Federated Hermes Inc. boosted its holdings in shares of Olo Inc. (NYSE:OLO - Free Report) by 80.2% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 1,002,785 shares of the company's stock after purchasing an additional 446,315 shares during the period. Federated Hermes Inc. owned about 0.60% of OLO worth $6,057,000 at the end of the most recent quarter.

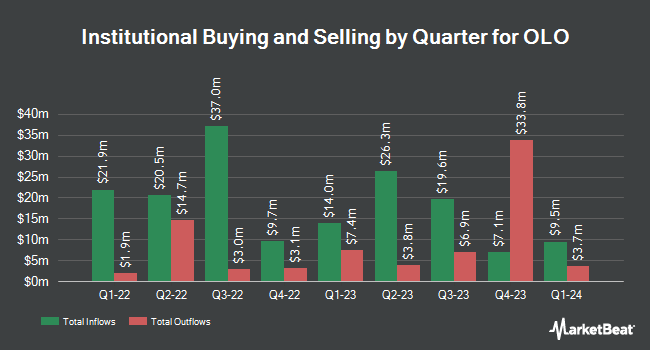

Several other hedge funds have also recently made changes to their positions in the business. SMI Advisory Services LLC acquired a new stake in shares of OLO in the first quarter valued at about $62,000. Calamos Advisors LLC bought a new stake in shares of OLO during the first quarter valued at approximately $63,000. Corton Capital Inc. acquired a new stake in OLO during the 1st quarter worth about $66,000. Envestnet Asset Management Inc. acquired a new stake in shares of OLO in the 4th quarter valued at $80,000. Finally, Franklin Resources Inc. acquired a new stake in OLO during the fourth quarter valued at approximately $81,000. 93.40% of the stock is owned by institutional investors.

OLO Price Performance

OLO traded down $0.07 on Thursday, hitting $10.33. The company had a trading volume of 3,069,041 shares, compared to its average volume of 2,234,421. Olo Inc. has a 52-week low of $4.56 and a 52-week high of $10.55. The stock has a fifty day simple moving average of $9.44 and a 200-day simple moving average of $7.86. The firm has a market capitalization of $1.71 billion, a P/E ratio of 148.29 and a beta of 1.58.

OLO (NYSE:OLO - Get Free Report) last announced its quarterly earnings data on Monday, August 4th. The company reported $0.07 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.08 by ($0.01). The business had revenue of $85.72 million for the quarter, compared to analysts' expectations of $82.23 million. OLO had a negative net margin of 0.28% and a positive return on equity of 2.13%. The firm's revenue was up 21.6% on a year-over-year basis. During the same period in the prior year, the company posted $0.05 EPS. Equities research analysts expect that Olo Inc. will post -0.03 earnings per share for the current fiscal year.

Insider Buying and Selling at OLO

In other news, insider Sherri Manning sold 5,657 shares of OLO stock in a transaction on Thursday, June 5th. The shares were sold at an average price of $8.80, for a total transaction of $49,781.60. Following the transaction, the insider directly owned 297,926 shares of the company's stock, valued at $2,621,748.80. This trade represents a 1.86% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CFO Peter J. Benevides sold 23,078 shares of the company's stock in a transaction on Thursday, June 5th. The stock was sold at an average price of $8.80, for a total value of $203,086.40. Following the sale, the chief financial officer owned 702,061 shares of the company's stock, valued at approximately $6,178,136.80. This represents a 3.18% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 98,630 shares of company stock worth $864,454. Corporate insiders own 39.33% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms recently weighed in on OLO. Wall Street Zen cut shares of OLO from a "buy" rating to a "hold" rating in a research report on Saturday, July 5th. Royal Bank Of Canada restated a "sector perform" rating and issued a $10.25 target price on shares of OLO in a research note on Monday, July 7th. Piper Sandler increased their price objective on shares of OLO from $8.00 to $10.25 and gave the stock a "neutral" rating in a research report on Monday, July 7th. Truist Financial downgraded OLO from a "strong-buy" rating to a "hold" rating in a report on Tuesday, July 8th. Finally, Lake Street Capital lowered OLO from a "strong-buy" rating to a "hold" rating in a research note on Thursday, July 3rd. Five investment analysts have rated the stock with a hold rating, According to data from MarketBeat.com, OLO has an average rating of "Hold" and a consensus price target of $10.17.

Read Our Latest Report on OLO

OLO Profile

(

Free Report)

Olo, Inc engages in the provision of a cloud-based, on-demand commerce platform for multi-location restaurant brands. It enables digital ordering and delivery. The company was founded by Noah H. Glass on June 1, 2005 and is headquartered in New York, NY.

Further Reading

Before you consider OLO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OLO wasn't on the list.

While OLO currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.