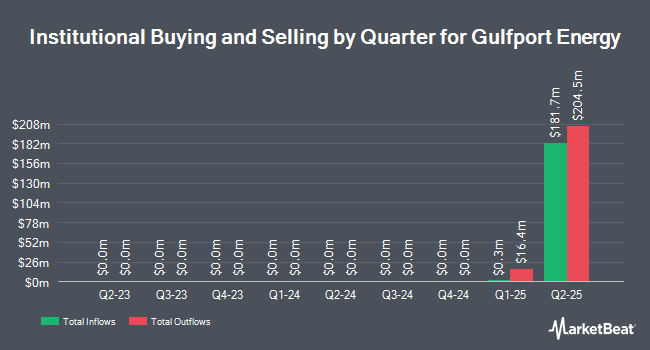

Foster & Motley Inc. purchased a new stake in shares of Gulfport Energy Corporation (NYSE:GPOR - Free Report) during the 2nd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 4,245 shares of the company's stock, valued at approximately $854,000.

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Wealth Enhancement Advisory Services LLC bought a new position in Gulfport Energy during the second quarter valued at about $557,000. Pallas Capital Advisors LLC bought a new position in Gulfport Energy during the second quarter valued at about $263,000. Azarias Capital Management L.P. bought a new position in Gulfport Energy during the second quarter valued at about $5,015,000. Assenagon Asset Management S.A. increased its stake in Gulfport Energy by 243.6% during the second quarter. Assenagon Asset Management S.A. now owns 42,763 shares of the company's stock valued at $8,603,000 after acquiring an additional 30,317 shares during the period. Finally, Tectonic Advisors LLC increased its stake in Gulfport Energy by 15.6% during the second quarter. Tectonic Advisors LLC now owns 12,383 shares of the company's stock valued at $2,491,000 after acquiring an additional 1,668 shares during the period.

Wall Street Analyst Weigh In

Several brokerages recently issued reports on GPOR. Evercore ISI lowered their price target on Gulfport Energy from $193.00 to $190.00 and set an "in-line" rating on the stock in a research note on Monday, October 6th. William Blair began coverage on Gulfport Energy in a research note on Monday, August 25th. They issued an "outperform" rating on the stock. Wall Street Zen upgraded Gulfport Energy from a "hold" rating to a "buy" rating in a research note on Saturday, August 9th. TD Cowen upgraded Gulfport Energy to a "strong-buy" rating in a research note on Monday, July 7th. Finally, Weiss Ratings reiterated a "hold (c-)" rating on shares of Gulfport Energy in a research note on Wednesday, October 8th. One research analyst has rated the stock with a Strong Buy rating, five have assigned a Buy rating, four have issued a Hold rating and one has issued a Sell rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $210.71.

View Our Latest Analysis on Gulfport Energy

Insider Buying and Selling

In related news, Director Jason Joseph Martinez sold 600 shares of the stock in a transaction that occurred on Tuesday, September 9th. The stock was sold at an average price of $171.57, for a total transaction of $102,942.00. Following the sale, the director directly owned 4,288 shares in the company, valued at $735,692.16. This represents a 12.27% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. 0.33% of the stock is currently owned by company insiders.

Gulfport Energy Price Performance

NYSE GPOR opened at $177.55 on Monday. The company has a market cap of $3.12 billion, a price-to-earnings ratio of -24.73 and a beta of 0.62. Gulfport Energy Corporation has a one year low of $136.45 and a one year high of $210.32. The stock's 50 day simple moving average is $174.82. The company has a debt-to-equity ratio of 0.42, a quick ratio of 0.51 and a current ratio of 0.51.

Gulfport Energy (NYSE:GPOR - Get Free Report) last released its quarterly earnings results on Monday, February 28th. The company reported $0.17 EPS for the quarter. The business had revenue of $298.62 million for the quarter. Gulfport Energy had a positive return on equity of 18.89% and a negative net margin of 9.14%.

Gulfport Energy Profile

(

Free Report)

Gulfport Energy Corporation engages in the exploration, development, acquisition, production of natural gas, crude oil, and natural gas liquids (NGL) in the United States. Its principal properties include Utica Shale covering an area approximately 187,000 net reservoir acres primarily located in Eastern Ohio; and SCOOP covering an area approximately 74,000 net reservoir acres primarily located in Garvin, Grady, and Stephens.

Featured Articles

Want to see what other hedge funds are holding GPOR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Gulfport Energy Corporation (NYSE:GPOR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Gulfport Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gulfport Energy wasn't on the list.

While Gulfport Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.