Boston Partners lessened its stake in shares of Fidelity National Information Services, Inc. (NYSE:FIS - Free Report) by 10.8% during the 1st quarter, according to its most recent 13F filing with the SEC. The firm owned 10,698,030 shares of the information technology services provider's stock after selling 1,301,022 shares during the period. Fidelity National Information Services makes up approximately 1.0% of Boston Partners' holdings, making the stock its 17th largest holding. Boston Partners owned approximately 2.04% of Fidelity National Information Services worth $800,444,000 at the end of the most recent reporting period.

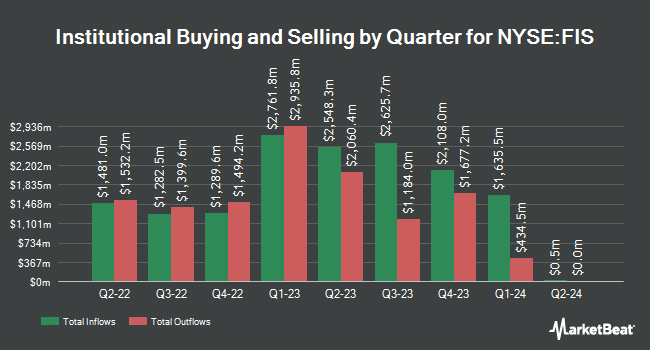

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Brighton Jones LLC bought a new position in Fidelity National Information Services in the 4th quarter valued at $347,000. Canada Post Corp Registered Pension Plan bought a new position in Fidelity National Information Services in the 4th quarter valued at $763,000. Bridgewater Associates LP grew its position in Fidelity National Information Services by 96.7% in the 4th quarter. Bridgewater Associates LP now owns 289,055 shares of the information technology services provider's stock valued at $23,347,000 after acquiring an additional 142,126 shares during the last quarter. Operose Advisors LLC grew its position in Fidelity National Information Services by 17.5% in the 4th quarter. Operose Advisors LLC now owns 3,553 shares of the information technology services provider's stock valued at $287,000 after acquiring an additional 529 shares during the last quarter. Finally, NewEdge Advisors LLC grew its position in Fidelity National Information Services by 4.5% in the 4th quarter. NewEdge Advisors LLC now owns 58,207 shares of the information technology services provider's stock valued at $4,701,000 after acquiring an additional 2,484 shares during the last quarter. Hedge funds and other institutional investors own 96.23% of the company's stock.

Fidelity National Information Services Price Performance

Shares of NYSE:FIS traded down $0.70 during trading on Friday, reaching $70.88. The stock had a trading volume of 3,952,820 shares, compared to its average volume of 3,476,062. The company has a debt-to-equity ratio of 0.63, a quick ratio of 0.59 and a current ratio of 0.59. The business has a fifty day moving average price of $78.90 and a 200-day moving average price of $76.42. The stock has a market cap of $37.03 billion, a PE ratio of 393.80 and a beta of 1.04. Fidelity National Information Services, Inc. has a 1-year low of $66.51 and a 1-year high of $91.98.

Fidelity National Information Services (NYSE:FIS - Get Free Report) last announced its quarterly earnings data on Tuesday, August 5th. The information technology services provider reported $1.36 EPS for the quarter, hitting analysts' consensus estimates of $1.36. Fidelity National Information Services had a return on equity of 18.73% and a net margin of 1.09%. The firm had revenue of $2.62 billion for the quarter, compared to the consensus estimate of $2.57 billion. During the same quarter last year, the business posted $1.36 earnings per share. The firm's revenue was up 5.1% compared to the same quarter last year. On average, equities analysts forecast that Fidelity National Information Services, Inc. will post 5.74 earnings per share for the current fiscal year.

Fidelity National Information Services Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, September 24th. Shareholders of record on Wednesday, September 10th will be given a $0.40 dividend. The ex-dividend date is Wednesday, September 10th. This represents a $1.60 dividend on an annualized basis and a yield of 2.3%. Fidelity National Information Services's payout ratio is currently 888.89%.

Analyst Upgrades and Downgrades

A number of research firms have recently issued reports on FIS. UBS Group dropped their price target on Fidelity National Information Services from $84.00 to $82.00 and set a "neutral" rating on the stock in a research report on Wednesday, August 6th. Stephens increased their price target on Fidelity National Information Services from $90.00 to $100.00 and gave the stock an "overweight" rating in a research report on Wednesday, May 7th. Robert W. Baird increased their price target on Fidelity National Information Services from $82.00 to $86.00 and gave the stock a "neutral" rating in a research report on Wednesday, July 16th. Truist Financial increased their price target on Fidelity National Information Services from $84.00 to $85.00 and gave the stock a "hold" rating in a research report on Thursday, July 17th. Finally, TD Cowen raised Fidelity National Information Services from a "hold" rating to a "buy" rating and set a $92.00 price target on the stock in a research report on Monday, April 21st. One investment analyst has rated the stock with a sell rating, seven have issued a hold rating and thirteen have given a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $91.63.

Read Our Latest Stock Report on FIS

About Fidelity National Information Services

(

Free Report)

Fidelity National Information Services, Inc engages in the provision of financial services technology solutions for financial institutions, businesses, and developers worldwide. It operates through Banking Solutions, Capital Market Solutions, and Corporate and Other segments. The company provides core processing and ancillary applications; mobile and online banking; fraud, risk management, and compliance; card and retail payment; electronic funds transfer and network; wealth and retirement; and item processing and output solutions.

Featured Articles

Before you consider Fidelity National Information Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fidelity National Information Services wasn't on the list.

While Fidelity National Information Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.