Acadian Asset Management LLC lowered its holdings in Expeditors International of Washington, Inc. (NASDAQ:EXPD - Free Report) by 33.5% in the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 77,792 shares of the transportation company's stock after selling 39,202 shares during the period. Acadian Asset Management LLC owned 0.06% of Expeditors International of Washington worth $9,352,000 as of its most recent SEC filing.

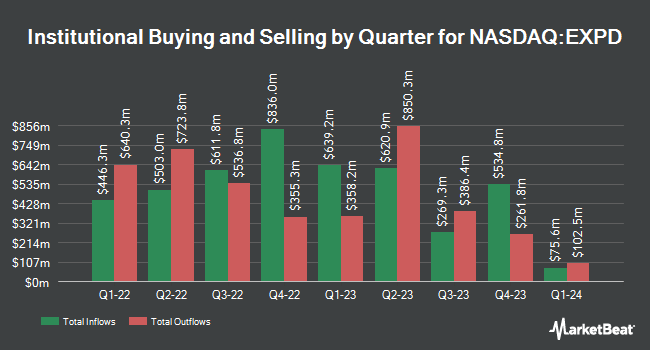

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Boston Partners increased its stake in Expeditors International of Washington by 13.1% during the first quarter. Boston Partners now owns 4,295,924 shares of the transportation company's stock worth $516,385,000 after acquiring an additional 498,212 shares during the last quarter. Invesco Ltd. increased its stake in Expeditors International of Washington by 23.4% during the first quarter. Invesco Ltd. now owns 3,039,899 shares of the transportation company's stock worth $365,548,000 after acquiring an additional 576,468 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its stake in Expeditors International of Washington by 1.2% during the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 2,428,914 shares of the transportation company's stock worth $269,051,000 after acquiring an additional 27,965 shares during the last quarter. Baird Financial Group Inc. increased its stake in Expeditors International of Washington by 4.8% during the first quarter. Baird Financial Group Inc. now owns 1,845,102 shares of the transportation company's stock worth $221,874,000 after acquiring an additional 84,556 shares during the last quarter. Finally, Marshfield Associates increased its stake in Expeditors International of Washington by 0.8% during the first quarter. Marshfield Associates now owns 1,841,746 shares of the transportation company's stock worth $221,470,000 after acquiring an additional 14,127 shares during the last quarter. 94.02% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

EXPD has been the subject of several research analyst reports. UBS Group upped their price target on Expeditors International of Washington from $117.00 to $120.00 and gave the stock a "neutral" rating in a research note on Wednesday, August 6th. Truist Financial upped their price target on Expeditors International of Washington from $105.00 to $110.00 and gave the stock a "hold" rating in a research note on Monday, June 30th. Baird R W upgraded Expeditors International of Washington to a "hold" rating in a research note on Tuesday, July 1st. Robert W. Baird initiated coverage on Expeditors International of Washington in a research report on Tuesday, July 1st. They issued a "neutral" rating and a $124.00 target price for the company. Finally, Bank of America downgraded Expeditors International of Washington from a "neutral" rating to an "underperform" rating and upped their target price for the stock from $117.00 to $118.00 in a research report on Friday, July 11th. Seven equities research analysts have rated the stock with a Hold rating and five have assigned a Sell rating to the company. According to MarketBeat, Expeditors International of Washington currently has a consensus rating of "Reduce" and an average target price of $114.78.

Get Our Latest Report on Expeditors International of Washington

Insider Buying and Selling

In related news, VP Jeffrey F. Dickerman sold 1,470 shares of the stock in a transaction dated Thursday, August 7th. The stock was sold at an average price of $118.05, for a total value of $173,533.50. Following the completion of the transaction, the vice president owned 7,651 shares of the company's stock, valued at approximately $903,200.55. This represents a 16.12% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Corporate insiders own 0.69% of the company's stock.

Expeditors International of Washington Price Performance

EXPD traded down $0.70 on Thursday, reaching $124.26. The company's stock had a trading volume of 326,792 shares, compared to its average volume of 1,339,488. The stock has a market cap of $16.86 billion, a price-to-earnings ratio of 21.72, a price-to-earnings-growth ratio of 5.00 and a beta of 1.06. Expeditors International of Washington, Inc. has a 1 year low of $100.47 and a 1 year high of $131.59. The business's 50 day moving average is $118.62 and its 200 day moving average is $115.39.

About Expeditors International of Washington

(

Free Report)

Expeditors International of Washington, Inc, together with its subsidiaries, provides logistics services worldwide. The company offers airfreight services, such as air freight consolidation and forwarding; ocean freight and ocean services, including ocean freight consolidation, direct ocean forwarding, and order management; customs brokerage, import, intra-continental ground transportation and delivery, and warehousing and distribution services; and customs clearance, purchase order management, vendor consolidation, time-definite transportation services, temperature-controlled transit, cargo insurance, specialized cargo monitoring and tracking, and other supply chain solutions.

Featured Articles

Before you consider Expeditors International of Washington, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expeditors International of Washington wasn't on the list.

While Expeditors International of Washington currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.