Fiera Capital Corp boosted its holdings in shares of Brink's Company (The) (NYSE:BCO - Free Report) by 2.3% during the 1st quarter, according to its most recent 13F filing with the SEC. The fund owned 223,320 shares of the business services provider's stock after purchasing an additional 5,116 shares during the period. Fiera Capital Corp owned approximately 0.52% of Brink's worth $19,241,000 as of its most recent filing with the SEC.

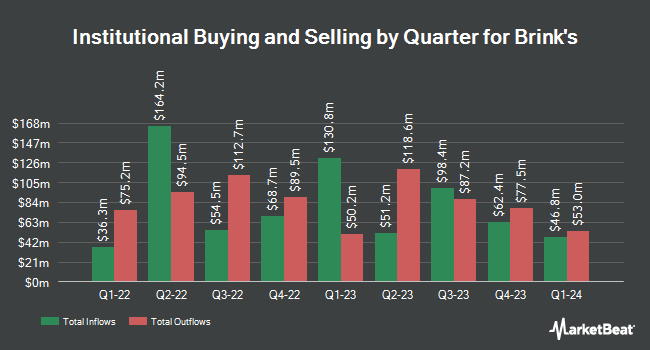

Several other hedge funds and other institutional investors have also made changes to their positions in the company. KLP Kapitalforvaltning AS acquired a new stake in shares of Brink's in the fourth quarter valued at about $816,000. JPMorgan Chase & Co. lifted its stake in shares of Brink's by 23.7% in the fourth quarter. JPMorgan Chase & Co. now owns 298,386 shares of the business services provider's stock valued at $27,681,000 after purchasing an additional 57,109 shares during the period. Norges Bank acquired a new stake in shares of Brink's in the fourth quarter valued at about $46,603,000. Pictet Asset Management Holding SA lifted its stake in shares of Brink's by 20.0% in the fourth quarter. Pictet Asset Management Holding SA now owns 7,193 shares of the business services provider's stock valued at $667,000 after purchasing an additional 1,199 shares during the period. Finally, Wellington Management Group LLP lifted its stake in shares of Brink's by 114.1% in the fourth quarter. Wellington Management Group LLP now owns 149,222 shares of the business services provider's stock valued at $13,843,000 after purchasing an additional 79,529 shares during the period. Hedge funds and other institutional investors own 94.96% of the company's stock.

Brink's Price Performance

BCO traded down $2.17 during midday trading on Friday, reaching $85.17. 248,792 shares of the company's stock were exchanged, compared to its average volume of 194,311. The company has a debt-to-equity ratio of 10.93, a current ratio of 1.52 and a quick ratio of 1.52. The stock has a market capitalization of $3.58 billion, a PE ratio of 23.02 and a beta of 1.46. The business's 50-day moving average price is $88.72 and its 200 day moving average price is $89.21. Brink's Company has a 1-year low of $80.10 and a 1-year high of $115.91.

Brink's (NYSE:BCO - Get Free Report) last announced its earnings results on Monday, May 12th. The business services provider reported $1.62 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.19 by $0.43. The company had revenue of $1.25 billion during the quarter, compared to analysts' expectations of $1.21 billion. Brink's had a net margin of 3.29% and a return on equity of 82.89%. The firm's quarterly revenue was up .9% compared to the same quarter last year. During the same quarter in the previous year, the business posted $1.52 earnings per share. As a group, equities analysts anticipate that Brink's Company will post 6.49 EPS for the current fiscal year.

Brink's Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 2nd. Stockholders of record on Monday, July 28th will be given a $0.255 dividend. This represents a $1.02 dividend on an annualized basis and a dividend yield of 1.2%. The ex-dividend date of this dividend is Monday, July 28th. Brink's's payout ratio is currently 27.57%.

Analysts Set New Price Targets

Separately, Wall Street Zen cut shares of Brink's from a "buy" rating to a "hold" rating in a research report on Saturday.

Check Out Our Latest Research Report on Brink's

Brink's Company Profile

(

Free Report)

The Brink's Co engages in providing cash management services, digital retail solutions, and ATM managed services. It operates through the following geographical segments: North America, Latin America, Europe, and Rest of World. The North America segment operates in the U.S. and Canada. The Latin America segment refers to the operations in Latin American countries.

Further Reading

Before you consider Brink's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brink's wasn't on the list.

While Brink's currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.