Cookson Peirce & Co. Inc. lifted its stake in shares of F5, Inc. (NASDAQ:FFIV - Free Report) by 1.7% during the first quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 215,205 shares of the network technology company's stock after purchasing an additional 3,602 shares during the quarter. F5 accounts for about 2.9% of Cookson Peirce & Co. Inc.'s holdings, making the stock its 5th largest position. Cookson Peirce & Co. Inc. owned about 0.37% of F5 worth $57,303,000 as of its most recent filing with the SEC.

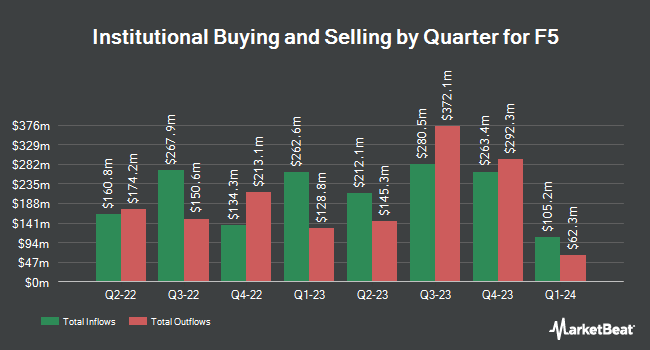

A number of other institutional investors have also added to or reduced their stakes in the business. GAMMA Investing LLC lifted its holdings in F5 by 34,698.9% in the 1st quarter. GAMMA Investing LLC now owns 746,089 shares of the network technology company's stock worth $198,661,000 after buying an additional 743,945 shares during the period. Robeco Institutional Asset Management B.V. grew its holdings in shares of F5 by 110.4% in the first quarter. Robeco Institutional Asset Management B.V. now owns 560,493 shares of the network technology company's stock worth $149,242,000 after acquiring an additional 294,050 shares during the period. Pacer Advisors Inc. grew its holdings in F5 by 659.3% during the first quarter. Pacer Advisors Inc. now owns 316,992 shares of the network technology company's stock valued at $84,405,000 after purchasing an additional 275,244 shares during the period. Northern Trust Corp grew its holdings in F5 by 38.0% during the fourth quarter. Northern Trust Corp now owns 913,021 shares of the network technology company's stock valued at $229,597,000 after purchasing an additional 251,534 shares during the period. Finally, Voya Investment Management LLC lifted its position in shares of F5 by 400.3% in the fourth quarter. Voya Investment Management LLC now owns 220,291 shares of the network technology company's stock valued at $55,397,000 after acquiring an additional 176,260 shares in the last quarter. 90.66% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

FFIV has been the topic of a number of research analyst reports. Royal Bank Of Canada boosted their target price on F5 from $314.00 to $326.00 and gave the stock a "sector perform" rating in a research report on Thursday, July 31st. Morgan Stanley increased their target price on F5 from $305.00 to $312.00 and gave the company an "equal weight" rating in a research report on Thursday, July 31st. Barclays raised their price objective on F5 from $274.00 to $321.00 and gave the stock an "equal weight" rating in a research report on Thursday, July 31st. William Blair reiterated an "outperform" rating on shares of F5 in a research note on Tuesday, April 29th. Finally, Needham & Company LLC lifted their price objective on F5 from $320.00 to $345.00 and gave the stock a "buy" rating in a report on Thursday, July 31st. One investment analyst has rated the stock with a sell rating, seven have given a hold rating and four have issued a buy rating to the company. According to MarketBeat, the stock has a consensus rating of "Hold" and a consensus target price of $309.89.

View Our Latest Stock Analysis on FFIV

Insider Activity

In other F5 news, Director Michael L. Dreyer sold 1,800 shares of F5 stock in a transaction on Tuesday, May 27th. The shares were sold at an average price of $285.96, for a total value of $514,728.00. Following the transaction, the director owned 4,376 shares in the company, valued at $1,251,360.96. This trade represents a 29.15% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, EVP Chad Michael Whalen sold 5,297 shares of F5 stock in a transaction on Monday, August 11th. The shares were sold at an average price of $322.24, for a total transaction of $1,706,905.28. Following the completion of the transaction, the executive vice president owned 23,591 shares in the company, valued at approximately $7,601,963.84. This trade represents a 18.34% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 13,816 shares of company stock valued at $4,227,002 in the last 90 days. Insiders own 0.52% of the company's stock.

F5 Trading Down 1.0%

Shares of FFIV traded down $3.16 during mid-day trading on Friday, hitting $315.34. 327,752 shares of the company's stock were exchanged, compared to its average volume of 583,240. F5, Inc. has a fifty-two week low of $194.45 and a fifty-two week high of $334.00. The firm has a market capitalization of $18.12 billion, a P/E ratio of 27.78, a P/E/G ratio of 3.64 and a beta of 1.03. The business's 50 day moving average is $301.13 and its two-hundred day moving average is $285.97.

F5 (NASDAQ:FFIV - Get Free Report) last issued its earnings results on Wednesday, July 30th. The network technology company reported $4.16 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $3.49 by $0.67. F5 had a net margin of 22.06% and a return on equity of 21.77%. The company had revenue of $780.37 million during the quarter, compared to analysts' expectations of $750.64 million. During the same period last year, the company posted $3.36 earnings per share. The firm's quarterly revenue was up 12.2% compared to the same quarter last year. On average, equities research analysts forecast that F5, Inc. will post 11.2 earnings per share for the current year.

F5 Profile

(

Free Report)

F5, Inc provides multi-cloud application security and delivery solutions in the United States, Europe, the Middle East, Africa, and the Asia Pacific region. The company's distributed cloud services enable its customers to deploy, secure, and operate applications in any architecture, from on-premises to the public cloud.

Featured Articles

Before you consider F5, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and F5 wasn't on the list.

While F5 currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report