First Manhattan CO. LLC. trimmed its holdings in Alphabet Inc. (NASDAQ:GOOGL - Free Report) by 0.9% during the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 1,931,548 shares of the information services provider's stock after selling 17,309 shares during the quarter. Alphabet makes up about 0.9% of First Manhattan CO. LLC.'s portfolio, making the stock its 23rd biggest position. First Manhattan CO. LLC.'s holdings in Alphabet were worth $298,695,000 as of its most recent SEC filing.

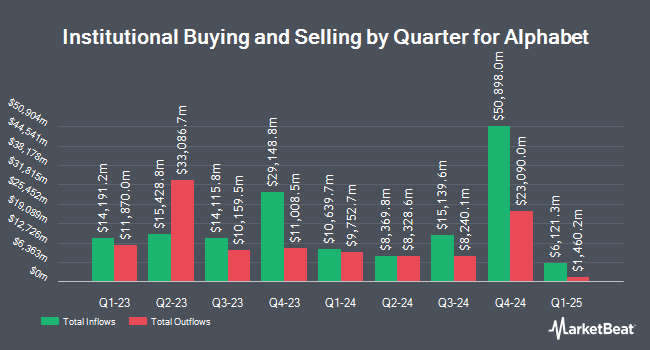

Several other hedge funds and other institutional investors have also recently modified their holdings of the business. Nia Impact Advisors LLC raised its holdings in shares of Alphabet by 0.3% in the fourth quarter. Nia Impact Advisors LLC now owns 17,161 shares of the information services provider's stock worth $3,249,000 after buying an additional 59 shares during the period. Enzi Wealth raised its holdings in shares of Alphabet by 2.5% in the first quarter. Enzi Wealth now owns 2,561 shares of the information services provider's stock worth $408,000 after buying an additional 62 shares during the period. Whipplewood Advisors LLC raised its holdings in shares of Alphabet by 1.2% in the first quarter. Whipplewood Advisors LLC now owns 5,438 shares of the information services provider's stock worth $817,000 after buying an additional 67 shares during the period. Aspire Capital Advisors LLC increased its holdings in Alphabet by 1.0% during the 1st quarter. Aspire Capital Advisors LLC now owns 7,020 shares of the information services provider's stock worth $1,086,000 after purchasing an additional 67 shares during the period. Finally, Rainey & Randall Wealth Advisors Inc. increased its holdings in Alphabet by 2.1% during the 1st quarter. Rainey & Randall Wealth Advisors Inc. now owns 3,209 shares of the information services provider's stock worth $496,000 after purchasing an additional 67 shares during the period. 40.03% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

GOOGL has been the topic of several research reports. Stifel Nicolaus raised their price objective on Alphabet from $200.00 to $218.00 and gave the stock a "buy" rating in a report on Tuesday, July 22nd. Cantor Fitzgerald raised their price objective on Alphabet from $196.00 to $201.00 and gave the stock a "neutral" rating in a report on Thursday, July 24th. JPMorgan Chase & Co. increased their target price on Alphabet from $200.00 to $232.00 and gave the company an "overweight" rating in a research report on Thursday, July 24th. Needham & Company LLC upped their price objective on Alphabet from $220.00 to $260.00 and gave the stock a "buy" rating in a research note on Wednesday. Finally, BNP Paribas Exane restated a "neutral" rating and set a $172.00 price objective on shares of Alphabet in a research note on Friday, June 27th. Four analysts have rated the stock with a Strong Buy rating, thirty have assigned a Buy rating and ten have issued a Hold rating to the stock. Based on data from MarketBeat.com, Alphabet presently has an average rating of "Moderate Buy" and an average target price of $219.11.

Read Our Latest Report on Alphabet

Insider Transactions at Alphabet

In other news, Director Kavitark Ram Shriram sold 15,000 shares of the business's stock in a transaction dated Friday, July 18th. The stock was sold at an average price of $185.76, for a total value of $2,786,400.00. Following the completion of the transaction, the director owned 240,400 shares of the company's stock, valued at $44,656,704. The trade was a 5.87% decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, insider John Kent Walker sold 23,820 shares of the business's stock in a transaction dated Monday, August 4th. The shares were sold at an average price of $194.70, for a total value of $4,637,754.00. Following the completion of the transaction, the insider directly owned 42,999 shares of the company's stock, valued at approximately $8,371,905.30. This trade represents a 35.65% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 222,210 shares of company stock worth $41,742,155. 11.55% of the stock is owned by insiders.

Alphabet Stock Performance

GOOGL traded up $19.31 on Wednesday, reaching $230.66. 102,404,162 shares of the stock were exchanged, compared to its average volume of 27,560,906. The company's 50-day moving average price is $192.29 and its 200 day moving average price is $174.41. Alphabet Inc. has a fifty-two week low of $140.53 and a fifty-two week high of $231.31. The company has a debt-to-equity ratio of 0.07, a current ratio of 1.90 and a quick ratio of 1.90. The firm has a market capitalization of $2.79 trillion, a PE ratio of 22.67, a PEG ratio of 1.43 and a beta of 1.01.

Alphabet (NASDAQ:GOOGL - Get Free Report) last issued its quarterly earnings results on Wednesday, July 23rd. The information services provider reported $2.31 EPS for the quarter, topping analysts' consensus estimates of $2.15 by $0.16. Alphabet had a return on equity of 34.31% and a net margin of 31.12%.The company had revenue of $96.43 billion during the quarter, compared to analysts' expectations of $93.60 billion. As a group, sell-side analysts forecast that Alphabet Inc. will post 8.9 EPS for the current fiscal year.

Alphabet Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Monday, September 15th. Shareholders of record on Monday, September 8th will be given a dividend of $0.21 per share. The ex-dividend date of this dividend is Monday, September 8th. This represents a $0.84 dividend on an annualized basis and a yield of 0.4%. Alphabet's payout ratio is currently 8.95%.

About Alphabet

(

Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

Further Reading

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report