Brandywine Global Investment Management LLC raised its position in Expedia Group, Inc. (NASDAQ:EXPE - Free Report) by 12.2% in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 197,442 shares of the online travel company's stock after buying an additional 21,419 shares during the period. Brandywine Global Investment Management LLC owned 0.15% of Expedia Group worth $33,190,000 as of its most recent filing with the SEC.

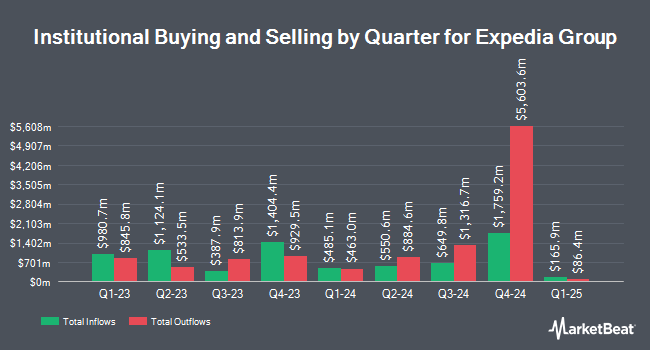

Several other large investors also recently modified their holdings of EXPE. Vanguard Group Inc. boosted its holdings in Expedia Group by 2.7% in the 1st quarter. Vanguard Group Inc. now owns 15,201,811 shares of the online travel company's stock worth $2,555,424,000 after buying an additional 394,147 shares during the period. Alkeon Capital Management LLC raised its position in shares of Expedia Group by 25.4% during the 4th quarter. Alkeon Capital Management LLC now owns 1,976,472 shares of the online travel company's stock valued at $368,276,000 after buying an additional 400,000 shares in the last quarter. Nuveen LLC purchased a new position in Expedia Group in the 1st quarter worth $227,174,000. Northern Trust Corp raised its position in Expedia Group by 8.8% in the 4th quarter. Northern Trust Corp now owns 1,275,907 shares of the online travel company's stock worth $237,740,000 after purchasing an additional 102,949 shares during the period. Finally, Dimensional Fund Advisors LP raised its position in Expedia Group by 1.5% in the 1st quarter. Dimensional Fund Advisors LP now owns 1,194,328 shares of the online travel company's stock worth $200,766,000 after purchasing an additional 17,659 shares during the period. Hedge funds and other institutional investors own 90.76% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages have recently weighed in on EXPE. Wall Street Zen raised shares of Expedia Group from a "hold" rating to a "buy" rating in a research note on Monday, July 28th. Sanford C. Bernstein set a $210.00 target price on shares of Expedia Group in a report on Monday, August 11th. Citigroup increased their price objective on shares of Expedia Group from $177.00 to $206.00 and gave the stock a "neutral" rating in a research note on Wednesday, August 13th. The Goldman Sachs Group dropped their target price on shares of Expedia Group from $219.00 to $183.00 and set a "buy" rating for the company in a research report on Friday, May 9th. Finally, Cantor Fitzgerald restated a "neutral" rating and set a $200.00 target price on shares of Expedia Group in a research report on Wednesday, July 23rd. Three research analysts have rated the stock with a Strong Buy rating, eleven have given a Buy rating, eighteen have given a Hold rating and one has assigned a Sell rating to the company's stock. Based on data from MarketBeat, Expedia Group presently has an average rating of "Hold" and a consensus target price of $205.63.

Check Out Our Latest Analysis on Expedia Group

Expedia Group Stock Up 0.7%

Expedia Group stock traded up $1.37 during trading hours on Tuesday, reaching $208.04. The stock had a trading volume of 1,726,019 shares, compared to its average volume of 2,118,797. The company has a market cap of $25.74 billion, a price-to-earnings ratio of 25.50, a PEG ratio of 1.03 and a beta of 1.61. The business's 50 day moving average price is $180.54 and its 200-day moving average price is $174.07. Expedia Group, Inc. has a 52 week low of $126.46 and a 52 week high of $213.00. The company has a debt-to-equity ratio of 2.14, a current ratio of 0.75 and a quick ratio of 0.75.

Expedia Group (NASDAQ:EXPE - Get Free Report) last posted its earnings results on Thursday, August 7th. The online travel company reported $4.24 EPS for the quarter, beating analysts' consensus estimates of $4.13 by $0.11. The company had revenue of $3.79 billion during the quarter, compared to analysts' expectations of $3.70 billion. Expedia Group had a net margin of 7.94% and a return on equity of 56.25%. Expedia Group's revenue for the quarter was up 6.4% compared to the same quarter last year. During the same quarter in the prior year, the company posted $3.51 earnings per share. Expedia Group has set its FY 2025 guidance at EPS. Q3 2025 guidance at EPS. Sell-side analysts anticipate that Expedia Group, Inc. will post 12.28 EPS for the current year.

Expedia Group Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, September 18th. Investors of record on Thursday, August 28th will be paid a $0.40 dividend. This represents a $1.60 annualized dividend and a dividend yield of 0.8%. The ex-dividend date is Thursday, August 28th. Expedia Group's payout ratio is currently 19.61%.

Insider Activity

In related news, insider Robert J. Dzielak sold 3,306 shares of the business's stock in a transaction on Tuesday, August 12th. The shares were sold at an average price of $200.84, for a total value of $663,977.04. Following the completion of the transaction, the insider directly owned 77,075 shares in the company, valued at $15,479,743. The trade was a 4.11% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. 9.13% of the stock is currently owned by corporate insiders.

Expedia Group Company Profile

(

Free Report)

Expedia Group, Inc operates as an online travel company in the United States and internationally. The company operates through B2C, B2B, and trivago segments. Its B2C segment includes Brand Expedia, a full-service online travel brand offers various travel products and services; Hotels.com for lodging accommodations; Vrbo, an online marketplace for the alternative accommodations; Orbitz, Travelocity, Wotif Group, ebookers, CheapTickets, Hotwire.com and CarRentals.com.

See Also

Before you consider Expedia Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expedia Group wasn't on the list.

While Expedia Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report