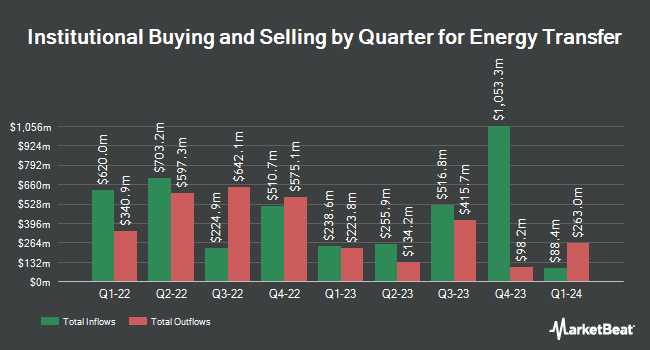

Other hedge funds and other institutional investors have also modified their holdings of the company. Capital A Wealth Management LLC bought a new stake in shares of Energy Transfer during the fourth quarter valued at about $26,000. Fourth Dimension Wealth LLC purchased a new position in Energy Transfer in the 4th quarter worth about $29,000. Vision Financial Markets LLC purchased a new position in Energy Transfer in the 1st quarter worth about $33,000. HWG Holdings LP purchased a new position in Energy Transfer in the 1st quarter worth about $38,000. Finally, Stone House Investment Management LLC purchased a new position in Energy Transfer during the 1st quarter valued at about $38,000. 38.22% of the stock is currently owned by institutional investors.

Energy Transfer Price Performance

NYSE:ET traded down $0.12 during trading hours on Friday, reaching $17.32. The company had a trading volume of 13,743,076 shares, compared to its average volume of 9,812,187. The stock has a 50-day moving average of $17.54 and a two-hundred day moving average of $17.61. Energy Transfer LP has a one year low of $14.60 and a one year high of $21.45. The firm has a market capitalization of $59.45 billion, a PE ratio of 13.43, a PEG ratio of 1.03 and a beta of 0.85. The company has a quick ratio of 0.92, a current ratio of 1.15 and a debt-to-equity ratio of 1.44.

Energy Transfer (NYSE:ET - Get Free Report) last announced its quarterly earnings results on Wednesday, August 6th. The pipeline company reported $0.32 earnings per share for the quarter, meeting analysts' consensus estimates of $0.32. The firm had revenue of $19.24 billion for the quarter, compared to analysts' expectations of $24.07 billion. Energy Transfer had a return on equity of 11.08% and a net margin of 5.80%.The business's revenue was down 7.2% compared to the same quarter last year. During the same period in the prior year, the business posted $0.35 earnings per share. Analysts forecast that Energy Transfer LP will post 1.46 earnings per share for the current year.

Energy Transfer Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, August 19th. Shareholders of record on Friday, August 8th were paid a $0.33 dividend. This is an increase from Energy Transfer's previous quarterly dividend of $0.33. This represents a $1.32 dividend on an annualized basis and a yield of 7.6%. The ex-dividend date of this dividend was Friday, August 8th. Energy Transfer's payout ratio is presently 102.33%.

Insider Buying and Selling

In other Energy Transfer news, Director Kelcy L. Warren acquired 1,350,000 shares of Energy Transfer stock in a transaction on Wednesday, August 20th. The shares were bought at an average price of $17.36 per share, with a total value of $23,436,000.00. Following the completion of the purchase, the director owned 69,178,477 shares in the company, valued at $1,200,938,360.72. This trade represents a 1.99% increase in their ownership of the stock. The purchase was disclosed in a legal filing with the SEC, which is available through the SEC website. Corporate insiders own 3.28% of the company's stock.

Analyst Ratings Changes

Several equities analysts have weighed in on ET shares. Morgan Stanley lowered their target price on Energy Transfer from $24.00 to $23.00 and set an "overweight" rating on the stock in a research note on Tuesday, August 26th. Wells Fargo & Company reaffirmed an "overweight" rating and set a $23.00 target price (up previously from $21.00) on shares of Energy Transfer in a research note on Tuesday, August 12th. Cowen initiated coverage on Energy Transfer in a report on Monday, July 7th. They set a "buy" rating for the company. Scotiabank initiated coverage on Energy Transfer in a report on Tuesday, September 2nd. They issued a "sector outperform" rating and a $23.00 target price for the company. Finally, TD Cowen initiated coverage on Energy Transfer in a report on Monday, July 7th. They issued a "buy" rating and a $22.00 target price for the company. Thirteen equities research analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $22.50.

Read Our Latest Analysis on Energy Transfer

About Energy Transfer

(

Free Report)

Energy Transfer LP provides energy-related services. The company owns and operates natural gas transportation pipeline, and natural gas storage facilities in Texas and Oklahoma; and approximately 20,090 miles of interstate natural gas pipeline. It also sells natural gas to electric utilities, independent power plants, local distribution and other marketing companies, and industrial end-users.

Further Reading

Before you consider Energy Transfer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Energy Transfer wasn't on the list.

While Energy Transfer currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.