Fjarde AP Fonden Fourth Swedish National Pension Fund trimmed its position in shares of Warner Bros. Discovery, Inc. (NASDAQ:WBD - Free Report) by 16.6% in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 368,600 shares of the company's stock after selling 73,500 shares during the quarter. Fjarde AP Fonden Fourth Swedish National Pension Fund's holdings in Warner Bros. Discovery were worth $3,955,000 as of its most recent filing with the Securities & Exchange Commission.

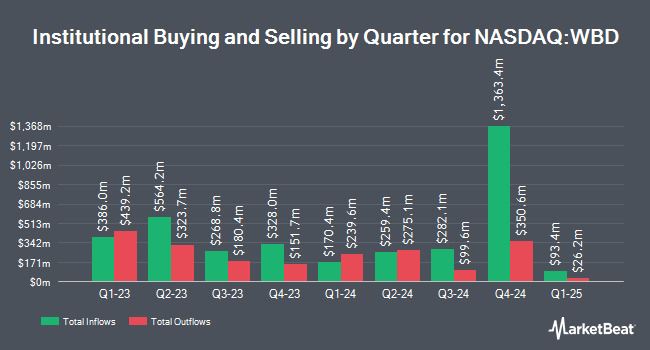

Other institutional investors and hedge funds also recently bought and sold shares of the company. Financial Gravity Asset Management Inc. purchased a new position in Warner Bros. Discovery during the first quarter worth $27,000. North Capital Inc. purchased a new position in Warner Bros. Discovery during the first quarter worth $28,000. Smallwood Wealth Investment Management LLC purchased a new position in Warner Bros. Discovery during the first quarter worth $29,000. Ameriflex Group Inc. purchased a new position in Warner Bros. Discovery during the fourth quarter worth $30,000. Finally, Golden State Wealth Management LLC boosted its stake in Warner Bros. Discovery by 448.0% during the first quarter. Golden State Wealth Management LLC now owns 2,877 shares of the company's stock worth $31,000 after buying an additional 2,352 shares during the period. 59.95% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several research firms have commented on WBD. Needham & Company LLC reaffirmed a "hold" rating on shares of Warner Bros. Discovery in a research note on Tuesday, June 10th. Huber Research upgraded Warner Bros. Discovery from a "strong sell" rating to a "strong-buy" rating in a research report on Monday, June 9th. Barrington Research reiterated an "outperform" rating and set a $16.00 target price on shares of Warner Bros. Discovery in a research report on Wednesday, July 30th. Morgan Stanley lifted their target price on Warner Bros. Discovery from $10.00 to $13.00 and gave the stock an "equal weight" rating in a research report on Wednesday, August 6th. Finally, Barclays lifted their target price on Warner Bros. Discovery from $9.00 to $13.00 and gave the stock an "equal weight" rating in a research report on Wednesday, July 9th. Eleven equities research analysts have rated the stock with a hold rating, eight have issued a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $13.14.

Read Our Latest Report on WBD

Warner Bros. Discovery Stock Performance

WBD stock opened at $11.85 on Friday. The company has a debt-to-equity ratio of 0.92, a current ratio of 1.04 and a quick ratio of 1.04. The business has a 50-day moving average price of $11.69 and a 200 day moving average price of $10.37. The company has a market capitalization of $29.09 billion, a P/E ratio of 39.50, a PEG ratio of 1.58 and a beta of 1.57. Warner Bros. Discovery, Inc. has a 1-year low of $6.78 and a 1-year high of $13.86.

Warner Bros. Discovery (NASDAQ:WBD - Get Free Report) last announced its earnings results on Thursday, August 7th. The company reported $0.63 EPS for the quarter, topping analysts' consensus estimates of ($0.16) by $0.79. The business had revenue of $9.81 billion during the quarter, compared to the consensus estimate of $9.73 billion. Warner Bros. Discovery had a net margin of 2.00% and a return on equity of 2.14%. The firm's revenue was up 1.0% on a year-over-year basis. During the same period in the previous year, the company posted ($4.07) earnings per share. As a group, equities research analysts forecast that Warner Bros. Discovery, Inc. will post -4.33 EPS for the current fiscal year.

Insider Buying and Selling

In other news, Director Anton J. Levy bought 250,000 shares of Warner Bros. Discovery stock in a transaction on Monday, August 11th. The stock was acquired at an average cost of $10.90 per share, for a total transaction of $2,725,000.00. Following the completion of the acquisition, the director owned 874,000 shares of the company's stock, valued at $9,526,600. This trade represents a 40.06% increase in their position. The purchase was disclosed in a filing with the SEC, which can be accessed through the SEC website. Corporate insiders own 1.90% of the company's stock.

Warner Bros. Discovery Profile

(

Free Report)

Warner Bros. Discovery, Inc operates as a media and entertainment company worldwide. It operates through three segments: Studios, Network, and DTC. The Studios segment produces and releases feature films for initial exhibition in theaters; produces and licenses television programs to its networks and third parties and direct-to-consumer services; distributes films and television programs to various third parties and internal television; and offers streaming services and distribution through the home entertainment market, themed experience licensing, and interactive gaming.

See Also

Want to see what other hedge funds are holding WBD? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Warner Bros. Discovery, Inc. (NASDAQ:WBD - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Warner Bros. Discovery, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warner Bros. Discovery wasn't on the list.

While Warner Bros. Discovery currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.