Farther Finance Advisors LLC lifted its stake in shares of Edwards Lifesciences Co. (NYSE:EW - Free Report) by 390.7% in the first quarter, according to its most recent filing with the SEC. The fund owned 8,808 shares of the medical research company's stock after acquiring an additional 7,013 shares during the period. Farther Finance Advisors LLC's holdings in Edwards Lifesciences were worth $633,000 as of its most recent SEC filing.

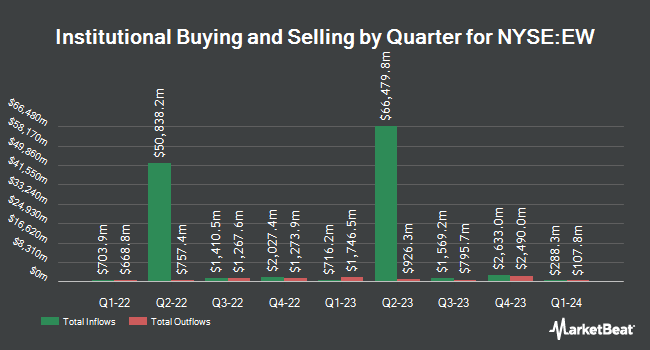

Other hedge funds and other institutional investors have also recently modified their holdings of the company. RDA Financial Network lifted its stake in shares of Edwards Lifesciences by 2.7% in the 1st quarter. RDA Financial Network now owns 34,696 shares of the medical research company's stock valued at $2,515,000 after acquiring an additional 926 shares during the last quarter. Wedmont Private Capital increased its stake in Edwards Lifesciences by 18.1% in the 1st quarter. Wedmont Private Capital now owns 9,860 shares of the medical research company's stock worth $684,000 after purchasing an additional 1,512 shares during the period. Gateway Investment Advisers LLC lifted its position in Edwards Lifesciences by 2.9% in the first quarter. Gateway Investment Advisers LLC now owns 11,917 shares of the medical research company's stock valued at $864,000 after purchasing an additional 336 shares during the last quarter. Radnor Capital Management LLC boosted its stake in shares of Edwards Lifesciences by 11.1% during the first quarter. Radnor Capital Management LLC now owns 24,070 shares of the medical research company's stock valued at $1,745,000 after purchasing an additional 2,400 shares during the period. Finally, Ehrlich Financial Group grew its holdings in shares of Edwards Lifesciences by 5.7% in the first quarter. Ehrlich Financial Group now owns 10,950 shares of the medical research company's stock worth $794,000 after purchasing an additional 586 shares during the last quarter. 79.46% of the stock is currently owned by hedge funds and other institutional investors.

Edwards Lifesciences Price Performance

EW opened at $75.12 on Friday. The company has a debt-to-equity ratio of 0.06, a current ratio of 3.46 and a quick ratio of 2.89. The firm has a market cap of $44.06 billion, a PE ratio of 10.78, a P/E/G ratio of 4.82 and a beta of 1.12. Edwards Lifesciences Co. has a 1 year low of $58.93 and a 1 year high of $95.25. The stock has a 50-day moving average price of $74.54 and a 200-day moving average price of $72.93.

Edwards Lifesciences (NYSE:EW - Get Free Report) last announced its quarterly earnings results on Wednesday, April 23rd. The medical research company reported $0.64 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.60 by $0.04. The firm had revenue of $1.41 billion for the quarter, compared to the consensus estimate of $1.40 billion. Edwards Lifesciences had a return on equity of 19.40% and a net margin of 72.93%. The company's quarterly revenue was up 6.2% on a year-over-year basis. During the same period in the prior year, the company posted $0.66 earnings per share. Sell-side analysts predict that Edwards Lifesciences Co. will post 2.45 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, CFO Scott B. Ullem sold 11,250 shares of the stock in a transaction that occurred on Wednesday, March 26th. The shares were sold at an average price of $70.87, for a total value of $797,287.50. Following the completion of the sale, the chief financial officer now directly owns 30,387 shares of the company's stock, valued at approximately $2,153,526.69. This represents a 27.02% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, VP Daveen Chopra sold 1,500 shares of Edwards Lifesciences stock in a transaction on Thursday, May 22nd. The shares were sold at an average price of $75.08, for a total transaction of $112,620.00. Following the transaction, the vice president now owns 33,496 shares in the company, valued at approximately $2,514,879.68. This trade represents a 4.29% decrease in their position. The disclosure for this sale can be found here. Insiders sold 42,948 shares of company stock valued at $3,122,845 over the last 90 days. Company insiders own 1.29% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts recently commented on the stock. Robert W. Baird upped their price target on shares of Edwards Lifesciences from $72.00 to $75.00 and gave the company a "neutral" rating in a report on Thursday, April 24th. Truist Financial reduced their price objective on shares of Edwards Lifesciences from $78.00 to $75.00 and set a "hold" rating on the stock in a research report on Friday, April 11th. Canaccord Genuity Group raised their target price on shares of Edwards Lifesciences from $71.00 to $75.00 and gave the stock a "hold" rating in a research report on Friday, April 25th. Dbs Bank upgraded shares of Edwards Lifesciences to a "hold" rating in a research report on Monday, June 2nd. Finally, Wall Street Zen lowered shares of Edwards Lifesciences from a "buy" rating to a "hold" rating in a report on Friday, May 16th. One equities research analyst has rated the stock with a sell rating, fourteen have assigned a hold rating and eleven have issued a buy rating to the company's stock. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $80.20.

Check Out Our Latest Analysis on EW

Edwards Lifesciences Company Profile

(

Free Report)

Edwards Lifesciences Corporation provides products and technologies for structural heart disease and critical care monitoring in the United States, Europe, Japan, and internationally. It offers transcatheter heart valve replacement products for the minimally invasive replacement of aortic heart valves under the Edwards SAPIEN family of valves system; and transcatheter heart valve repair and replacement products to treat mitral and tricuspid valve diseases under the PASCAL PRECISION and Cardioband names.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Edwards Lifesciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Edwards Lifesciences wasn't on the list.

While Edwards Lifesciences currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.