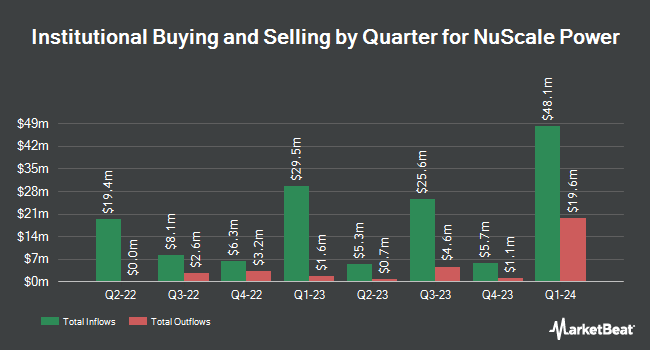

Family Capital Management Inc. bought a new position in shares of NuScale Power Corporation (NYSE:SMR - Free Report) in the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm bought 8,391 shares of the company's stock, valued at approximately $332,000.

A number of other large investors have also recently added to or reduced their stakes in SMR. Wealth Enhancement Advisory Services LLC boosted its holdings in NuScale Power by 51.7% during the first quarter. Wealth Enhancement Advisory Services LLC now owns 17,522 shares of the company's stock worth $248,000 after buying an additional 5,974 shares in the last quarter. Janney Montgomery Scott LLC boosted its holdings in NuScale Power by 652.0% during the first quarter. Janney Montgomery Scott LLC now owns 84,778 shares of the company's stock worth $1,200,000 after buying an additional 73,504 shares in the last quarter. Cambridge Investment Research Advisors Inc. boosted its holdings in NuScale Power by 31.9% during the first quarter. Cambridge Investment Research Advisors Inc. now owns 193,098 shares of the company's stock worth $2,734,000 after buying an additional 46,744 shares in the last quarter. Legacy Advisors LLC bought a new stake in NuScale Power during the first quarter worth approximately $186,000. Finally, Wealth Effects LLC bought a new stake in NuScale Power during the first quarter worth approximately $683,000. 78.37% of the stock is currently owned by institutional investors.

Insider Transactions at NuScale Power

In other NuScale Power news, Director Corp Fluor sold 87,900 shares of the stock in a transaction that occurred on Wednesday, October 8th. The shares were sold at an average price of $39.58, for a total value of $3,479,082.00. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. In the last three months, insiders have sold 15,048,847 shares of company stock valued at $606,761,579. 1.96% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

Several brokerages recently commented on SMR. Bank of America restated an "underperform" rating and issued a $34.00 price target (down previously from $38.00) on shares of NuScale Power in a research report on Tuesday, September 30th. Canaccord Genuity Group upped their price target on shares of NuScale Power from $44.00 to $60.00 and gave the company a "buy" rating in a research report on Wednesday, September 3rd. Northland Capmk upgraded shares of NuScale Power to a "hold" rating in a research report on Monday, July 7th. BNP Paribas downgraded shares of NuScale Power to an "underperform" rating in a research report on Tuesday. Finally, Cantor Fitzgerald began coverage on shares of NuScale Power in a research report on Tuesday. They issued an "overweight" rating and a $55.00 price target for the company. Three research analysts have rated the stock with a Buy rating, seven have issued a Hold rating and five have given a Sell rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Reduce" and a consensus target price of $37.73.

View Our Latest Research Report on NuScale Power

NuScale Power Stock Down 13.2%

SMR stock opened at $38.37 on Wednesday. NuScale Power Corporation has a 12-month low of $11.08 and a 12-month high of $57.42. The company has a market cap of $10.93 billion, a price-to-earnings ratio of -32.24 and a beta of 2.02. The company has a 50 day moving average of $38.42 and a two-hundred day moving average of $33.81.

NuScale Power (NYSE:SMR - Get Free Report) last released its earnings results on Thursday, August 7th. The company reported ($0.13) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.12) by ($0.01). NuScale Power had a positive return on equity of 2.61% and a negative net margin of 221.07%.The company had revenue of $8.05 million during the quarter, compared to analysts' expectations of $10.49 million. On average, research analysts anticipate that NuScale Power Corporation will post -0.73 EPS for the current year.

About NuScale Power

(

Free Report)

NuScale Power Corporation engages in the development and sale of modular light water reactor nuclear power plants to supply energy for electrical generation, district heating, desalination, hydrogen production, and other process heat applications. It offers NuScale Power Module (NPM), a water reactor that can generate 77 megawatts of electricity (MWe); and VOYGR power plant designs for three facility sizes that are capable of housing from one to four and six or twelve NPMs.

Further Reading

Want to see what other hedge funds are holding SMR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for NuScale Power Corporation (NYSE:SMR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NuScale Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NuScale Power wasn't on the list.

While NuScale Power currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.