Foster & Motley Inc. purchased a new position in shares of Harmony Biosciences Holdings, Inc. (NASDAQ:HRMY - Free Report) during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 10,559 shares of the company's stock, valued at approximately $350,000.

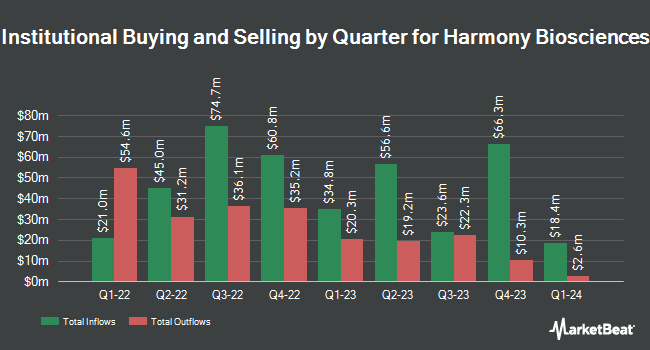

A number of other institutional investors and hedge funds have also made changes to their positions in HRMY. Deep Track Capital LP purchased a new position in shares of Harmony Biosciences during the fourth quarter valued at approximately $49,894,000. Vanguard Group Inc. boosted its holdings in shares of Harmony Biosciences by 36.4% in the 4th quarter. Vanguard Group Inc. now owns 4,733,609 shares of the company's stock valued at $162,883,000 after purchasing an additional 1,262,362 shares during the last quarter. Marshall Wace LLP raised its stake in shares of Harmony Biosciences by 165.2% in the 4th quarter. Marshall Wace LLP now owns 929,744 shares of the company's stock valued at $31,992,000 after acquiring an additional 579,103 shares during the period. Norges Bank purchased a new stake in Harmony Biosciences during the 4th quarter worth $16,118,000. Finally, Invesco Ltd. grew its holdings in Harmony Biosciences by 173.9% during the 4th quarter. Invesco Ltd. now owns 449,180 shares of the company's stock worth $15,456,000 after acquiring an additional 285,156 shares in the last quarter. 86.23% of the stock is currently owned by institutional investors and hedge funds.

Harmony Biosciences Trading Down 3.9%

HRMY stock traded down $1.38 during trading on Tuesday, hitting $34.16. The company had a trading volume of 555,584 shares, compared to its average volume of 665,254. The stock has a market cap of $1.96 billion, a PE ratio of 13.06, a PEG ratio of 0.47 and a beta of 0.84. Harmony Biosciences Holdings, Inc. has a one year low of $26.47 and a one year high of $41.61. The company has a current ratio of 3.67, a quick ratio of 3.63 and a debt-to-equity ratio of 0.22. The business has a 50-day moving average of $34.09 and a 200-day moving average of $33.93.

Harmony Biosciences (NASDAQ:HRMY - Get Free Report) last issued its earnings results on Tuesday, August 5th. The company reported $0.68 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.78 by ($0.10). Harmony Biosciences had a return on equity of 24.32% and a net margin of 20.53%. The firm had revenue of $200.49 million during the quarter, compared to the consensus estimate of $204.37 million. During the same quarter in the prior year, the business earned $1.05 earnings per share. Harmony Biosciences's revenue for the quarter was up 16.0% on a year-over-year basis. Research analysts predict that Harmony Biosciences Holdings, Inc. will post 2.43 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

Several research firms have commented on HRMY. HC Wainwright restated a "buy" rating and issued a $70.00 target price on shares of Harmony Biosciences in a research report on Tuesday, April 8th. Deutsche Bank Aktiengesellschaft reaffirmed a "buy" rating and set a $55.00 price objective (up from $54.00) on shares of Harmony Biosciences in a research report on Thursday, July 10th. Mizuho boosted their price objective on shares of Harmony Biosciences from $44.00 to $48.00 and gave the company an "outperform" rating in a research report on Thursday, May 15th. Needham & Company LLC reiterated a "buy" rating and set a $49.00 target price on shares of Harmony Biosciences in a research note on Tuesday, May 6th. Finally, Oppenheimer assumed coverage on shares of Harmony Biosciences in a research note on Monday, June 2nd. They issued an "outperform" rating and a $61.00 price objective for the company. One investment analyst has rated the stock with a hold rating, eight have issued a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, Harmony Biosciences presently has an average rating of "Buy" and an average target price of $51.00.

Read Our Latest Stock Report on Harmony Biosciences

Harmony Biosciences Company Profile

(

Free Report)

Harmony Biosciences Holdings, Inc, a commercial-stage pharmaceutical company, focuses on developing and commercializing therapies for patients with rare and other neurological diseases in the United States. The company offers WAKIX (pitolisant), a molecule with a novel mechanism of action for the treatment of excessive daytime sleepiness in adult patients with narcolepsy.

Featured Stories

Before you consider Harmony Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Harmony Biosciences wasn't on the list.

While Harmony Biosciences currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.