FORA Capital LLC trimmed its stake in shares of The Campbell's Company (NASDAQ:CPB - Free Report) by 51.1% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 24,777 shares of the company's stock after selling 25,873 shares during the quarter. FORA Capital LLC's holdings in Campbell's were worth $989,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

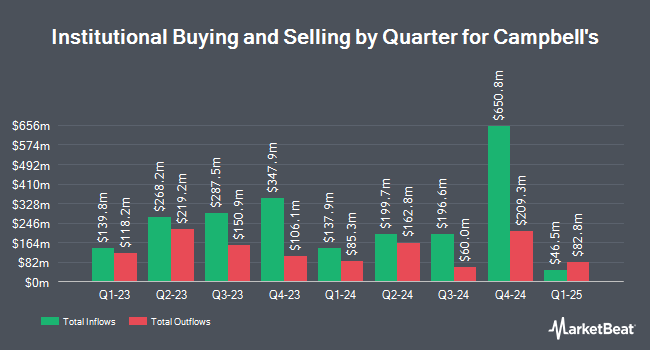

A number of other hedge funds also recently made changes to their positions in CPB. Manchester Capital Management LLC increased its holdings in Campbell's by 923.2% in the first quarter. Manchester Capital Management LLC now owns 706 shares of the company's stock worth $28,000 after purchasing an additional 637 shares in the last quarter. NBC Securities Inc. acquired a new stake in Campbell's in the first quarter valued at approximately $31,000. Riverview Trust Co acquired a new stake in Campbell's in the first quarter valued at approximately $46,000. Banque Cantonale Vaudoise acquired a new stake in Campbell's in the first quarter valued at approximately $47,000. Finally, Curat Global LLC acquired a new stake in Campbell's in the first quarter valued at approximately $58,000. 52.35% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

CPB has been the subject of a number of research reports. Jefferies Financial Group reduced their price objective on Campbell's from $40.00 to $37.00 and set a "buy" rating for the company in a research note on Wednesday, May 21st. Deutsche Bank Aktiengesellschaft cut their target price on Campbell's from $43.00 to $39.00 and set a "hold" rating on the stock in a research report on Wednesday, May 21st. UBS Group cut their target price on Campbell's from $33.00 to $30.00 and set a "sell" rating on the stock in a research report on Friday. Stephens cut their target price on Campbell's from $48.00 to $43.00 in a research report on Wednesday, May 28th. Finally, DA Davidson cut their target price on Campbell's from $39.00 to $34.00 and set a "neutral" rating on the stock in a research report on Monday, June 9th. Three investment analysts have rated the stock with a Buy rating, twelve have given a Hold rating and five have given a Sell rating to the company's stock. Based on data from MarketBeat.com, Campbell's presently has a consensus rating of "Reduce" and an average price target of $38.11.

Read Our Latest Stock Analysis on CPB

Campbell's Stock Performance

Shares of CPB traded up $0.29 during mid-day trading on Monday, hitting $31.93. The stock had a trading volume of 5,908,823 shares, compared to its average volume of 5,824,681. The firm has a market cap of $9.52 billion, a P/E ratio of 21.15, a PEG ratio of 10.41 and a beta of 0.05. The business has a fifty day moving average price of $31.87 and a 200-day moving average price of $35.17. The company has a debt-to-equity ratio of 1.57, a current ratio of 0.78 and a quick ratio of 0.33. The Campbell's Company has a 52 week low of $29.39 and a 52 week high of $52.81.

Campbell's (NASDAQ:CPB - Get Free Report) last released its quarterly earnings data on Monday, June 2nd. The company reported $0.73 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.65 by $0.08. Campbell's had a return on equity of 23.22% and a net margin of 4.44%.The company had revenue of $2.48 billion for the quarter, compared to analyst estimates of $2.44 billion. During the same period in the previous year, the company posted $0.75 EPS. The firm's revenue for the quarter was up 4.5% compared to the same quarter last year. On average, equities research analysts expect that The Campbell's Company will post 3.15 EPS for the current year.

About Campbell's

(

Free Report)

The Campbell's Company, formerly known as Campbell Soup Company, together with its subsidiaries, manufactures and markets food and beverage products in the United States and internationally. The company operates through Meals & Beverages and Snacks segments. The Meals & Beverages segment engages in the retail and foodservice businesses in the United States and Canada.

Read More

Before you consider Campbell's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Campbell's wasn't on the list.

While Campbell's currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.