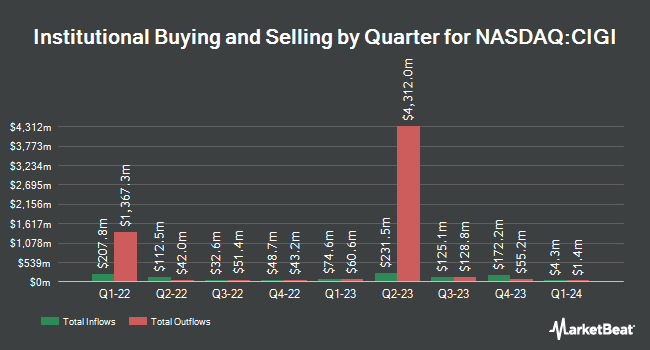

Federation des caisses Desjardins du Quebec lowered its position in shares of Colliers International Group Inc. (NASDAQ:CIGI - Free Report) TSE: CIGI by 58.9% during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 15,912 shares of the financial services provider's stock after selling 22,830 shares during the quarter. Federation des caisses Desjardins du Quebec's holdings in Colliers International Group were worth $1,898,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in CIGI. T. Rowe Price Investment Management Inc. grew its position in Colliers International Group by 56.6% during the first quarter. T. Rowe Price Investment Management Inc. now owns 965,700 shares of the financial services provider's stock valued at $117,140,000 after purchasing an additional 349,046 shares in the last quarter. Durable Capital Partners LP grew its position in Colliers International Group by 12.4% during the first quarter. Durable Capital Partners LP now owns 2,972,757 shares of the financial services provider's stock valued at $360,595,000 after purchasing an additional 328,430 shares in the last quarter. Ameriprise Financial Inc. grew its position in Colliers International Group by 39.9% during the first quarter. Ameriprise Financial Inc. now owns 480,040 shares of the financial services provider's stock valued at $58,229,000 after purchasing an additional 136,871 shares in the last quarter. Nuveen Asset Management LLC grew its position in Colliers International Group by 288.0% during the fourth quarter. Nuveen Asset Management LLC now owns 126,451 shares of the financial services provider's stock valued at $17,187,000 after purchasing an additional 93,864 shares in the last quarter. Finally, 1832 Asset Management L.P. grew its position in Colliers International Group by 17.5% during the first quarter. 1832 Asset Management L.P. now owns 404,706 shares of the financial services provider's stock valued at $49,091,000 after purchasing an additional 60,334 shares in the last quarter. 80.09% of the stock is owned by hedge funds and other institutional investors.

Colliers International Group Stock Performance

Shares of NASDAQ CIGI traded down $1.46 during trading hours on Friday, hitting $166.83. 79,861 shares of the stock were exchanged, compared to its average volume of 117,886. The company has a debt-to-equity ratio of 1.24, a current ratio of 1.17 and a quick ratio of 1.17. The company's 50 day moving average is $153.44 and its 200 day moving average is $133.19. The firm has a market capitalization of $8.27 billion, a P/E ratio of 75.83 and a beta of 1.41. Colliers International Group Inc. has a one year low of $100.86 and a one year high of $170.65.

Colliers International Group (NASDAQ:CIGI - Get Free Report) TSE: CIGI last posted its quarterly earnings data on Thursday, July 31st. The financial services provider reported $1.72 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.52 by $0.20. The business had revenue of $1.37 billion during the quarter, compared to the consensus estimate of $1.29 billion. Colliers International Group had a net margin of 2.17% and a return on equity of 20.82%. Colliers International Group's quarterly revenue was up 18.3% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.36 EPS. On average, research analysts expect that Colliers International Group Inc. will post 6.2 EPS for the current year.

Analyst Ratings Changes

A number of brokerages recently commented on CIGI. Scotiabank boosted their price objective on shares of Colliers International Group from $155.00 to $170.00 and gave the company a "sector outperform" rating in a research report on Friday, August 1st. National Bankshares boosted their price objective on shares of Colliers International Group from $169.00 to $175.00 and gave the company an "outperform" rating in a research report on Friday, August 1st. Stifel Nicolaus boosted their price objective on shares of Colliers International Group from $165.00 to $180.00 and gave the company a "buy" rating in a research report on Friday, August 1st. Raymond James Financial boosted their price objective on shares of Colliers International Group from $170.00 to $180.00 and gave the company an "outperform" rating in a research report on Friday, August 1st. Finally, CIBC boosted their target price on shares of Colliers International Group from $149.00 to $175.00 and gave the stock an "outperformer" rating in a research report on Friday, August 1st. Two equities research analysts have rated the stock with a Strong Buy rating, six have assigned a Buy rating and five have assigned a Hold rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $172.30.

Read Our Latest Analysis on CIGI

Colliers International Group Profile

(

Free Report)

Colliers International Group Inc provides commercial real estate professional and investment management services to corporate and institutional clients in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers outsourcing and advisory services, such as engineering and project management, property management, valuation, and other services, as well as loan servicing for commercial real estate clients.

Featured Articles

Before you consider Colliers International Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Colliers International Group wasn't on the list.

While Colliers International Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.