Farther Finance Advisors LLC cut its stake in Lincoln Electric Holdings, Inc. (NASDAQ:LECO - Free Report) by 47.3% during the 2nd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,220 shares of the industrial products company's stock after selling 1,096 shares during the quarter. Farther Finance Advisors LLC's holdings in Lincoln Electric were worth $253,000 as of its most recent SEC filing.

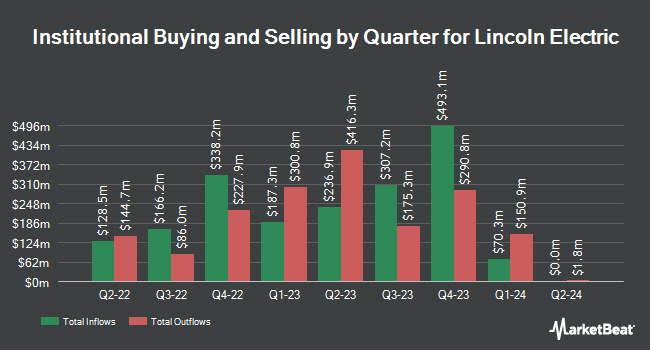

Several other large investors also recently modified their holdings of LECO. GAMMA Investing LLC raised its position in shares of Lincoln Electric by 22,146.5% in the first quarter. GAMMA Investing LLC now owns 291,874 shares of the industrial products company's stock valued at $55,211,000 after purchasing an additional 290,562 shares during the period. Victory Capital Management Inc. raised its position in shares of Lincoln Electric by 16.2% in the first quarter. Victory Capital Management Inc. now owns 1,351,223 shares of the industrial products company's stock valued at $255,597,000 after purchasing an additional 188,104 shares during the period. Nuveen LLC bought a new position in shares of Lincoln Electric in the first quarter valued at about $28,548,000. Millennium Management LLC raised its position in shares of Lincoln Electric by 195.2% in the first quarter. Millennium Management LLC now owns 223,025 shares of the industrial products company's stock valued at $42,187,000 after purchasing an additional 147,483 shares during the period. Finally, Vaughan Nelson Investment Management L.P. raised its position in shares of Lincoln Electric by 51.2% in the first quarter. Vaughan Nelson Investment Management L.P. now owns 405,559 shares of the industrial products company's stock valued at $76,715,000 after purchasing an additional 137,330 shares during the period. 79.61% of the stock is owned by institutional investors.

Lincoln Electric Trading Up 0.6%

LECO opened at $235.83 on Wednesday. The company's 50 day moving average is $238.77 and its 200-day moving average is $210.79. Lincoln Electric Holdings, Inc. has a 1-year low of $161.11 and a 1-year high of $249.19. The company has a current ratio of 1.68, a quick ratio of 1.08 and a debt-to-equity ratio of 0.83. The company has a market cap of $13.02 billion, a P/E ratio of 26.50, a PEG ratio of 1.62 and a beta of 1.22.

Lincoln Electric (NASDAQ:LECO - Get Free Report) last posted its quarterly earnings results on Thursday, July 31st. The industrial products company reported $2.60 earnings per share for the quarter, beating analysts' consensus estimates of $2.32 by $0.28. Lincoln Electric had a net margin of 12.27% and a return on equity of 39.79%. The company had revenue of $1.09 billion for the quarter, compared to the consensus estimate of $1.04 billion. During the same period last year, the company posted $2.34 EPS. The firm's quarterly revenue was up 6.6% compared to the same quarter last year. Equities research analysts predict that Lincoln Electric Holdings, Inc. will post 9.36 earnings per share for the current fiscal year.

Lincoln Electric Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, October 15th. Stockholders of record on Tuesday, September 30th will be paid a $0.75 dividend. This represents a $3.00 dividend on an annualized basis and a dividend yield of 1.3%. The ex-dividend date is Tuesday, September 30th. Lincoln Electric's dividend payout ratio (DPR) is presently 33.71%.

Insider Buying and Selling at Lincoln Electric

In related news, EVP Jennifer I. Ansberry sold 3,000 shares of Lincoln Electric stock in a transaction that occurred on Tuesday, August 12th. The shares were sold at an average price of $242.18, for a total transaction of $726,540.00. Following the sale, the executive vice president directly owned 19,173 shares in the company, valued at $4,643,317.14. This trade represents a 13.53% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CEO Steven B. Hedlund sold 12,387 shares of Lincoln Electric stock in a transaction that occurred on Thursday, September 11th. The stock was sold at an average price of $243.36, for a total transaction of $3,014,500.32. Following the sale, the chief executive officer owned 55,866 shares in the company, valued at approximately $13,595,549.76. This represents a 18.15% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 23,692 shares of company stock valued at $5,745,148 in the last quarter. 2.41% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

Several brokerages have recently weighed in on LECO. KeyCorp increased their price objective on shares of Lincoln Electric from $250.00 to $280.00 and gave the company an "overweight" rating in a research report on Friday, August 1st. Wall Street Zen raised shares of Lincoln Electric from a "buy" rating to a "strong-buy" rating in a research report on Saturday, August 2nd. Roth Capital started coverage on shares of Lincoln Electric in a research report on Friday, September 5th. They set a "buy" rating and a $279.00 price target on the stock. Finally, Stifel Nicolaus raised their price target on shares of Lincoln Electric from $236.00 to $250.00 and gave the stock a "hold" rating in a research report on Friday, August 1st. Four investment analysts have rated the stock with a Buy rating, one has issued a Hold rating and one has given a Sell rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $239.33.

View Our Latest Stock Analysis on LECO

About Lincoln Electric

(

Free Report)

Lincoln Electric Holdings, Inc, through its subsidiaries, designs, develops, manufactures, and sells welding, cutting, and brazing products worldwide. The company operates through three segments: Americas Welding, International Welding, and The Harris Products Group. It offers brazing and soldering filler metals, arc welding equipment, plasma and oxyfuel cutting systems, wire feeding systems, fume control equipment, welding accessories, and specialty gas regulators, and education solutions, as well as a portfolio of automated solutions for joining, cutting, material handling, module assembly, and end of line testing, as well as involved in brazing and soldering alloys, and in the retail business in the United States.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lincoln Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lincoln Electric wasn't on the list.

While Lincoln Electric currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report