Fjarde AP Fonden Fourth Swedish National Pension Fund lessened its position in shares of Airbnb, Inc. (NASDAQ:ABNB - Free Report) by 21.2% in the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 64,300 shares of the company's stock after selling 17,300 shares during the period. Fjarde AP Fonden Fourth Swedish National Pension Fund's holdings in Airbnb were worth $7,681,000 at the end of the most recent quarter.

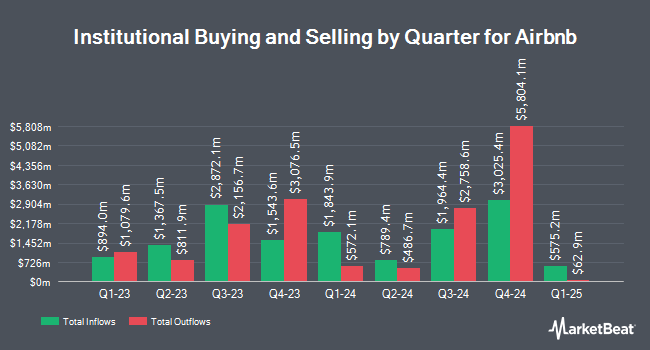

A number of other institutional investors also recently made changes to their positions in the company. Park Square Financial Group LLC acquired a new position in Airbnb during the fourth quarter valued at approximately $26,000. Orion Capital Management LLC acquired a new position in Airbnb during the fourth quarter valued at approximately $28,000. Stonebridge Financial Group LLC raised its position in Airbnb by 75.7% during the first quarter. Stonebridge Financial Group LLC now owns 246 shares of the company's stock valued at $29,000 after purchasing an additional 106 shares in the last quarter. Bartlett & CO. Wealth Management LLC raised its position in Airbnb by 209.6% during the first quarter. Bartlett & CO. Wealth Management LLC now owns 257 shares of the company's stock valued at $31,000 after purchasing an additional 174 shares in the last quarter. Finally, SouthState Corp raised its position in Airbnb by 216.1% during the first quarter. SouthState Corp now owns 294 shares of the company's stock valued at $35,000 after purchasing an additional 201 shares in the last quarter. Institutional investors own 80.76% of the company's stock.

Airbnb Stock Down 1.1%

ABNB traded down $1.3950 during trading on Wednesday, reaching $124.6050. 2,537,235 shares of the stock traded hands, compared to its average volume of 5,296,106. The stock has a market capitalization of $77.43 billion, a PE ratio of 30.17, a P/E/G ratio of 2.29 and a beta of 1.13. The stock's 50-day moving average is $133.24 and its 200 day moving average is $130.62. Airbnb, Inc. has a 12 month low of $99.88 and a 12 month high of $163.93.

Airbnb (NASDAQ:ABNB - Get Free Report) last issued its quarterly earnings results on Wednesday, August 6th. The company reported $1.03 EPS for the quarter, beating analysts' consensus estimates of $0.92 by $0.11. The business had revenue of $3.10 billion for the quarter, compared to analysts' expectations of $3.02 billion. Airbnb had a net margin of 22.67% and a return on equity of 32.19%. The business's quarterly revenue was up 12.7% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $0.86 earnings per share. As a group, equities research analysts anticipate that Airbnb, Inc. will post 4.31 EPS for the current year.

Insider Activity

In other Airbnb news, CFO Elinor Mertz sold 6,250 shares of the company's stock in a transaction on Monday, July 7th. The shares were sold at an average price of $135.86, for a total transaction of $849,125.00. Following the sale, the chief financial officer owned 461,361 shares of the company's stock, valued at approximately $62,680,505.46. This represents a 1.34% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, CAO David C. Bernstein sold 5,000 shares of the stock in a transaction dated Thursday, July 24th. The stock was sold at an average price of $142.00, for a total transaction of $710,000.00. Following the transaction, the chief accounting officer directly owned 42,619 shares in the company, valued at $6,051,898. This trade represents a 10.50% decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 1,454,493 shares of company stock worth $194,497,481. 27.83% of the stock is owned by insiders.

Wall Street Analyst Weigh In

Several brokerages have commented on ABNB. Piper Sandler lowered their price objective on shares of Airbnb from $145.00 to $132.00 and set a "neutral" rating for the company in a research report on Monday, April 28th. B. Riley lowered their price objective on shares of Airbnb from $145.00 to $140.00 and set a "neutral" rating for the company in a research report on Friday, May 2nd. BMO Capital Markets set a $124.00 price objective on shares of Airbnb and gave the company a "market perform" rating in a research report on Thursday, August 7th. Canaccord Genuity Group lowered their price objective on shares of Airbnb from $190.00 to $180.00 and set a "buy" rating for the company in a research report on Monday, April 28th. Finally, Citigroup lowered their price target on shares of Airbnb from $170.00 to $155.00 and set a "buy" rating for the company in a report on Monday, May 5th. Two analysts have rated the stock with a Strong Buy rating, thirteen have given a Buy rating, nineteen have issued a Hold rating and five have issued a Sell rating to the company. According to MarketBeat, the company has an average rating of "Hold" and a consensus price target of $142.72.

Read Our Latest Stock Report on Airbnb

About Airbnb

(

Free Report)

Airbnb, Inc, together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company's marketplace connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily offers private rooms, primary homes, and vacation homes.

See Also

Before you consider Airbnb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Airbnb wasn't on the list.

While Airbnb currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.