First Manhattan CO. LLC. decreased its position in GE Aerospace (NYSE:GE - Free Report) by 2.4% during the 1st quarter, according to its most recent disclosure with the SEC. The fund owned 186,580 shares of the company's stock after selling 4,594 shares during the period. First Manhattan CO. LLC.'s holdings in GE Aerospace were worth $37,400,000 as of its most recent SEC filing.

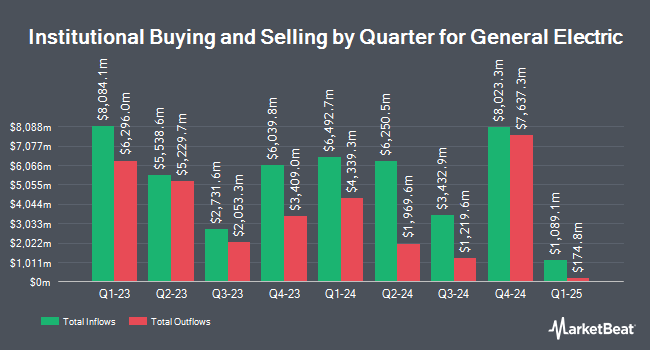

Other large investors have also added to or reduced their stakes in the company. Smartleaf Asset Management LLC boosted its holdings in GE Aerospace by 17.1% in the first quarter. Smartleaf Asset Management LLC now owns 8,241 shares of the company's stock valued at $1,647,000 after acquiring an additional 1,201 shares in the last quarter. Rainey & Randall Wealth Advisors Inc. bought a new stake in GE Aerospace in the first quarter valued at $203,000. Sendero Wealth Management LLC boosted its holdings in GE Aerospace by 526.6% in the first quarter. Sendero Wealth Management LLC now owns 15,008 shares of the company's stock valued at $3,004,000 after acquiring an additional 12,613 shares in the last quarter. Concurrent Investment Advisors LLC boosted its holdings in GE Aerospace by 25.1% in the first quarter. Concurrent Investment Advisors LLC now owns 41,039 shares of the company's stock valued at $8,065,000 after acquiring an additional 8,245 shares in the last quarter. Finally, Global Assets Advisory LLC boosted its holdings in GE Aerospace by 186.7% in the first quarter. Global Assets Advisory LLC now owns 14,710 shares of the company's stock valued at $2,751,000 after acquiring an additional 9,580 shares in the last quarter. Institutional investors own 74.77% of the company's stock.

GE Aerospace Stock Up 0.1%

GE Aerospace stock traded up $0.34 during mid-day trading on Wednesday, reaching $275.73. The stock had a trading volume of 4,118,528 shares, compared to its average volume of 3,897,477. The company has a market capitalization of $292.40 billion, a price-to-earnings ratio of 38.46, a PEG ratio of 2.96 and a beta of 1.48. The company has a 50-day moving average price of $264.62 and a two-hundred day moving average price of $229.77. GE Aerospace has a one year low of $159.36 and a one year high of $281.50. The company has a debt-to-equity ratio of 0.88, a current ratio of 1.04 and a quick ratio of 0.73.

GE Aerospace (NYSE:GE - Get Free Report) last announced its quarterly earnings results on Thursday, July 17th. The company reported $1.66 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.43 by $0.23. The company had revenue of $10.15 billion for the quarter, compared to analysts' expectations of $9.49 billion. GE Aerospace had a net margin of 18.64% and a return on equity of 31.32%. GE Aerospace's revenue was up 21.2% compared to the same quarter last year. During the same quarter in the previous year, the business posted $1.20 EPS. GE Aerospace has set its FY 2025 guidance at 5.600-5.800 EPS. On average, analysts expect that GE Aerospace will post 5.4 EPS for the current fiscal year.

GE Aerospace Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, July 25th. Shareholders of record on Monday, July 7th were given a $0.36 dividend. The ex-dividend date of this dividend was Monday, July 7th. This represents a $1.44 dividend on an annualized basis and a yield of 0.5%. GE Aerospace's payout ratio is 20.08%.

Wall Street Analyst Weigh In

Several research firms recently weighed in on GE. Wall Street Zen cut shares of GE Aerospace from a "buy" rating to a "hold" rating in a report on Saturday. Barclays boosted their target price on shares of GE Aerospace from $230.00 to $295.00 and gave the company an "overweight" rating in a report on Wednesday, July 23rd. Citigroup restated a "buy" rating and set a $296.00 target price (up previously from $227.00) on shares of GE Aerospace in a report on Monday, July 14th. Northcoast Research cut shares of GE Aerospace from a "buy" rating to a "neutral" rating in a report on Monday, May 19th. Finally, Sanford C. Bernstein restated an "outperform" rating on shares of GE Aerospace in a report on Friday, August 15th. Ten analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $232.92.

Check Out Our Latest Stock Analysis on GE Aerospace

About GE Aerospace

(

Free Report)

GE Aerospace (also known as General Electric) is a company that specializes in providing aerospace products and services. It operates through two reportable segments: Commercial Engines and Services and Defense and Propulsion Technologies. It offers jet and turboprop engines, as well as integrated systems for commercial, military, business, and general aviation aircraft.

Further Reading

Before you consider GE Aerospace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GE Aerospace wasn't on the list.

While GE Aerospace currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.