Fiduciary Wealth Partners LLC bought a new stake in Manulife Financial Corp (NYSE:MFC - Free Report) TSE: MFC during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm bought 9,828 shares of the financial services provider's stock, valued at approximately $306,000. Manulife Financial comprises about 0.3% of Fiduciary Wealth Partners LLC's investment portfolio, making the stock its 23rd biggest position.

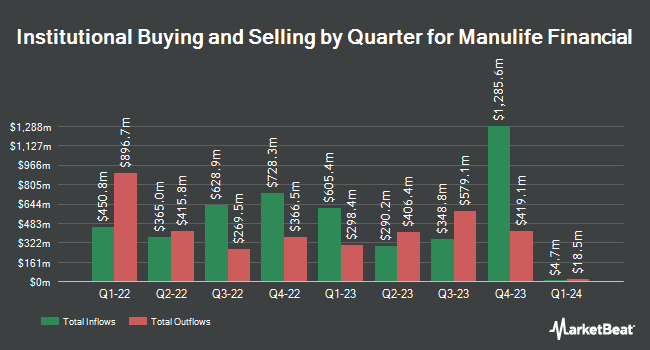

Several other hedge funds have also recently added to or reduced their stakes in the stock. Foundations Investment Advisors LLC acquired a new stake in shares of Manulife Financial in the first quarter valued at approximately $205,000. Norden Group LLC increased its stake in shares of Manulife Financial by 7.0% in the first quarter. Norden Group LLC now owns 30,808 shares of the financial services provider's stock valued at $960,000 after buying an additional 2,021 shares during the period. LPL Financial LLC raised its position in shares of Manulife Financial by 1.9% in the 1st quarter. LPL Financial LLC now owns 573,236 shares of the financial services provider's stock worth $17,856,000 after acquiring an additional 10,496 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank lifted its stake in Manulife Financial by 3.9% in the first quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 1,462,870 shares of the financial services provider's stock valued at $45,576,000 after buying an additional 54,743 shares during the period. Finally, HB Wealth Management LLC raised its holdings in Manulife Financial by 109.9% during the first quarter. HB Wealth Management LLC now owns 57,978 shares of the financial services provider's stock worth $1,806,000 after buying an additional 30,358 shares during the last quarter. Institutional investors and hedge funds own 52.56% of the company's stock.

Manulife Financial Price Performance

Shares of NYSE MFC traded up $0.46 during mid-day trading on Wednesday, hitting $31.28. 740,851 shares of the company's stock traded hands, compared to its average volume of 2,277,687. The company has a market capitalization of $53.28 billion, a P/E ratio of 16.37, a PEG ratio of 1.04 and a beta of 1.01. Manulife Financial Corp has a 1 year low of $23.91 and a 1 year high of $33.07. The company's 50-day moving average is $31.27 and its two-hundred day moving average is $30.55.

Manulife Financial (NYSE:MFC - Get Free Report) TSE: MFC last released its quarterly earnings data on Wednesday, May 7th. The financial services provider reported $0.69 EPS for the quarter, missing the consensus estimate of $0.70 by ($0.01). The business had revenue of $1.49 billion during the quarter. Manulife Financial had a net margin of 9.58% and a return on equity of 15.84%. During the same quarter in the prior year, the business earned $0.94 earnings per share. Equities analysts anticipate that Manulife Financial Corp will post 2.87 EPS for the current fiscal year.

Manulife Financial Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, June 19th. Stockholders of record on Wednesday, May 21st were issued a dividend of $0.3194 per share. The ex-dividend date was Wednesday, May 21st. This represents a $1.28 annualized dividend and a dividend yield of 4.1%. This is a boost from Manulife Financial's previous quarterly dividend of $0.31. Manulife Financial's payout ratio is presently 67.02%.

Analyst Ratings Changes

Separately, Morgan Stanley set a $46.00 price target on shares of Manulife Financial in a report on Monday, May 19th.

Read Our Latest Stock Analysis on MFC

Manulife Financial Profile

(

Free Report)

Manulife Financial Corporation, together with its subsidiaries, provides financial products and services in the United States, Canada, Asia, and internationally. The company operates through Wealth and Asset Management Businesses; Insurance and Annuity Products; and Corporate and Other segments. The Wealth and Asset Management Businesses segment offers investment advice and solutions to retirement, retail, and institutional clients through multiple distribution channels, including agents and brokers affiliated with the company, independent securities brokerage firms and financial advisors pension plan consultants, and banks.

Featured Stories

Before you consider Manulife Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Manulife Financial wasn't on the list.

While Manulife Financial currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.